Decoding Mutual Fund Taxes All You Need to Know

![]() November 18, 2023

November 18, 2023

![]() 0 Comments

0 Comments

Thinking about diving into the world of mutual funds? Awesome choice! But, before you jump in, let's talk about taxes. Understanding mutual fund taxation helps you gain more from mutual fund investments by choosing the right funds and optimising your investments and withdrawals. Let's break it down in simple terms.

There are a few key things that decide how much tax you'll owe on your mutual fund gains.

- Types of Funds: Different mutual funds have different tax rules. Whether it's an Equity Mutual Fund, Debt Mutual Fund, or a Hybrid Mutual Fund, each has its own set of tax guidelines.

- Dividends or Capital gains: If you have invested in Income Distribution Cum Withdrawal (IDCW) plans or dividend plans, the regular payouts form a part of your taxable income. If you sell your mutual fund units, the gains, if any, are called “Capital Gains”. Both dividends and capital gains are taxable and have different tax rules.

- Holding Period: The tax rate on capital gains depends on the holding period of the mutual funds unit. Generally, the longer you hold onto your MF investment, the less tax you'll have to pay.

Taxation: Dividends and Capital Gains

The dividends you get from mutual funds are added to your taxable income and get taxed based on your income slab rates. Also, if the dividend income is more than Rs.5000, then the sum is subject to 10% TDS as well.

Now, capital gains taxation depends on how long you've held onto your mutual fund units and what type of fund you're in. Gains are classified as short-term and long-term based on the following rules and have different tax rates which are discussed later in this blog.

1. Funds Investing Over 65% in Indian Equity: Think equity funds, arbitrage funds, equity savings, and others in this category.

- Short-term gains (STCG) – when the units are redeemed before the completion of 12 months

- Long-term gains (LTCG) –b when the units are redeemed after the completion of 12 months.

2. Funds Investing 35-65% in Indian Equity: Balanced hybrid funds and the likes fall into this category.

- Short-term gains (STCG) –held for less than 36 months

- Long-term gains (LTCG) –held for 36 months or more

3. Funds Investing Less Than or Equal to 35% in Indian Equity: Here, the holding period doesn't matter much. All gains are treated as short-term. Debt funds, conservative hybrid funds, and the likes fall into this category.

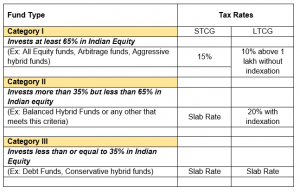

Taxation Rates

Recent Changes

Till FY23, all funds that invested less than 65% in Indian equity were classified as non-equity and holding period and tax rates for capital gains taxation was similar to category II above. So, if you have units that were purchased before 1st Apr 2023, the gains will be taxed accordingly. All units purchased on or after 1st Apr 2023 come under the new taxation rules.

Thank you for taking the time to read.

~Nischay Avichal

Share With

I'm a cool paragraph that lives inside of an even cooler modal. Wins!

Are you sure?

In case you didnt know, you can open your account online within 24 hours. Offline account opening takes up to 4 working days. If you wish to open your account offline, fill and sign the forms using a black/blue ballpoint pen. Please fill in the email and mobile number of the applicant to avoid account opening delays.

Enter Password

Please enter your details and password

New to Dayco?

Enter Password

Please enter your details and password

New to Dayco?

Filing Complaints on SCORES (SEBI) – Easy & Quick

- Register on SCORES Portal (SEBI)

- Mandatory details for filing complaints on SCORES:

- Name, PAN, Address, Mobile Number, E-mail ID

- Benifits:

- Effective Communication

- Speedy redressal of the grievances

Thanks !!

Your details were successfully received.

Thank you for Your Feedback!

Our Team is working constantly on improving our user experience and your feedback really means a lot.

Thanks !!

App Link Send to your mobile number successfully.

Thank You

All your Questions have been recorded

Thank You

All your Questions have been recorded

Thank You!

Thank you for your response. We'll get in touch with you at the earlisest for your investment planning needs

NEXT

Thank You!

Thank You for your interest in our Moderate Equity Portfolio. Please find below the credentials to track this portfolio:

User ID: mockmod@daycoindia.com

Password: abcd@1234

Portfolio Tracker

Please Read!

Risk profiling is crucial for identifying and managing potential risks in investment decisions. Please carry out your risk profiling before making any investment decisions.

Complete Risk Assessment Now

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Set Your Goal

Please Select an option from below

Set Your Goal

Please Select an option from below

Thanks You !

We appreciate your interest in our services. Our team will be in touch with you shortly.

CloseSet your Goal

Please enter your details in the fields provided

Thanks You!!

Calculation report has been sent to your mail id successfully

Clear form?

This will remove your answers from all questions and cannot be undone.

Book Appointment

Book Appointment

Leave a Reply