Smart Beta Funds Should You Invest In Them

![]() May 24, 2024

May 24, 2024

![]() 0 Comments

0 Comments

There are two extremes in the mutual fund world. One one end, there are those actively managed funds. And on the other end, there are passive funds that track indexes. However, there is a middle path - smart beta funds.

What Is a Smart Beta Fund?

A smart beta fund tracks a particular index, but the stocks are selected NOT on the basis of market-cap, but on the basis of certain factors. These factors include: value, momentum, dividend, quality etc.

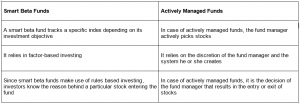

The way smart beta funds work, it can be mistaken as an actively managed fund. However there are some differences between smart beta funds and actively managed funds.

That being said, both NSE and BSE have smart beta indices that mutual funds and etfs can track and replicate. When a smart beta fund tracks a smart beta index, the fund should be termed as passive factor-based fund.

Factors That a Smart Beta Fund Take Into Account

Smart beta funds leverage factors-based investing. Some take a single factor into account, while others take multiple factors into account. What are these factors?

Value: A smart beta fund that takes the factor of value into account contains stocks whose current prices are less than their intrinsic prices. Fundamentals like P/B ratio, P/E ratio, P/S ratio, and dividend yield are used to identify and select such stocks.

Dividend Yield: Many smart beta funds also take dividend yield as the criteria for selecting stocks. In this case, stocks from a particular index are selected based on how high their dividend yields are.

Low Volatility: Investors with low risk appetite hate volatility. Smart beta funds that take low volatility into account identify and select stocks that have lower than the average volatility displayed by the index of which those stocks are a part. Fundamentals like beta value and standard deviation are used to identify low volatility stocks.

Quality: Many smart beta funds take profitability and good financials of stocks into account to select and add stocks. Fundamentals like profitability, debt to equity ratio, RoE, RoCE, cash flow, current ratio etc to identify and select stocks with good financials.

As we said, many smart beta funds take more than one of the factors mentioned above into account.

Examples of Smart Beta Funds:

There are several smart beta funds that take different factors into account. Here are some examples of smart beta funds:

- Nifty 100 Low Volatility 30 funds: This kind of smart beta fund tracks the Nifty 100 low volatility 30 index. The basic idea is to invest in stocks (from the parent Nifty 100 index) that have the lowest volatility compared across the entire index. The index calculates volatility using the standard deviation of the daily prices of stocks for the last one year. Mirae Asset Nifty 100 Low Volatility 30 ETF or Bandhan Nifty 100 Low Volatility 30 index fund are examples of funds tracking this index.

- Nifty Smallcap250 Momentum Quality 100 fund: This smart beta fund takes two factors into account - the momentum score which is calculated based on 6-month and 12-month price return, and the quality score which is calculated based on RoE, Debt to Equity ratio and EPS. Mirae Asset Smallcap 250 Momentum Quality 100 ETF is an example of such a fund. As you can see, this ETF tracks an index that has a multi factor model - both quality and momentum are taken into account.

Pros and Cons of Smart Beta Funds

As with any investment strategy, smart beta funds have their pros and cons.

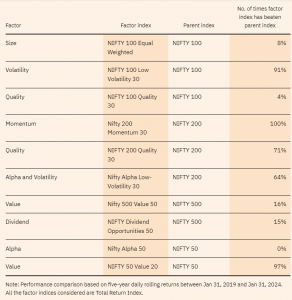

One of the most notable positive aspects of smart beta funds is the fact that they are driven by rules - not the emotion or thoughts of the fund manager. This makes these funds resilient against biases. Some smart beta indices have the potential of beating the returns generated by parent indices. Here is an interesting data point from valueresearchonline.com

Here’s how smart beta indices have fared historically:

However, during a period when a particular strategy is out of favour, smart beta funds will underperform. As you can see from the annual returns of smart beta indices below that they have had periods where returns are negative or suboptimal.

There are times when these funds perform exceptionally well and then, there are times when they lag behind.

Should You Invest In Smart Beta Funds?

