Direct Tax Updates What Changes For You After The Recent Budget

![]() July 27, 2024

July 27, 2024

![]() 0 Comments

0 Comments

This recent Union Budget has brought in a spate of major changes in direct taxes, impacting every individual taxpayer and investor. Getting one's head around the new tax regime to keeping oneself aware of the revision in the capital gains tax on equity shares, ETFs, and mutual funds—is crucial in comprehending their impact on your finances. This blog will break down all the key updates that you should be aware to stay ahead in the taxation game.

The New Tax Regime

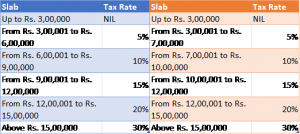

What has changed? The tax slabs have been modified to increase more tax savings for individuals opting for the new tax regime. Further, the standard deduction which is 50K currently has been increased to 75K in the new tax regime only.

The table on the right below illustrates the proposed changes in the new tax regime.

National Pension System (NPS)

One notable change in the recent Union Budget is the adjustment to the Employer’s NPS deduction limit under Section 80CCD (2). Previously, if you worked for a non-government employer, their contribution to your NPS was eligible for a tax deduction up to 10% of your gross salary. This was applicable in both the old and the new tax regimes. However, the Budget has brought good news for NPS subscribers. The deduction limit for the employer's contribution has now been increased from 10% to 14% of your gross salary. This means you can now contribute more through your employer to gain greater tax benefits.

Capital Gains:

If there is one thing everyone is talking a lot about after the budget, it is the changes in the capital gains taxation. If you are investor, there is a lot of change you need to wrap your head around. The most significant changes are the removal of indexation benefit for all assets, increment in STCG and LTCG rates for some assets (and reduction in others), and the reduction of the number of holding periods to just two. We will look at the changes in taxation from the perspective of different investment vehicles and assets to help you understand these changes and their impact.

Listed Equity Shares/Equity MFs/Equity ETFs (holding >65% domestic equity)

Before the Budget 2024 amendments, short-term capital gains (STCG) on these assets were taxed at 15%, while long-term capital gains (LTCG) were taxed at 10%. There was no tax for long-term capital gains if they were within 1 lakh in a financial year for these assets. Now, with the new changes, LTCG tax has risen to 12.5%, and STCG will be taxed at 20%. However, the exemption limit for LTCG tax has been raised from 1 to 1.25 lakhs. The holding period requirement of 12 months remains unchanged for classification of gains into short-term and long-term. These changes are effective for securities sold on or after 23rd July 2024.

Debt Mutual Funds/Debt ETFs

Debt mutual funds and ETFs are funds holding more than 65% bonds or money market instruments in their portfolio. Irrespective of the holding period of these funds, the gains will be taxed at slab rates for units brought on or after 1st April 2023. If you had brought the funds before 1st April 2023 and sell the units on or after 23rd July 2024, the gains will be taxed at 12.5% without indexation. The holding period for debt funds and ETFs have been changed to 24 months and 12 months respectively from 36 months earlier.

Other Mutual Funds

All other mutual fund schemes – funds that do not have more than 65% in equity and more than 65% in bonds or money market instruments will now have a holding period of 24 months. STCG will be taxed at slab rates and LTCG will be taxed at 12.5% without indexation. Examples of some of these funds are multi asset funds, balanced advantage funds (may differ based on fund’s mandate), foreign FOFs, and feeder funds, etc.

Real Estate

Gains from the sale of immovable property (Land or Building or both) were historically taxed at 20% with indexation for LTCG and according to your income tax slab rates for STCG. The STCG tax remains as per your applicable slab rates and the holding period remains the same, but the LTCG tax has been reduced to 12.5% and a major blow has been the removal of indexation benefit for LTCG. Indexation benefit helped you inflate the cost of acquisition of the asset as per the inflation rate. This helped you decrease your capital gains and thus led to lower tax outgo. The removal of the indexation can lead to higher tax outgo but not in all cases. These changes are effective for real estate sold on or after 23rd July 2024.

