Towards making Indian Securities Market - Transparent, Efficient, & Investor friendly by providing safe, reliable, transparent and trusted record keeping platform for investors to hold and transfer securities in dematerialized form.

To hold securities of investors in dematerialised form and facilitate its transfer, while ensuring safekeeping of securities and protecting interest of investors.

To provide timely and accurate information to investors with regard to their holding and transfer of securities held by them.

To provide the highest standards of investor education, investor awareness and timely services so as to enhance Investor Protection and create awareness about Investor Rights.

A Depository is an organization which holds securities of investors in electronic form. Depositories provide services to various market participants - Exchanges, Clearing Corporations, Depository Participants (DPs), Issuers and Investors in both primary as well as secondary markets. The depository carries out its activities through its agents which are known as Depository Participants (DP). Details available in the link https://nsdl.co.in/dpsch.php

1. Basic Services

| Sr. No | Brief about the Activity / Service | Expected Timelines for processing by the DP after receipt of proper documents |

|---|---|---|

| 1 | Dematerialization of securities | 7 days |

| 2 | Rematerialization of securities | 7 days |

| 3 | Mutual Fund Conversion / Destatementization | 5 days |

| 4 | Re-conversion / Restatementisation of Mutual fund units | 7 days |

| 5 | Transmission of securities | 7 days |

| 6 | Registering pledge request | 15 days |

| 7 | Closure of Demat account | 30 days |

| 8 | Settlement Instruction | Depositories to accept physical DIS for pay-in of securities upto 4 p.m. and DIS in electronic form upto 6 p.m. on T+1 day |

2. Depositories provide special services like pledge, hypothecation, internet based services etc. in addition to their core services and these include

| Sr. No | Type of Activity /Service | Brief about the Activity / Service |

|---|---|---|

| 1 | Value Added Services | Depositories also provide value added services

such as

|

| 2 | Consolidated Account statement (CAS) | CAS is issued 10 days from the end of the month (if there were transactions in the previous month) or half yearly (if no transactions). |

| 3 | Digitalization of services provided by the depositories | Depositories offer below technology solutions

and e-facilities to their demat account holders

through DPs:

|

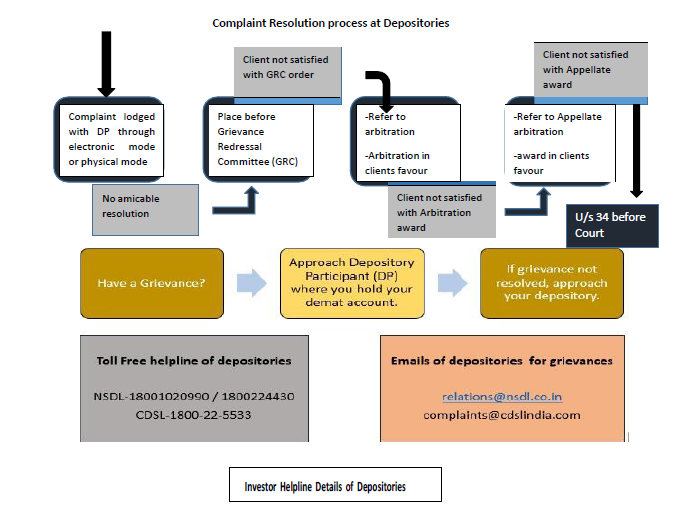

1. The Process of investor grievance redressal

| Sr. No | Type of Activity /Service | Brief about the Activity / Service |

|---|---|---|

| 1 | Investor Complaint/ Grievances | Investor can lodge complaint/ grievance against

the Depository/DP in the following ways:

a. Electronic mode -

The complaints/ grievances lodged directly with the Depository shall be resolved within 30 days. |

| 2 | Investor Grievance Redressal Committee of Depository | If no amicable resolution is arrived, then the Investor has the option to refer the complaint/ grievance to the Grievance Redressal Committee (GRC) of the Depository. Upon receipt of reference, the GRC will endeavor to resolve the complaint/ grievance by hearing the parties, and examining the necessary information and documents. |

