Every parent wants to give their child the best start in life; a solid education is a fundamental part of that. Planning for a child’s education can be overwhelming and confusing, with many options and decisions to make. And financing is a very crucial part of the various decisions you are likely to make as your child grows up. In this blog, we’ll explore the importance of education planning, how you can plan for your child’s education, and the various vehicles available to help you fund it.

The importance of planning

Some crucial points on why planning your child’s education is the need of the hour.

- Education loan: The rising education expenses make it likely that more parents will rely on education loans. By planning for your child’s education expenses early, you’ll be able to avoid those high-cost education loans which can weigh you and your child down with debt for years to come.

- Financial stress: When educational expenses are planned in advance, parents can be more confident that they will be able to pay for them. It will help you avoid financial stress as you will have the right resources at the appropriate time.

- Inflation: As pointed out earlier, education costs are rising. From tuition fees, transportation, living expenses, academic resources, and exam fees, expenses have not been the same over the years. Inflation is high. The current cost of education will double every seven years if we assume a 10% inflation. In order to prepare for this ahead, adjusting the needs for inflation and planning a suitable corpus is paramount.

- Opportunities: The education landscape is ever-changing. The education opportunities in the future are likely to be vast. Planning ensures you will be prepared to give your child better educational opportunities, from prestigious universities to specialized programs.

- Early investing: Starting early means having the chance to save up a huge sum of money over time. Monthly contributions of 10K increased by just 5% every year can add up to more than one crore in 20 years’ time assuming a 10% ROI.

How to plan?

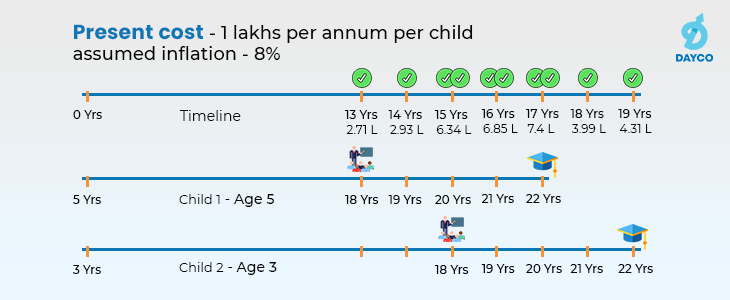

For planning the expenses, you’ll have to consider two primary inputs – the current cost of education your child wishes to pursue and the expected inflation of the said cost. An inflation rate of anywhere between 8-12% is recommended to estimate the corpus suitably. Although a lot can’t be said about the type of education your child will pursue in the future; a rough estimate can be arrived at by seeking appropriate guidance from a career counselor. After you have both inputs, you can prepare a timeline like the one below to get a better idea about the funds you’ll need and when you’ll need them. A timeline can help you plan your portfolio and savings requirements.

| Inflation | 8% | ||

| Present Cost | ₹ 1,00,000 | per child per annum | |

| Age Child 1 | 5 | ||

| Age Child 2 | 3 | ||

| Higher education costs starting from the age of 18 | |||

| Age Child 1 | Age Child 2 | Year to goal | Future Cost |

| 18 | 16 | 13 | ₹ 2,71,962 |

| 19 | 17 | 14 | ₹ 2,93,719 |

| 20 | 18 | 15 | ₹ 6,34,434 |

| 21 | 19 | 16 | ₹ 6,85,189 |

| 22 | 20 | 17 | ₹ 7,40,004 |

| 23 | 21 | 18 | ₹ 3,99,602 |

| 24 | 22 | 19 | ₹ 4,31,570 |

Where to invest?

Before starting an investment plan for your child, be sure to consider three important things. First, understand your risk appetite. Risk appetite or risk profiling is the process of understanding your attitude towards investment risks. Risk profiling can help you choose the investment vehicles you are comfortable with. A risk analysis is typically carried out by a psychometric questionnaire by your financial advisor. Second, calculate the number of years left to fund your child’s education needs. Your goal horizon, together with your risk profile, helps you narrow down appropriate asset classes and products. Third, be wary of buying expensive and low-yielding insurance vehicles that are widely mis-sold as a replacement for effective investment products already available in the Indian market. Avoid insurance plans that are marketed as savings plans or child plans. Pure-term life insurance is the best way to insure yourself (your child doesn’t need insurance). The best child investment plan can be created using the following investment vehicles:

- Mutual Funds: Mutual funds are pooled investment vehicles managed by experts with stringent regulatory norms and provide an easier way for ordinary investors to invest in the equity and debt market. Investment options like systematic investment plans can be used to save small amounts consistently. Equity investments should form a significant part of your overall allocation for a long-term goal, such as child education, to generate inflation-beating returns. Mutual funds can help you generate handsome returns in the long term with better risk management and periodic review of your portfolio.

- PPF: Public provident fund is a central government-backed small savings scheme. The scheme comes in the EEE tax category and provides a risk-free return. It can be a suitable alternative for parents who can’t open an SSY account (available for a girl child only, more below). You can read all about the PPF scheme here.

- SSY: Sukanya Samriddhi Yojana is a Central Government-backed small savings scheme launched to encourage girl child education. The scheme is similar in the tax benefits & investment limits associated with PPF but offers higher returns than PPF. The account can be opened with any post office and authorized bank in India in the name of the girl child. Read more about the scheme here.

Finally, when planning for your child’s education goals, including foreign asset class exposure in your investment strategy is important for diversification and dollar risk hedging. Diversification refers to spreading your investments across different asset classes, sectors, and geographic regions to reduce the overall risk of your portfolio. The cost of overseas education can be significant and can be affected by changes in currency exchange rates. By investing in foreign assets, you can benefit from favorable currency fluctuations and offset some of the costs associated with an overseas education. Vehicles like international ETFs, international mutual funds, FOFs, and platforms like India INX Global Access (BSE) can provide an effective way for taking international exposure.

Thank you for taking the time to read.

If you have a question, share it in the comments below or DM us or call us – +91 9051052222. We’ll be happy to answer it.

– Nischay Avichal