Physical Gold

Like real estate, the tax on LTCG from gold has been reduced from 20% to 12.5% and the indexation benefit has been removed. STCG on gold continues to be taxed according to your income tax slab rates. Another major change is the reduction of the holding period to qualify for LTCG taxation from 36 months to 24 months. These changes are effective for gold sold on or after 23rd July 2024.

Gold ETFs/Gold Funds

Gold ETFs and Gold funds are classified as other funds i.e. they do not hold more than 65% equity or more than 65% bonds. STCG on both these instruments continue to be taxed at slab rates and the holding period have been reduced to 12 months for gold ETFs and 24 months for gold funds from 36 months. LTCG from these instruments will now be taxed at 12.5%.

Listed Bonds/Debentures

Previously, LTCG on listed bonds were taxed at 10%, while STCG were taxed according to your income tax slab rates. Now, LTCG will be taxed at 12.5%. This means you'll need to pay higher tax rate on your long-term investments in listed bonds than before. The holding period of 12 months remains the same. These changes are effective from 23rd July 2024.

Buyback

Another significant change introduced in the recent Union Budget pertains to the buyback of shares by companies. Previously, when a company repurchased its own shares, the money paid to shareholders for those shares was tax-exempt. However, this favorable treatment is set to change. From 1st October 2024, the proceeds shareholders receive from a company buyback will be treated as dividends and taxed according to the applicable slab rates.

This means that shareholders will need to pay tax on the amount received, just as they would on any other dividend income. Moreover, shareholders cannot deduct any expenses related to this dividend income.

But there's more to consider. The original cost of the bought-back shares will now be classified as a capital loss for the shareholder since those shares have been extinguished. This capital loss is a good thing, as it can be used to offset future capital gains from selling other shares or assets, potentially reducing overall tax liability.

In summary, the recent Union Budget has introduced several noteworthy changes to direct taxes that will impact a wide range of taxpayers and investors. By staying informed about these changes and understanding their implications, you can make better decisions to optimize your tax liabilities and investment outcomes. Thank you for taking the time to read.

-Nischay Avichal

Share With

I'm a cool paragraph that lives inside of an even cooler modal. Wins!

Are you sure?

In case you didnt know, you can open your account online within 24 hours. Offline account opening takes up to 4 working days. If you wish to open your account offline, fill and sign the forms using a black/blue ballpoint pen. Please fill in the email and mobile number of the applicant to avoid account opening delays.

Enter Password

Please enter your details and password

New to Dayco?

Enter Password

Please enter your details and password

New to Dayco?

Filing Complaints on SCORES (SEBI) – Easy & Quick

- Register on SCORES Portal (SEBI)

- Mandatory details for filing complaints on SCORES:

- Name, PAN, Address, Mobile Number, E-mail ID

- Benifits:

- Effective Communication

- Speedy redressal of the grievances

Thanks !!

Your details were successfully received.

Thank you for Your Feedback!

Our Team is working constantly on improving our user experience and your feedback really means a lot.

Thanks !!

App Link Send to your mobile number successfully.

Thank You

All your Questions have been recorded

Thank You

All your Questions have been recorded

Thank You!

Thank you for your response. We'll get in touch with you at the earlisest for your investment planning needs

NEXT

Thank You!

Thank You for your interest in our Moderate Equity Portfolio. Please find below the credentials to track this portfolio:

User ID: mockmod@daycoindia.com

Password: abcd@1234

Portfolio Tracker

Please Read!

Risk profiling is crucial for identifying and managing potential risks in investment decisions. Please carry out your risk profiling before making any investment decisions.

Complete Risk Assessment Now

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Set Your Goal

Please Select an option from below

Set Your Goal

Please Select an option from below

Thanks You !

We appreciate your interest in our services. Our team will be in touch with you shortly.

CloseSet your Goal

Please enter your details in the fields provided

Thanks You!!

Calculation report has been sent to your mail id successfully

Clear form?

This will remove your answers from all questions and cannot be undone.

Book Appointment

Book Appointment

Leave a Reply