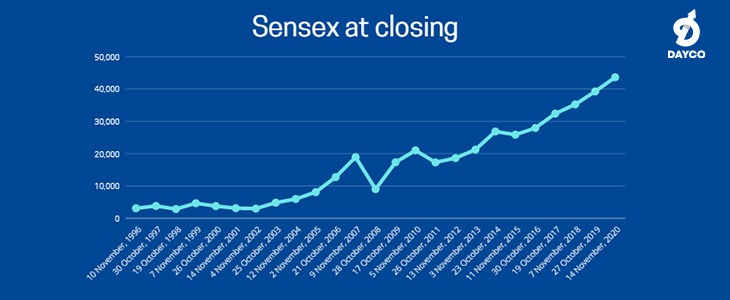

Buy it and forget it. If this is the strategy you are following to make money in stock investment, think again. Stock markets do not go up in a straight line. In between scaling new highs, the market goes down to climb up again. This is where selling a stock plays a more important role than buying a stock. You might have heard the cliche — it is not timing the market, but the time in the market that is important. But consider the following examples. In the US, Mr X had bought six shares of Cities Service stock at a …

3 points why is selling more important than buying in stock investments