How Budgeting Helped Arjun Take Control of His Finances

![]() August 31, 2024

August 31, 2024

![]() 0 Comments

0 Comments

Allow me to introduce you to Arjun, a young professional who has just acquired his first job. The excitement of earning one's own money and the newly acquired freedom to spend it as he saw fit was intoxicating. Arjun celebrated his new job: nice dinners, gadgets that he had hitherto eyed and bought, enjoying weekends out with friends.

Pretty soon, the thrill started to wear off as reality started seeping in. Despite his salary, Arjun soon came to realize that meeting his most basic or unexpected expenses came from waiting for a paycheck. The piling of unexpected costs, with no other option besides using his credit card or borrowing from friends and family, led to an ever-growing pile of debt. He lived paycheck to paycheck.

Arjun’s situation is a classic example of how a disorganized financial life can set the stage for unmet financial goals and financial setbacks. Without a clear plan or structure, Arjun’s impulsive spending, rising debt, and lack of savings were steering him toward a future filled with financial uncertainty.

But it didn’t have to be this way. Recognizing the downward spiral he was on; Arjun knew he needed to make a change. That’s when he finally mustered the courage to seek the help of a financial planner. Quickly recognizing this pattern his financial planner asked him to start from the very basic —budgeting—a simple yet powerful tool that can bring order to his chaotic financial life and help him regain control of his future.

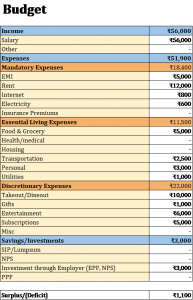

They sat down to prepare what a normal monthly budget looked like for Arjun in the past three months with the help of his bank statements, payment apps, and what he could recall spending.

After studying this budget for Arjun his financial planner made the following observations:

- Arjun’s emergency fund ratio was 0. This ratio is calculated by diving liquid cash that is kept aside by the monthly non-discretionary (most essential and mandatory) expenses. Ideally, it should be at least 6 times or more.

- His planner noticed that a significant portion of income (more than 30% of in-hand income for the past three months) is allocated to non-essential expenses, such as dining out, entertainment, and shopping, leaving little room for savings or investment.

- Investment and savings were irregular or non-existent, with savings often made at the end of the month only. EPF deduction was the only investment that he was consistently making–which is a compulsory deduction from his salary.

- Arjun was only paying the minimum balance due for the credit card with no proper debt reduction plan. The credit card loan loans charged upwards of 16% per annum. To compound the issue, these credits were also not taken for something that would help Arjun build his current skills and improve his current income.

- In the last three months, his bank statements had two large expenses which were equivalent to his in-hand income and these were not paid using any planned savings or investments. These expenses were first, totally unplanned and discretionary and second, made through his credit card.

- Arjun didn’t have a solid investment plan in place that would help him build wealth over the long term– wealth that can be utilized for essential goals in the future. He was also not making any additional investments towards his retirement.

Discussing all these issues with Arjun made him realize that his financial health was not looking good. Lack of an emergency fund always led him to make take additional debts when important unplanned expenses cropped up or when there was a slight crunch in his cashflows. Discretionary expenses are important because life is about enjoying what we love and not just penny-pinching, but it's crucial to strike a balance to ensure we’re also securing our financial future. Arjun was finding it hard to strike this balance.

Savings and investments should be an important part of our finances. Keeping money aside is essential for meeting important financial goals in the future like purchasing a house, a child’s education, a good vacation, retirement, etc. No investment plan means when you want money for these goals, you would either not be able to meet these goals or end up taking loans.

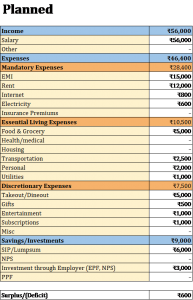

His financial planner came up with the newly planned budget along with the following recommendations after discussing the above issues with Arjun.

- Arjun should start making full contributions for his credit card EMIs instead of making minimum payments. Minimum payments saved him late fees and action from the lender, but the outstanding balance kept adding interest at 16% p.a. which was only hurting his financial health. He was also asked to not take any additional debt during the next 12 months.

- He should cut down the current average discretionary expenses to 7.5K from the present 22K. This would mean canceling a bunch of subscriptions and cutting down on dine-outs, and some entertainment expenses. The money saved up here would be used to save for the emergency fund and for making full payments towards credit card EMIs.

- In the next 6 months he will continuously save 6K for building his emergency fund. In about six months, he will end up clearing his current credit card dues which will increase this savings by 15K more. Following this pattern, he will be able to successfully build up his emergency fund in the next 1 year. This savings should be done instantly when the salary hits his account– which can be achieved if he can set up an auto debit facility. A great example is a SIP.

- The next 12 months are crucial for getting his financial life back on track. This period would be tough initially as he was used to a certain lifestyle. The idea of budgeting and tracking his expenses is completely new to him. Tracking expenses each month across different categories will also be a tedious task. He will be provided an Excel template to get started and will also get continued support and handholding throughout this period. He should remember that his present spending habit is harmful and building these habits would only help him build a secure financial future.

In the current scenario, saving for important financial goals and building an investment plan for Arjun is not the priority. His financial situation will be reviewed post 12 months to focus on his financial goals, insurance, and retirement.

By taking control of his finances, Arjun has started his path towards financial stability. He will now be able to differentiate between needs and wants, reduce impulsive spending, and allocate his resources more effectively. Budgeting will help him manage his money—reduce stress and build a secure foundation through an emergency fund. Like Arjun, anyone can take charge of their finances and build a life of financial freedom and fulfillment.

-Nischay Avichal

Disclaimer: Arjun is a fictional character created for illustrative purposes.

Share With

I'm a cool paragraph that lives inside of an even cooler modal. Wins!

Are you sure?

In case you didnt know, you can open your account online within 24 hours. Offline account opening takes up to 4 working days. If you wish to open your account offline, fill and sign the forms using a black/blue ballpoint pen. Please fill in the email and mobile number of the applicant to avoid account opening delays.

Enter Password

Please enter your details and password

New to Dayco?

Enter Password

Please enter your details and password

New to Dayco?

Filing Complaints on SCORES (SEBI) – Easy & Quick

- Register on SCORES Portal (SEBI)

- Mandatory details for filing complaints on SCORES:

- Name, PAN, Address, Mobile Number, E-mail ID

- Benifits:

- Effective Communication

- Speedy redressal of the grievances

Thanks !!

Your details were successfully received.

Thank you for Your Feedback!

Our Team is working constantly on improving our user experience and your feedback really means a lot.

Thanks !!

App Link Send to your mobile number successfully.

Thank You

All your Questions have been recorded

Thank You

All your Questions have been recorded

Thank You!

Thank you for your response. We'll get in touch with you at the earlisest for your investment planning needs

NEXT

Thank You!

Thank You for your interest in our Moderate Equity Portfolio. Please find below the credentials to track this portfolio:

User ID: mockmod@daycoindia.com

Password: abcd@1234

Portfolio Tracker

Please Read!

Risk profiling is crucial for identifying and managing potential risks in investment decisions. Please carry out your risk profiling before making any investment decisions.

Complete Risk Assessment Now

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Set Your Goal

Please Select an option from below

Set Your Goal

Please Select an option from below

Thanks You !

We appreciate your interest in our services. Our team will be in touch with you shortly.

CloseSet your Goal

Please enter your details in the fields provided

Thanks You!!

Calculation report has been sent to your mail id successfully

Clear form?

This will remove your answers from all questions and cannot be undone.

Book Appointment

Book Appointment

Leave a Reply