| 3 | Arbitration proceedings | The Investor May also avail the arbitration mechanism set out in the Byelaws and Business Rules/Operating Instructions of the Depository in relation to any grievance, or dispute relating to depository services. The arbitration reference shall be concluded by way of issue of an arbitral award within 4 months from the date of appointment of arbitrator(s). |

| Sr. No | Type of special circumstances | Timelines for the Activity/ Service |

|---|---|---|

| 1 |

|

Client will have a right to transfer all its securities to any other Participant of its choice without any charges for the transfer within 30 days from the date of intimation by way of letter/email. |

| Sr. No | Guidance |

|---|---|

| 1 |

|

| 2 |

|

| 3 |

|

| 4 |

|

| 5 |

|

| 6 |

|

| 7 |

|

| 8 |

|

| 9 |

|

| 10 |

|

| 11 |

|

| 12 |

|

| 13 |

|

| 14 |

|

| 15 |

|

| 16 |

|

| 17 |

|

| 18 |

|

| 19 |

|

| 20 |

|

1. Receive a copy of KYC, copy of account opening documents.

2. No minimum balance is required to be maintained in a demat account.

3. No charges are payable for opening of demat accounts.

4. If executed, receive a copy of Power of Attorney. However, Power of Attorney is not a mandatory requirement as per SEBI / Stock Exchanges. You have the right to revoke any authorization given at any time.

5. You can open more than one demat account in the same name with single DP/ multiple DPs.

6. Receive statement of accounts periodically. In case of any discrepancies in statements, take up the same with the DP immediately. If the DP does not respond, take up the matter with the Depositories.

7. Pledge and /or any other interest or encumbrance can be created on demat holdings.

8. Right to give standing instructions with regard to the crediting of securities in demat account.

9. Investor can exercise its right to freeze/defreeze his/her demat account or specific securities / specific quantity of securities in the account, maintained with the DP.

10. In case of any grievances, Investor has right to approach Participant or Depository or SEBI for getting the same resolved within prescribed timelines.

11. Every eligible investor shareholder has a right to cast its vote on various resolutions proposed by the companies for which Depositories have developed an internet based ‘e-Voting’ platform.

12. Receive information about charges and fees. Any charges/tariff agreed upon shall not increase unless a notice in writing of not less than thirty days is given to the Investor.

1. Deal with a SEBI registered DP for opening demat account, KYC and Depository activities.

2. Provide complete documents for account opening and KYC (Know Your Client). Fill all the required details in Account Opening Form / KYC form in own handwriting and cancel out the blanks.

3. Read all documents and conditions being agreed before signing the account opening form.

4. Accept the Delivery Instruction Slip (DIS) book from DP only (preprinted with a serial number along with client ID) and keep it in safe custody and do not sign or issue blank or partially filled DIS.

5. Always mention the details like ISIN, number of securities accurately.

6. Inform any change in information linked to demat account and obtain confirmation of updation in the system.

7. Regularly verify balances and demat statement and reconcile with trades / transactions.

8. Appoint nominee(s) to facilitate heirs in obtaining the securities in their demat account.

9. Do not fall prey to fraudsters sending emails and SMSs luring to trade in stocks / securities promising huge profits.

To follow highest standards of ethics and compliances while facilitating the trading by clients in securities in a fair and transparent manner, so as to contribute in creation of wealth for investors.

| S.No. | Activities | Expected Timelines |

|---|---|---|

| 1 | KYC entered into KRA System and CKYCR | 10 days of account opening |

| 2 | Client Onboarding | Immediate, but not later than one week |

| 3 | Order execution | Immediate on receipt of order, but not later than the same day |

| 4 | Allocation of Unique Client Code | Before trading |

| 5 | Copy of duly completed Client Registration Documents to clients | 7 days from the date of upload of Unique Client Code to the Exchange by the trading member |

| 6 | Issuance of contract notes | 24 hours of execution of trades |

| 7 | Collection of upfront margin from client | Before initiation of trade |

| 8 | Issuance of intimations regarding other margin due payments | At the end of the T day |

