What are Corporate Actions

![]() June 19, 2023

June 19, 2023

![]() 0 Comments

0 Comments

Corporate actions help investors get an idea of how the management plans to maintain the company’s future path. These periodic events affect investors and the company’s financial structure in various ways. Understanding their implications can help you make investment decisions & understand the company’s financial prospects. This article discusses the five common corporate actions – Dividends, bonuses, Splits, Rights, and Buybacks.

DIVIDEND

Dividends are a medium through which the company distributes its profits to the shareholders. Companies are not obligated to pay dividends to the shareholders. Some companies choose instead to use the reserves for expansion and future growth.

Dividend payments have a specific timeline to shortlist all the eligible beneficiaries. Some of the important dates with regards to dividends are below:

Dividend Declaration: This is when the company declares the dividend.

Record Date: This company shortlists the shareholders eligible to receive dividends on this date. This means you should have the shares in your Demat account on this date.

Ex-dividend Date: Ex-date is set before the record date. Investors should purchase shares prior to this date to be eligible for dividends. Because of the T+2 settlement cycle in India, you should buy the shares before the Ex-date for the delivery of shares to your Demat account. The company shares are cum-dividend (the share price includes the dividend) till the ex-date. Payment of dividends is a form of reduction in distributable equity. Following the dividend payout, the share prices fall by the dividend amount.

BONUS ISSUE

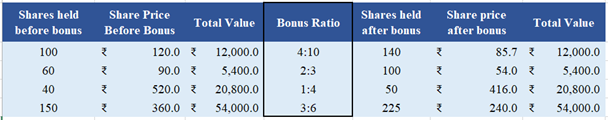

Bonus involves the issue of free shares in a fixed bonus ratio to existing shareholders of the company. The company gives these as an alternative to cash dividends. Similar to dividend declaration, there is a record date to finalize the list of shareholders eligible for the bonus. Issue of bonus shares increases your shares, but your investment value remains the same. Below is an illustration to help you understand how your holdings would be impacted across different bonus ratios.

The company may use bonus issues to decrease the share price, making them more affordable to retail investors or enhancing the stock’s liquidity.

STOCK-SPLIT

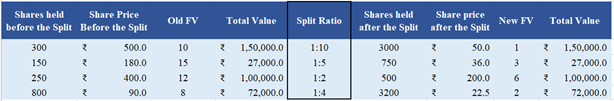

As the name suggests, a stock split involves splitting the face value of the stock. A stock split increases your shares like a bonus issue, but the overall market value remains unchanged. Splits are used for the similar reason of bringing down the share price to a more investor-friendly level. They are also used to increase the stock’s liquidity.

The below table gives you a glance at how your investment would be impacted under various split ratios.

Furthermore, opposite to a regular stock split are reverse stock splits. In a reverse stock split, the number of shares decreases in the market, and the share price increases proportionately while the market cap remains the same. Companies might carry this out to avoid being delisted from exchanges or bring the stock prices back to a more respectable level in the market if the stock prices had fallen drastically.

BUYBACK

A buyback is an exercise carried out by the company to buy its shares from the market. The company buys back its shares within a time frame by quoting a fixed price in a tender offer, usually above the market price. You can participate in the proposal by tendering your shares wholly or partly through your broker. You’ll be entitled to participate in the tender offer subject to your holding on the record date. Your tendered shares are subject to acceptance/non-acceptance by the company.

Releasing excess cash to the shareholders (in the case of scant investment opportunities), offering investors a fair exit route, or consolidating their stake are the primary reasons a company goes for share repurchase. A buyback also increases a company’s valuation due to EPS (Earnings Per Share) and ROE (Return on Equity) improvement. According to the current tax regulations, buybacks are a tax-efficient way to get back your money from the company.

RIGHTS ISSUE

A listed company goes for a rights issue to raise fresh capital from existing shareholders. Unlike bonus shares, you’ll have to pay for these stocks. The company offers the shares to existing shareholders at a discount with respect to the market. The number of shares you can apply for depends upon your holding.

For example, a 1:2 Rights means you can buy an additional share for every two shares you own. It’s upon you to either apply for the rights issue (partly or wholly) or refrain from it altogether. The rights entitlement will be credited to your Demat & are traded on the stock exchange, enabling trade and transfer of your rights entitlement (Renunciation) to other interested investors. You can also renunciate your rights off-market.

There are several reasons a company would go for a rights issue, like expanding their business or funding a new project or improving solvency, or paying off existing debt.

We hope this blog helped you get a clearer picture of various corporate actions and their impact. Stay tuned for the next blog, where we discuss corporate actions and their taxation.

If you have a question, share it in the comments below or DM us or call us - +91 9051052222. We'll be happy to answer it.

- Nischay Avichal, Krishnendu Patra

Share With

I'm a cool paragraph that lives inside of an even cooler modal. Wins!

Are you sure?

In case you didnt know, you can open your account online within 24 hours. Offline account opening takes up to 4 working days. If you wish to open your account offline, fill and sign the forms using a black/blue ballpoint pen. Please fill in the email and mobile number of the applicant to avoid account opening delays.

Enter Password

Please enter your details and password

New to Dayco?

Enter Password

Please enter your details and password

New to Dayco?

Filing Complaints on SCORES (SEBI) – Easy & Quick

- Register on SCORES Portal (SEBI)

- Mandatory details for filing complaints on SCORES:

- Name, PAN, Address, Mobile Number, E-mail ID

- Benifits:

- Effective Communication

- Speedy redressal of the grievances

Thanks !!

Your details were successfully received.

Thank you for Your Feedback!

Our Team is working constantly on improving our user experience and your feedback really means a lot.

Thanks !!

App Link Send to your mobile number successfully.

Thank You

All your Questions have been recorded

Thank You

All your Questions have been recorded

Thank You!

Thank you for your response. We'll get in touch with you at the earlisest for your investment planning needs

NEXT

Thank You!

Thank You for your interest in our Moderate Equity Portfolio. Please find below the credentials to track this portfolio:

User ID: mockmod@daycoindia.com

Password: abcd@1234

Portfolio Tracker

Please Read!

Risk profiling is crucial for identifying and managing potential risks in investment decisions. Please carry out your risk profiling before making any investment decisions.

Complete Risk Assessment Now

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Set Your Goal

Please Select an option from below

Set Your Goal

Please Select an option from below

Thanks You !

We appreciate your interest in our services. Our team will be in touch with you shortly.

CloseSet your Goal

Please enter your details in the fields provided

Thanks You!!

Calculation report has been sent to your mail id successfully

Clear form?

This will remove your answers from all questions and cannot be undone.

Book Appointment

Book Appointment

Leave a Reply