Time Value of Money A Key to Accelerating Your Path to Financial Independence

![]() November 14, 2024

November 14, 2024

![]() 0 Comments

0 Comments

Imagine your employer paid you a bonus of Rs.1000 today. What can you do with it? You can buy essential things, or you can save or invest it. Now imagine that your employer says that the Rs.1000 that you have earned will be paid to you one year later. Will you be able to get the same value out of it when you receive it after a year? No. Here’s why…

If you have Rs.1000 today, you can buy yourself a work wear for the amount. However, six months later, the same workwear might cost you more than Rs. 1000. Why? Due to inflation. Again, if you invest the money in a fixed deposit, you would get at least Rs.1060 after a year as it would accrue interest. So, if you get the money a year later, you will just have Rs.1000 in your hand. This is the time value of money. The basic concept is:

The amount of money that you get today is worth more than the same amount that you might get a year later. The simple reason is because you have the option to invest this money today.

Opportunity Cost: The Root Idea Behind The Time Value of Money

There are Mathematical formulas pertaining to the Time Value of Money. Before we talk about them, let’s first identify how TVM and opportunity cost are intrinsically related.

Money is a resource with which you can buy things and make your life easier, healthier. So when you get Rs.1000 today you can invest and gain at least an interest of Rs.60 after a year. But if you get the money after a year, you lose the opportunity of earning any interest on it over the course of that year. This is your opportunity cost. Similarly, you might not be able to buy the thing that you can buy today with Rs.1000 if you get the money after a year - due to inflation. This is again another way of looking at opportunity cost.

Time Value of Money in Investment

Now, let’s take some examples of TVM that can help us gain more clarity on our investments and the returns on it. These examples use the concept of future value and present value which are the core part of TVM.

Starting Early vs. Starting Late

The time value of money shines when you consider the impact of compounding. Imagine two individuals – Mr. A and Mr. B – both of them want to retire at 50. However, A starts investing 10 years earlier than B.

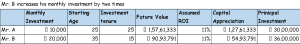

A starts investing 10K per month from the age of 25 while B delays his investment by 10 years and starts with the same amount from 35. Here is the result:

It is very clear from the above that A made the right decision by starting early – B is way off (around 1.12 Cr) from the corpus A was able to save up. Let’s change the scenario and assume that since B is starting late, he can increase his investment and start with a much higher amount due to his successful career growth. B decides to increase his starting amount by two times that of A– he invests 20K per month. Nothing changes for A. Here are the results:

B still fell short by 66.6 Lakhs. The interesting thing here is that only if B had increased his monthly investment by at least 3.5 times (35K monthly investment), he would have been able to catch up to A. Another interesting conclusion can be drawn by changing a few assumptions of A. Let’s assume A only invests for the first 15 years of his investment tenure and lets the accumulated value compound for the next 10 years. B invests 20K as earlier and nothing changes for him. Here is the result:

The key? Compounding works like magic over long periods, turning small contributions into significant sums. The earlier you invest, the more time your money has to multiply. This can mean the difference between a comfortable retirement and falling short of your financial independence goals. Time in the market beats timing the market, and compounding rewards the patient.

Inflation Erosion: Protecting Your Wealth Over Time

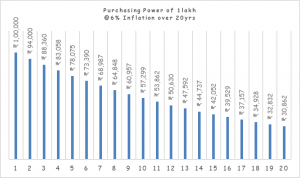

Inflation silently erodes the purchasing power of your money. What you can buy today for ₹1 lakh might cost twice as much in the future. This makes early investing crucial because simply holding onto cash means losing value over time.

Here is an illustration on how inflation erodes the value of one lakh over a 20-year period.

When you invest, especially in instruments that grow faster than inflation, like equities or mutual funds, you not only preserve your purchasing power but also increase it. Financial independence isn’t just about saving money; it’s about growing your wealth so that it can outpace inflation. By investing early, you’re protecting your future self from the shrinking value of money.

Reaching Your Goals with Less Effort

Reaching financial independence doesn’t require herculean savings efforts if you start early. The beauty of time is that it allows your money to work for you, growing steadily year after year. By investing small amounts consistently over a long period, you can achieve large financial goals with much less effort than someone who starts later in life as you have already seen above.

TVM helps you set your goal and start investing with a plan. Let’s say your goal is to accumulate 5 crores for retirement. If you start investing at 30, you have around 30 years to accumulate this amount, assuming you will retire at 60. Without the help of TVM, you start investing around 10K per month for this goal. But is it the right amount to save for? Will it help you reach your goal? Let’s check

![]()

Clearly, you may fall short of your target amount of 5 crores by at least 2.19 crore assuming a 11% ROI. These calculations through TVM can help you clearly understand where you stand when it comes to each of your goal. In the above scenario, increasing your monthly investment by 8K would help you reach your goal. Other option would be to keep increasing your monthly investments by at least 5% every year – meaning next year you would increase the amount to 10.5K, the following year to 11K, and so on.

Bottomline:

The time value of money is actually a very important concept for investment strategies and personal finance decisions. Whether active investor or simply interested in how money grows with time, TVM is a key influencer in making better financial choices. Time reminds that it is one of the most valued bases on which the building of wealth relies. Meanwhile, as deep as one plunges into the world of TVM, it is quite important not to forget the opportunity cost that comes with TVM, hand in glove. When you learn the two, you will have a better understanding of how best to use your money and get closer to attaining all your goals.

~ Nischay Avichal

Share With

I'm a cool paragraph that lives inside of an even cooler modal. Wins!

Are you sure?

In case you didnt know, you can open your account online within 24 hours. Offline account opening takes up to 4 working days. If you wish to open your account offline, fill and sign the forms using a black/blue ballpoint pen. Please fill in the email and mobile number of the applicant to avoid account opening delays.

Enter Password

Please enter your details and password

New to Dayco?

Enter Password

Please enter your details and password

New to Dayco?

Filing Complaints on SCORES (SEBI) – Easy & Quick

- Register on SCORES Portal (SEBI)

- Mandatory details for filing complaints on SCORES:

- Name, PAN, Address, Mobile Number, E-mail ID

- Benifits:

- Effective Communication

- Speedy redressal of the grievances

Thanks !!

Your details were successfully received.

Thank you for Your Feedback!

Our Team is working constantly on improving our user experience and your feedback really means a lot.

Thanks !!

App Link Send to your mobile number successfully.

Thank You

All your Questions have been recorded

Thank You

All your Questions have been recorded

Thank You!

Thank you for your response. We'll get in touch with you at the earlisest for your investment planning needs

NEXT

Thank You!

Thank You for your interest in our Moderate Equity Portfolio. Please find below the credentials to track this portfolio:

User ID: mockmod@daycoindia.com

Password: abcd@1234

Portfolio Tracker

Please Read!

Risk profiling is crucial for identifying and managing potential risks in investment decisions. Please carry out your risk profiling before making any investment decisions.

Complete Risk Assessment Now

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Set Your Goal

Please Select an option from below

Set Your Goal

Please Select an option from below

Thanks You !

We appreciate your interest in our services. Our team will be in touch with you shortly.

CloseSet your Goal

Please enter your details in the fields provided

Thanks You!!

Calculation report has been sent to your mail id successfully

Clear form?

This will remove your answers from all questions and cannot be undone.

Book Appointment

Book Appointment

Leave a Reply