Samvat 2077 gave a fabulous return Will Samvat 2078 stay the course

![]() June 14, 2023

June 14, 2023

![]() 0 Comments

0 Comments

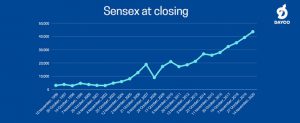

Stock market investors have reasons to celebrate this Diwali with much vigor and enthusiasm. In the Vikram Samvat 2077 that began from 16 November 2020, the Sensex has till 19 October given a mind boggling 42.64% return!

You also can join the party on 4 November if you have missed the bus before and soak your hands in stock dabbling on the auspicious moment of Muhurat Trading.

However, pay attention to a note of caution. Since the Sensex scaled its lifetime peak of 62245.43 points on 19 October 2021, the index has climbed down more than 1000 points and is finding it increasingly difficult to hold its head above the 61000 mark.

In 2020-21, the share of corporate profits as a percentage of domestic GDP hit a 10-year high of 2.69%, steeply up from a record low of 1.6% in 2019-20. While a 7.3% GDP contraction shows the share of corporate profits at an elevated level, the combined net profit of listed corporate entities shot up by nearly 58% in 2020-21.

This was primarily due to very low commodity and energy prices, low interest rate regime, and a reduction in operating expenditure owing to lower travel and wage cost.

But the scenario has changed from the beginning of the current calendar year. Commodity and energy prices in the international market shot up as countries around the world began to claw back from the depth of the pandemic onto their economic growth path. This will surely eat into profit margins of corporate entities sooner rather than later.

The fear of inflation is looming large globally. Coupled with it is the fear of policy normalisation. Hence, an end to the days of easy money soon is pushing up yields in the government securities market from the US to India.

In short, Samvat 2078 may not begin as enthusiastically as last year.

With the fear that inflation is here to stay elevated for some more time (rather than being transitory), investors will very soon turn to gold for safe haven investment.

Experts believe this may send gold prices to $3000 a troy ounce (one troy ounce = 31.1035 gm) from its current level of $1800 at present.

The rupee has become cheaper against the US dollar and has again crossed the Rs 75-a-dollar mark, indicating that foreign institutional investors have started pulling out. Till Monday (25 October), FIIs were net sellers to the extent of Rs 12329 crore!

Then the IPO market is flushed with big ticket issues such as Paytm etc. This may propel a selloff in the secondary market.

If you have a question, share it in the comments below or DM us or call us - +91 9051052222. We'll be happy to answer it.

- Porichoy Gupta

Share With

I'm a cool paragraph that lives inside of an even cooler modal. Wins!

Are you sure?

In case you didnt know, you can open your account online within 24 hours. Offline account opening takes up to 4 working days. If you wish to open your account offline, fill and sign the forms using a black/blue ballpoint pen. Please fill in the email and mobile number of the applicant to avoid account opening delays.

Enter Password

Please enter your details and password

New to Dayco?

Enter Password

Please enter your details and password

New to Dayco?

Filing Complaints on SCORES (SEBI) – Easy & Quick

- Register on SCORES Portal (SEBI)

- Mandatory details for filing complaints on SCORES:

- Name, PAN, Address, Mobile Number, E-mail ID

- Benifits:

- Effective Communication

- Speedy redressal of the grievances

Thanks !!

Your details were successfully received.

Thank you for Your Feedback!

Our Team is working constantly on improving our user experience and your feedback really means a lot.

Thanks !!

App Link Send to your mobile number successfully.

Thank You

All your Questions have been recorded

Thank You

All your Questions have been recorded

Thank You!

Thank you for your response. We'll get in touch with you at the earlisest for your investment planning needs

NEXT

Thank You!

Thank You for your interest in our Moderate Equity Portfolio. Please find below the credentials to track this portfolio:

User ID: mockmod@daycoindia.com

Password: abcd@1234

Portfolio Tracker

Please Read!

Risk profiling is crucial for identifying and managing potential risks in investment decisions. Please carry out your risk profiling before making any investment decisions.

Complete Risk Assessment Now

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Set Your Goal

Please Select an option from below

Set Your Goal

Please Select an option from below

Thanks You !

We appreciate your interest in our services. Our team will be in touch with you shortly.

CloseSet your Goal

Please enter your details in the fields provided

Thanks You!!

Calculation report has been sent to your mail id successfully

Clear form?

This will remove your answers from all questions and cannot be undone.

Book Appointment

Book Appointment

Leave a Reply