| 9 | Settlement of client funds | 30 days / 90 days for running account settlement (RAS) as per the preference of client. If consent not given for RAS – within 24 hours of pay-out |

| 10 | ‘Statement of Accounts’ for Funds, Securities and Commodities | Weekly basis (Within four trading days of following week) |

| 11 | Issuance of retention statement of funds/commodities | 5 days from the date of settlement |

| 12 | Issuance of Annual Global Statement | 30 days from the end of the financial year |

| 13 | Investor grievances redressal | 30 days from the receipt of the complaint |

| Sr. No | DOs | DON’Ts |

|---|---|---|

| 1 | Read all documents and conditions being agreed before signing the account opening form. | Do not deal with unregistered stock broker. |

| 2 | Receive a copy of KYC, copy of account opening documents and Unique Client Code. | Do not forget to strike off blanks in your account opening and KYC |

| 3 | Read the product / operational framework / timelines related to various Trading and Clearing & Settlement processes. | Do not submit an incomplete account opening and KYC form. |

| 4 | Receive all information about brokerage, fees and other charges levied. | Do not forget to inform any change in information linked to trading account and obtain confirmation of updation in the system |

| 5 | Register your mobile number and email ID in your trading, demat and bank accounts to get regular alerts on your transactions. | Do not transfer funds, for the purposes of trading to anyone other than a stock broker. No payment should be made in name of employee of stock broker. |

| 6 | If executed, receive a copy of Power of Attorney. However, Power of Attorney is not a mandatory requirement as per SEBI / Stock Exchanges. Before granting Power of Attorney, carefully examine the scope and implications of powers being granted. | Do not ignore any emails / SMSs received with regards to trades done, from the Stock Exchange and raise a concern, if discrepancy is observed. |

| 7 | Receive contract notes for trades executed, showing transaction price, brokerage, GST and STT etc. as applicable, separately, within 24 hours of execution of trades. | Do not opt for digital contracts, if not familiar with computers |

| 8 | Receive funds and securities / commodities on time within 24 hours from pay-out. | Do not share trading password. |

| 9 | Verify details of trades, contract notes and statement of account and approach relevant authority for any discrepancies. Verify trade details on the Exchange websites from the trade verification facility provided by the Exchanges. | Do not fall prey to fixed / guaranteed returns schemes. |

| 10 | Receive statement of accounts periodically. If opted for running account settlement, account has to be settled by the stock broker as per the option given by the client (30 or 90 days). | Do not fall prey to fraudsters sending emails and SMSs luring to trade in stocks / securities promising huge profits |

| 11 | In case of any grievances, approach stock broker or Stock Exchange or SEBI for getting the same resolved within prescribed timelines. | Do not follow herd mentality for investments. Seek expert and professional advice for your investments. |

Level 1 – Approach the Stock Broker at the designated Investor Grievance e-mail ID of the stock broker. The Stock Broker will strive to redress the grievance immediately, but not later than 30 days of the receipt of the grievance.

Level 2 – Approach the Stock Exchange using the grievance mechanism mentioned at the website of the respective exchange.

| Sr. No | Type of Activity | Day of complaint (C Day). |

|---|---|---|

| 1 | Receipt of Complaint | Day of complaint (C Day). |

| 2 | Additional information sought from the investor, if any, and provisionally forwarded to stock broker. | C + 7 Working days. |

| 3 | Registration of the complaint and forwarding to the stock broker. | C+8 Working Days i.e. T day. |

| 4 | Amicable Resolution. | T+15 Working Days. |

| 5 | Refer to Grievance Redressal Committee (GRC), in case of no amicable resolution. | T+16 Working Days. |

| 6 | Complete resolution process post GRC. | T + 30 Working Days. |

| 7 | In case where the GRC Member requires additional information, GRC order shall be completed within. | T + 45 Working Days. |

| 8 | Implementation of GRC Order. | On receipt of GRC Order, if the order is in favour of the investor, debit the funds of the stock broker. Order for debit is issued immediately or as per the directions given in RC order |

