How can the 503020 budgeting rule help you gain control of your finances

![]() July 10, 2023

July 10, 2023

![]() 0 Comments

0 Comments

Budgeting is the cornerstone of your financial well-being. If you are aiming for financial independence, the answer begins with a budget. Budgeting is not just about noting down your expenses. A sound budget helps you shed light on bad spending habits and work towards your long-term goals. In this blog, we discuss an important budgeting technique called 50/30/20 (also called the 50/20/30 rule) and how it can help you bring more control over your financial life.

What is the 50/30/20 rule?

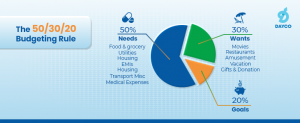

The 50/20/30 rule is a budgeting technique that can help you easily prepare and manage your budget. The straightforward rule is that you split your post-tax monthly income into three categories– needs, wants & savings. 50% of the split should go towards your wants, 20% towards financial goals and 30% towards all your wants. Elizabeth Warren conceptualised this budgeting technique in her book, All Your Worth: The Ultimate Lifetime Money Plan.

50%: This category includes the most essential expenses that you must absolutely meet for survival. This includes things like:

- Housing

- Utilities

- Food & Grocery

- Transportation

- Healthcare

- EMIs

30%: This is the Want “bucket”. Essentially, wants are expenses that are optional or expenses that are not absolutely essential. Wants are not necessarily a “bad” expense, but moderation is key here. Some common expenses in the bucket include:

- Hobbies

- Dining out

- Vacation

- Subscriptions

20%: This category covers two main areas:

- Savings that you make for your retirement, emergency fund, and other goals. This will include your SIP payments and other investments that you make regularly.

- Debt payments. Although EMIs are part of the “Needs” bucket, any extra that you pre-pay is saving as it brings down principal and saves future interest costs

Need v/s Want

Budgeting is easier said than done if you miscategorise wants as needs– which is easy to fall prey to. Wants and needs can differ among persons, and growing habituated to certain expenses make people miscategorise. Hence one of the most vital steps is categorising your spending appropriately. Some examples we discussed under the various heads above should be a good starting point for you.

For most, saving may feel like a want because it is not an immediate need. This is because not putting money into an emergency fund, paying credit card bills, or saving for retirement drastically affects your survival over a month. But, saving for your goals is an essential part of your budget, which will decide your long-term well-being, both personal and financial, which is why the budget has a separate bucket for it. For instance, retirement savings ensure you have an adequate corpus to sustain yourself when you don’t earn.

It is essential that you apply the technique to your life in your way because personal finance is “Personal”, and your needs and wants are unlike anyone else’s. Although it provides a perfect framework for you to start, the best and honest judge of your life and finances is you.

How to prepare the budget?

- Calculate your monthly income: Calculate your net pay, i.e., monthly income after taxes. You can estimate the taxes you will likely pay or use the net income figure in your pay slip. If your employer deducts retirement benefit contributions, add that back to your net pay. This will form part of the 20% split we discussed. If you are not salaried, past inflows should be used to estimate monthly income.

- Categorization: After you have the net figure you receive in hand, multiply the same by 0.5 (for needs), 0.3 (for wants), and 0.2 (for investments/savings/financial goals). This would give you the maximum threshold limit under the three heads.

- Allocate expenses: Now that you have created the three buckets with their max limits, allocate the list of your expenses under the three of them. Once you list them, see whether you’re spending less or more than the monthly limits set for the buckets.

- Follow: Track your expenses over the month and adjust the budget as per the scenario so that you stick to the thresholds.

An Example

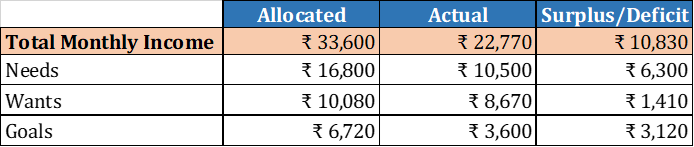

Let’s say you receive 30K in your bank account each month from your job. Your salary slip also includes the 3,600 that is being contributed to your EPF. Hence, your total salary comes to 33.6K (30,000+3,600).

Now we can calculate the threshold for each of the buckets:

Needs: 33600*0.5= 16,800

Wants: 33,600*0.3= 10,080

Goals: 33,600*0.2= 6,720 (Since you’ve already contributed 3.6K here, you can use the rest for other goals and debt repayment)

Once the buckets are created, you can either plan out your spending by allocating expenses under various buckets or see how well it is already aligned with these targets.

Organising and having control over finances is something people put off. Finance can be intimidating, and people are often confused about where to start. 50/30/20 budgeting is an easy and simpler technique that can help you achieve more control over your financial life.

If you have a question, share it in the comments below or DM us or call us - +91 9051052222. We'll be happy to answer it.

- Nischay Avichal

Share With

I'm a cool paragraph that lives inside of an even cooler modal. Wins!

Are you sure?

In case you didnt know, you can open your account online within 24 hours. Offline account opening takes up to 4 working days. If you wish to open your account offline, fill and sign the forms using a black/blue ballpoint pen. Please fill in the email and mobile number of the applicant to avoid account opening delays.

Enter Password

Please enter your details and password

New to Dayco?

Enter Password

Please enter your details and password

New to Dayco?

Filing Complaints on SCORES (SEBI) – Easy & Quick

- Register on SCORES Portal (SEBI)

- Mandatory details for filing complaints on SCORES:

- Name, PAN, Address, Mobile Number, E-mail ID

- Benifits:

- Effective Communication

- Speedy redressal of the grievances

Thanks !!

Your details were successfully received.

Thank you for Your Feedback!

Our Team is working constantly on improving our user experience and your feedback really means a lot.

Thanks !!

App Link Send to your mobile number successfully.

Thank You

All your Questions have been recorded

Thank You

All your Questions have been recorded

Thank You!

Thank you for your response. We'll get in touch with you at the earlisest for your investment planning needs

NEXT

Thank You!

Thank You for your interest in our Moderate Equity Portfolio. Please find below the credentials to track this portfolio:

User ID: mockmod@daycoindia.com

Password: abcd@1234

Portfolio Tracker

Please Read!

Risk profiling is crucial for identifying and managing potential risks in investment decisions. Please carry out your risk profiling before making any investment decisions.

Complete Risk Assessment Now

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Set Your Goal

Please Select an option from below

Set Your Goal

Please Select an option from below

Thanks You !

We appreciate your interest in our services. Our team will be in touch with you shortly.

CloseSet your Goal

Please enter your details in the fields provided

Thanks You!!

Calculation report has been sent to your mail id successfully

Clear form?

This will remove your answers from all questions and cannot be undone.

Book Appointment

Book Appointment

Leave a Reply