Should you continue your debt mutual funds after the change in taxation

![]() June 10, 2023

June 10, 2023

![]() 0 Comments

0 Comments

When investors adopt a narrow mindset focused solely on one aspect of the investment process, such as taxation or recent return trends, they inadvertently restrict their ability to see the bigger picture and achieve their ultimate financial goals, which often include wealth creation and meeting specific objectives. By fixating on taxation, you may prioritize minimizing your tax liabilities without fully considering the long-term growth potential of your investments or the suitability of the product itself. Similar is the case of this recent ruckus in the mutual fund space due to the changes in the taxation of debt mutual funds.

In this blog, we discuss what has changed for debt mutual funds, how it impacts your investments, and whether you should continue your debt mutual fund investments.

What has changed for Debt Mutual Funds?

Let's begin with a brief explanation of capital gains and how they are taxed. When you sell an asset and make a profit, it is referred to as a capital gain. This gain is calculated by subtracting the purchase price from the sale price. Capital gains are categorized into short-term capital gains (STCG) and long-term capital gains (LTCG), depending on the duration of ownership. If you sell shares or equity mutual funds within 12 months of acquiring them, it falls under STCG. However, if you sell them after holding them for 12 months or more, it is considered LTCG. As of April 1, 2023 (FY23-24 onwards), the benefit of indexation is no longer applicable to debt mutual fund investments. Previously, holding debt mutual funds for three or more years allowed for taxation at an LTCG rate of 20% with indexation. In simple terms, indexation is a way to adjust the purchase price of an asset for inflation. With indexation benefits, the government allows you to factor in the impact of inflation on the purchase price of the asset. This adjustment helps to reduce the taxable capital gains and, in turn, lowers the amount of tax you have to pay.

However, indexation is now unavailable, and the returns on debt funds are added to an individual's income, being taxed according to their respective tax slab.

What should you do?

First, do not liquidate any investments you have made before 1st April 2023. They still enjoy the indexation benefit. Second, taxes are just one aspect of the investment process. Focusing solely on taxation hinders you from developing a comprehensive investment strategy that aligns with your long-term goals and may result in missed opportunities and suboptimal returns. An investment that doesn’t align with your investment goals is of no use to you, regardless of the tax benefits it offers (or doesn’t). Your primary objective with your debt funds should be to make sure that they fit into your strategy.

Compared to other fixed-income options, debt funds offers long-term returns that are well matched with other fixed-income options and have many benefits like better liquidity, active management, tax deferment, and better taxation than fixed deposits even after the tax changes. Many of the debt fund categories are suitable for meeting various purposes, like parking short-term funds, saving for financial goals, rebalancing, and, more importantly, providing stability to your portfolio via diversification.

Why are debt funds still a good option?

- Liquidity: Debt funds are more liquid than other fixed-income options like fixed deposits, PPF, and NSCs, as a redemption request can be placed at any point in time without a penalty (Most debt fund categories don’t have an exit load). This convenience is not available with many fixed-income options like NSC, PPF, and Fixed deposits where funds are locked in for a fixed period of time or a penalty is levied on premature closure.

- Active Management: Debt funds can take advantage of changing market scenarios faster to deliver higher yields to investors. Fund managers can adapt their portfolio’s tenure or mix of instruments to capitalize on the changing interest rate scenario.

- Tax Deferment: Debt funds still allow you to defer your tax liability. Let’s take the example of banks and other fixed-income deposits. Even if an FD has a long tenure, including those with cumulative interest payout upon maturity, there is still a tax obligation at the end of each financial year for the accrued interest. This means that you are required to pay taxes on the interest even if it has not been paid out to you yet. In the case of a debt fund, however, the tax liability arises only upon redemption. This means that you are taxed only when you actually realize the gain by selling or redeeming the fund.

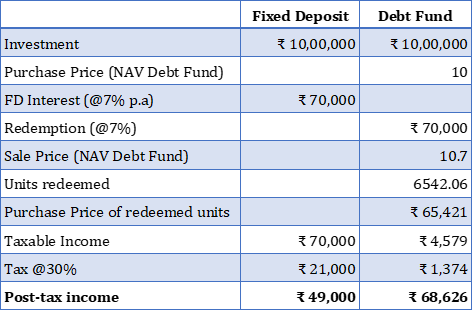

- SWPs are still better: If you plan to withdraw a certain % of your investments via SWPs from your debt mutual funds, it is still a tax-efficient way than using a common go-to vehicle like FD. Refer to the table below to understand this better.

Returns assumed at 7% per annum for both the vehicles

Final Words

You must remember that not long ago, equity investments were exempt from tax. Did the changes in the taxation of equities change the way people invest in equities today? No, at the end of the day, the importance of a vehicle or asset to your portfolio should be analyzed on the basis of its alignment with your financial objective. Debt funds still have a major role to play in meeting your financial goals. Hence, stay invested, and this mere taxation change shouldn’t change your investment strategy.

If you have a question, share it in the comments below or DM us or call us – +91 9051052222. We’ll be happy to answer it.

Share With

I'm a cool paragraph that lives inside of an even cooler modal. Wins!

Are you sure?

In case you didnt know, you can open your account online within 24 hours. Offline account opening takes up to 4 working days. If you wish to open your account offline, fill and sign the forms using a black/blue ballpoint pen. Please fill in the email and mobile number of the applicant to avoid account opening delays.

Enter Password

Please enter your details and password

New to Dayco?

Enter Password

Please enter your details and password

New to Dayco?

Filing Complaints on SCORES (SEBI) – Easy & Quick

- Register on SCORES Portal (SEBI)

- Mandatory details for filing complaints on SCORES:

- Name, PAN, Address, Mobile Number, E-mail ID

- Benifits:

- Effective Communication

- Speedy redressal of the grievances

Thanks !!

Your details were successfully received.

Thank you for Your Feedback!

Our Team is working constantly on improving our user experience and your feedback really means a lot.

Thanks !!

App Link Send to your mobile number successfully.

Thank You

All your Questions have been recorded

Thank You

All your Questions have been recorded

Thank You!

Thank you for your response. We'll get in touch with you at the earlisest for your investment planning needs

NEXT

Thank You!

Thank You for your interest in our Moderate Equity Portfolio. Please find below the credentials to track this portfolio:

User ID: mockmod@daycoindia.com

Password: abcd@1234

Portfolio Tracker

Please Read!

Risk profiling is crucial for identifying and managing potential risks in investment decisions. Please carry out your risk profiling before making any investment decisions.

Complete Risk Assessment Now

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Set Your Goal

Please Select an option from below

Set Your Goal

Please Select an option from below

Thanks You !

We appreciate your interest in our services. Our team will be in touch with you shortly.

CloseSet your Goal

Please enter your details in the fields provided

Thanks You!!

Calculation report has been sent to your mail id successfully

Clear form?

This will remove your answers from all questions and cannot be undone.

Book Appointment

Book Appointment

Leave a Reply