For those who wish to manage their Finances the right way

Winners do not do different things! They do things differently! Simplify data and separate signals from noise with ease!

Open an account with us in minutes. Your window to invest seamlessly in Stocks, start a SIP, Mutual Funds, ETFs, IPOs, and more.

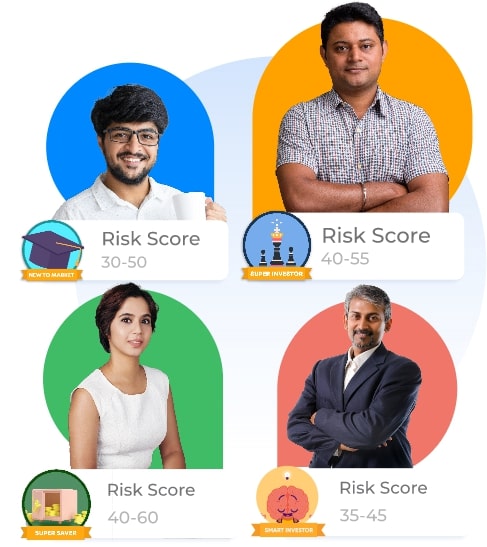

Get StartedKnow your strengths and turn them to your advantage. Know your weakness and avoid them for your best financial future! It’s your life, your hard-earned money, and your investment!

Get StartedIt is important to know the objective and give a clear direction to your investments. A set target and a set timeline are the basics of successful money management.

Get StartedChoose from one of our scientifically curated and research-backed plans matched with your risk profile, to meet your goals! Secret recipes for perfect life planning!

Get Started

You are more likely to succeed when you know what you are doing and why. Bring an edge to your investments by making decisions that match your investor persona.

10/11/2025

10/11/2025

The most effective investment approach across different market cycles is a combination of long-term focus, diversification across asset classes, and a disciplined strategy like rupee-cost averaging or regular portfolio rebalancing. This approach helps manage risk...

Read More 07/11/2025

07/11/2025

A one-time investment decision requires careful evaluation of various financial and personal factors to ensure that the chosen investment...

Read More 06/11/2025

06/11/2025

ou must define what you want to achieve in financial terms. A smart financial goal is Specific, Measurable, Achievable, Realistic, and Time-bound. Before deciding whether a Systematic...

Read More 04/11/2025

04/11/2025

Planning your child’s education requires early preparation, smart financial decisions, and choosing investments that match your risk...

Read More 03/11/2025

03/11/2025

Financial planning is more than just managing money; it's about setting a direction for your life. It helps you align your income, spending, and investments with your goals, giving you greater control and confidence over your future. Whether you're building a...

Read More 31/10/2025

31/10/2025

Effective tax planning is the strategic process of legally minimising tax liability by making smart financial and investment decisions, while ensuring full compliance with tax laws and aligning with long-term financial goals. Here are some benefits of effective tax planning...

Read More 30/10/2025

30/10/2025

Investment planning helps individuals align their financial resources with long-term goals, but common mistakes can hinder progress and...

Read More 29/10/2025

29/10/2025

Planning early for retirement sets the foundation for financial freedom and long-term security. It enables you to build a consistent income source for your later years, ensuring stability and protection against future uncertainties. With a well-structured plan in place, you can look forward to a stress-free and comfortable retirement, enjoying the rewards of your foresight and discipline...

Read More 28/10/2025

28/10/2025

Critical illness and regular health insurance serve distinct yet complementary roles together, and form a complete health protection strategy...

Read More

Investment decisions are shaped by a combination of personal, financial, and economic factors that determine how and where an...

Read MorePlease enter your details in the fields provided

I'm a cool paragraph that lives inside of an even cooler modal. Wins!

In case you didn’t know, you can open your account online within 24 hours. Offline account opening takes up to 4 working days. If you wish to open your account offline, fill and sign the forms using a black/blue ballpoint pen. Please fill in the email and mobile number of the applicant to avoid account opening delays.

Please enter your details and password

New to Dayco?

Please enter your details and password

New to Dayco?

Please enter your details and password

New to Dayco?

Please enter your details and password

New to Dayco?

Your details were successfully received.

Our Team is working constantly on improving our user experience and your feedback really means a lot.

App Link Send to your mobile number successfully.

All your Questions have been recorded

All your Questions have been recorded

Thank you for your response. We'll get in touch with you at the earlisest for your investment planning needs

Thank You for your interest in our Moderate Equity Portfolio. Please find below the credentials to track this portfolio:

User ID: mockmod@daycoindia.com

Password: abcd@1234

Risk profiling is crucial for identifying and managing potential risks in investment decisions. Please carry out your risk profiling before making any investment decisions.

Please enter your details to download/print the report

Please enter your details to download/print the report

Please enter your details to download/print the report

Please enter your details to download/print the report

Please enter your details to download/print the report

Please Select an option from below

Please Select an option from below

We appreciate your interest in our services. Our team will be in touch with you shortly.

ClosePlease enter your details in the fields provided

Calculation report has been sent to your mail id successfully

Absolutely Quick & Free

All Investments Managed Under One Roof

Quicker & Simpler Transactions Anytime

Ease of Transfer & Gifting of Investments

Multiple Nominees & One-Point Transmission Support

Join thousands of smart investors who have already modernized their portfolios. Experience seamless, digital investment management today. For Portfolio Summary and Investment Advisory, Contact At: 9051052222

Login to the app or web to trade.