| 9 | In case the stock broker is aggrieved by the GRC order, will provide intention to avail arbitration | Within 7 days from receipt of order |

| 10 | If intention from stock broker is received and the GRC order amount is upto Rs.20 lakhs | Investor is eligible for interim relief from Investor Protection Fund (IPF).The interim relief will be 50% of the GRC order amount or Rs.2 lakhs whichever is less. The same shall be provided after obtaining an Undertaking from the investor. |

| 11 | Stock Broker shall file for arbitration | Within 6 months from the date of GRC recommendation |

| 12 | In case the stock broker does not file for arbitration within 6 months | The GRC order amount shall be released to the investor after adjusting the amount released as interim relief, if any. |

Default of TM/CM

Following steps are carried out by Stock Exchange for benefit of investor, in case stock broker defaults:

Following information is available on Stock Exchange website for information of investors:

Level 3 – The complaint not redressed at Stock Broker / Stock Exchange level, may be lodged with SEBI on SCORES (a web based centralized grievance redressal system of SEBI) @ https://scores.gov.in/scores/Welcome.html

Invest with knowledge & safety.

Every investor should be able to invest in right investment products based on their needs, manage and monitor them to meet their goals, access reports and enjoy financial wellness.

To enter into an agreement with the client providing all details including fee details, aspect of Conflict of interest disclosure and maintaining confidentiality of information.

To do a proper and unbiased risk – profiling and suitability assessment of the client.

To obtain registration with Know Your Client Registration Agency (KRA) and Central Know Your Customer Registry (CKYC).

To conduct audit annually.

To disclose the status of complaints in its website.

To disclose the name, proprietor name, type of registration, registration number, validity, complete address with telephone numbers and associated SEBI regional/local Office details in its website.

To employ only qualified and certified employees.

To deal with clients only from official number

To maintain records of interactions, with all clients including prospective clients (prior to onboarding), where any conversation related to advice has taken place.

Onboarding of Clients

Completing KYC of clients

Disclosure to Clients

To disclose the risk profile to the client.

To provide investment advice to the client based on the risk-profiling of the clients and suitability of the client.

In case of any grievance / complaint, an investor should approach the concerned Investment Adviser and shall ensure that the grievance is resolved within 30 days.

If the investor’s complaint is not redressed satisfactorily, one May lodge a complaint with SEBI on SEBI’s 'SCORES' portal which is a centralized web based complaints redressal system. SEBI takes up the complaints registered via SCORES with the concerned intermediary for timely redressal. SCORES facilitates tracking the status of the complaint.

With regard to physical complaints, investors May send their complaints to: Office of Investor Assistance and Education, Securities and Exchange Board of India, SEBI Bhavan, Plot No. C4-A, ‘G’ Block, Bandra-Kurla Complex, Bandra (E), Mumbai - 400 051.

Do's

Always deal with SEBI registered Investment Advisers.

Ensure that the Investment Adviser has a valid registration certificate.

Check for SEBI registration number. Please refer to the list of all SEBI registered Investment Advisers which is available on SEBI website in the following link: https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognisedFpi=yes&intmId=13)

Pay only advisory fees to your Investment Adviser. Make payments of advisory fees through banking channels only and maintain duly signed receipts mentioning the details of your payments.

Always ask for your risk profiling before accepting investment advice. Insist that Investment Adviser provides advisory strictly on the basis of your risk profiling and take into account available investment alternatives.

Ask all relevant questions and clear your doubts with your Investment Adviser before acting on advice.

Assess the risk–return profile of the investment as well as the liquidity and safety aspects before making investments.

Insist on getting the terms and conditions in writing duly signed and stamped. Read these terms and conditions carefully particularly regarding advisory fees, advisory plans, category of recommendations etc. before dealing with any Investment Adviser.

Be vigilant in your transactions.

Approach the appropriate authorities for redressal of your doubts / grievances.

Inform SEBI about Investment Advisers offering assured or guaranteed returns.

Don’ts

Don’t fall for stock tips offered under the pretext of investment advice.