The question, “Should I invest in smart beta funds?” can have multiple answers. Why? Because different smart beta funds can have different strategies. For example, Nifty Low Volatility 50 funds are designed to help investors leverage the Nifty 50 index but with more protection against volatility. So anyone who is intending to invest in Nifty 50 but has a comparatively lower risk appetite can leverage this fund.

Remember, smart beta funds can have long periods of underperformance. For example, the Nifty 500 value 50 fund gave -26% and -14% returns in 2018 and 2019 consecutively. You might sometimes need to wait for more than 3 or 4 years for your investment to turn positive. So, invest in these factor-based funds if you can afford a longer time horizon. This means that your goals need to be at least 5 years away as far as investing in these funds are concerned. And don’t forget to take your risk profile into account while investing in these funds.

Factors like momentum, value or low volatility have a positive potential in terms of returns. When you invest in funds that use a mix of factors - you get the best of all the worlds. Such funds have seen good performance. Smart beta funds consisting of small cap and midcap stocks can be volatile irrespective of strategies used. These small cap and mid cap stocks can have extended periods of underperformance thereby bringing the returns of these funds down.

Another point to consider - the first smart beta fund in India was launched in 2015. The India stock market was heavily influenced by factors like political shifts from 2014 to 2019. Then came the pandemic and the ensuing bull run. Due to these extraordinary circumstances, the historical return generated by these funds might have become skewed. You can’t really base your investment decision by looking at the returns during this short time frame. So, when you invest in these funds, use the same caution as you would when you invest in other equity funds. The short term data looks promising. There is no reason why you should completely avoid smart beta funds. But keep the above-mentioned aspects in mind. Keep in mind, though, that these smart beta funds are essentially passively managed. So invest only those smart beta funds that have expense ratios closer to those of the corresponding parent index funds. Lastly, make sure that you invest in those factor-based funds that have a lower tracking difference and tracking error. You can talk to a registered investment advisor for a more nuanced analysis based on your unique financial situation.

Bottomline:

Smart beta funds offer a nice twist to traditional market-cap based index funds. Yes, you need to monitor your investment in these funds as the factors used by these funds might not always perform. It’s a nice middle path between investing in entirely passively managed funds and investing in actively managed funds.

-Nischay Avichal

Share With

I'm a cool paragraph that lives inside of an even cooler modal. Wins!

Are you sure?

In case you didnt know, you can open your account online within 24 hours. Offline account opening takes up to 4 working days. If you wish to open your account offline, fill and sign the forms using a black/blue ballpoint pen. Please fill in the email and mobile number of the applicant to avoid account opening delays.

Enter Password

Please enter your details and password

New to Dayco?

Enter Password

Please enter your details and password

New to Dayco?

Filing Complaints on SCORES (SEBI) – Easy & Quick

- Register on SCORES Portal (SEBI)

- Mandatory details for filing complaints on SCORES:

- Name, PAN, Address, Mobile Number, E-mail ID

- Benifits:

- Effective Communication

- Speedy redressal of the grievances

Thanks !!

Your details were successfully received.

Thank you for Your Feedback!

Our Team is working constantly on improving our user experience and your feedback really means a lot.

Thanks !!

App Link Send to your mobile number successfully.

Thank You

All your Questions have been recorded

Thank You

All your Questions have been recorded

Thank You!

Thank you for your response. We'll get in touch with you at the earlisest for your investment planning needs

NEXT

Thank You!

Thank You for your interest in our Moderate Equity Portfolio. Please find below the credentials to track this portfolio:

User ID: mockmod@daycoindia.com

Password: abcd@1234

Portfolio Tracker

Please Read!

Risk profiling is crucial for identifying and managing potential risks in investment decisions. Please carry out your risk profiling before making any investment decisions.

Complete Risk Assessment Now

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Set Your Goal

Please Select an option from below

Set Your Goal

Please Select an option from below

Thanks You !

We appreciate your interest in our services. Our team will be in touch with you shortly.

CloseSet your Goal

Please enter your details in the fields provided

Thanks You!!

Calculation report has been sent to your mail id successfully

Clear form?

This will remove your answers from all questions and cannot be undone.

Book Appointment

Book Appointment

Leave a Reply