Do not provide funds for investment to the Investment Adviser.

Don’t fall for the promise of indicative or exorbitant or assured returns by the Investment Advisers. Don’t let greed overcome rational investment decisions.

Don’t fall prey to luring advertisements or market rumors.

Avoid doing transactions only on the basis of phone calls or messages from any Investment adviser or its representatives.

Don’t take decisions just because of repeated messages and calls by Investment Advisers.

Do not fall prey to limited period discount or other incentive, gifts, etc. offered by Investment advisers.

Don’t rush into making investments that do not match your risk taking appetite and investment goals.

Do not share login credential and password of your trading and demat accounts with the Investment Adviser.

| Sr. No. | Financial Year | Compliance Audit Status | Remarks, If any |

| 1 | FY 2021-22 | Conducted | NA |

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month Issued in the interest of Investors"

All clients are requested to record their email id for electronic despatch of contract and statement. In case of electronic contract note, the link/login for the same is available on website for download.

Pay 20% upfront margin of the transaction value to trade in the cash market segment. Investors May please refer to the Exchange' s Frequently Asked Questions (FAQs) issued vide circular reference NSE/INSP/45191 dated July 31, 2020 and

Pay 20% upfront margin of the transaction value to trade in the cash market segment. Investors May please refer to the Exchange' s Frequently Asked Questions (FAQs) issued vide circular reference NSE/INSP/45191 dated July 31, 2020 and

Notice on Collection of Upfront Margin from 1 Aug, 2020 in Cash Segment:

No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investors account.

Submit application letter along with photocopy of PAN and address proof requesting activation of Dormant Account.

No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investors account.

Submit application letter along with photocopy of PAN and address proof requesting activation of Dormant Account.

Invest with knowledge & safety.

Every investor should be able to invest in right investment products based on their needs, manage and monitor them to meet their goals, access reports and enjoy financial wellness.

Download Client Registration Documents (Rights & Obligations, Risk Disclosure Document, Do's & Don't's) in Vernacular Language :

Dayco Securities Pvt Ltd

Type of Registration: Non-Individual

Registration Number INA300016701

Validity of registration: NA

CIN- U67120WB1994PTC064961

BASL Membership Number- BASL1757

Registered office: 113 Park Street, Poddar Point Building, 7Th Floor, North Block 700016

Telephone: 033-40675063

Aditi Day Nundy - 033-40675065

Securities And Exchange Board Of India

Eastern Regional Office, Kolkata

L & T Chambers, 3rd Floor, 16 Camac Street, Kolkata- 700017

“Investments in securities market are subject to market risks. Read all the related documents carefully before investing.”

“Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

Since we are registered with SEBI as an Investment Adviser, we are required to disclose certain information to our clients so that they can take informed decisions before taking any of our services.

Dayco Securities Private Limited is registered with the Securities and Exchange Board of India (“SEBI”) as an Investment Advisor under SEBI (Investment Advisers) Regulations, 2013 (“IA regulations”) vide registration no. INA300016701 dated February18, 2022, pursuant to which it provides investment advisory services to its clients.

There are no outstanding litigations or no disciplinary history against the Company and its directors.

There is no affiliation with any other intermediaries as on date, except as mentioned above.

The Principal Officer and the persons associated with investment advice may have holding or position in the financial products or securities which are subject matter of advice.

Disclosure with respect to compliance with Annual compliance audit requirement under Regulation 19(3) of SECURITIES AND EXCHANGE BOARD OF INDIA (INVESTMENT ADVISERS) REGULATIONS, 2013 for last and current financial year are as under :

| Sr. No. | Financial Year | Compliance Audit Status | Remarks, If any |

|---|---|---|---|

| 1 | FY 2021 -22 | Conducted | None |

| 2 | FY 2021 -23 | Conducted | None |

Disclaimer: This content is intended for the purpose of information and education only. The content does not consider any specific investment objectives. Registration granted by SEBI, membership of BSE Limited and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

Dayco Securities Pvt. Ltd. is in the business of Investment Advisory since December 2022 It is registered with SEBI as an Investment Adviser (SEBI registration number INA300016701 ). In its capacity as Investment Adviser, Dayco Securities Pvt. Ltd. is providing advice to clients on the portfolio of client and does not provide advice for any particular securities/stocks or derivatives. Dayco Securities Pvt. Ltd. may or may not hold any position with regard to the any stock/security or derivative which is held by the client. Dayco Securities Pvt. Ltd. hereby mentions that there is no obligation on the client of Dayco Securities Pvt. Ltd.'s Investment Advisory division to execute any transaction through Dayco Securities Pvt. Ltd. or any other company of Dayco Securities Pvt. Ltd. group in any manner.

The documents/reports available on the Website does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Dayco Securities Pvt. Ltd. and its group companies, directors, employees, affiliates and associates shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this document should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved) and should consult his own advisors to determine the merits and risks of such investments. The investment discussed or views expressed may not be suitable for all investors. Mutual Fund Investments are subject to market risk. Kindly read the offer document / schemes document carefully before making an investment.

We /I, the above-mentioned Research Analyst(s) of Dayco Securities Pvt Ltd (in short “Dayco Securities Pvt Ltd / the Company”), authors and the names subscribed to this Research Report, hereby certify that all of the views expressed in this Research Report accurately reflect our views about the subject issuer(s) or securities and distributed as per SEBI (Research Analysts) Regulations 2014. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this Research Report. It is also confirmed that We/I, the above mentioned Research Analyst(s) of this Research Report have not received any compensation from the subject companies mentioned in the Research Report in the preceding twelve months and do not serve as an officer, director or employee of the subject companies mentioned in the Research Report.

Dayco Securities Pvt Ltd is engaged in the business of Stock Broking, Depository Services, Portfolio Management and Distribution of Financial Products. Dayco Securities Pvt Ltd is registered as Research Analyst Entity with Securities & Exchange Board of India (SEBI) with Registration Number – INH3 INH00012892.

Dayco Securities Pvt Ltd and our associates might have investment banking and other business relationship with a significant percentage of companies covered by our Research Analysts. Dayco Securities Pvt Ltd generally prohibits its analysts, persons reporting to analysts and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

The information and opinions in this Research Report have been prepared by Dayco Securities Pvt Ltd and are subject to change without any notice. The Research Report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of Dayco Securities Pvt Ltd . While we would endeavor to update the information herein on a reasonable basis, Dayco Securities Pvt Ltd is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent Dayco Securities Pvt Ltd from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or policies of Dayco Securities Pvt Ltd, in circumstances where Dayco Securities Pvt Ltd might be acting in an advisory capacity to this company, or in certain other circumstances.

This Research Report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This Research Report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Securities as defined in clause

(h) of section 2 of the Securities Contract Act, 1956, includes Financial Instruments, Currency and Commodity Derivatives. Though disseminated to all the customers simultaneously, not all customers may receive this Research Report at the same time. Dayco Securities Pvt Ltd will not treat recipients as customers by virtue of their receiving this Research Report. Nothing in this Research Report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this Research Report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. Dayco Securities Pvt Ltd accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this Research Report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. The information given in this report is as of date of this report and there can be no assurance that future results or events will be consistent with this information. The information provided in this report remains, unless otherwise stated, the copyright of Dayco Securities Pvt Ltd. All layout, design, original artwork, concepts and intellectual Properties remains the property and copyright of Dayco Securities Pvt Ltd and may not be used in any form or for any purpose whatsoever by any party without the express written permission of the Dayco Securities Pvt Ltd.

Dayco Securities Pvt Ltd shall not be liable for any delay or any other interruption which may occur in presenting the data due to any reason including network (Internet) reasons or snags in the system, breakdown of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of Dayco Securities Pvt Ltd to present the data. In no event shall Dayco Securities Pvt Ltd be liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising in connection with the data presented by the Dayco Securities Pvt Ltd through this report. Participants in foreign exchange transactions may incur risks arising from several factors, including the following: (a) Exchange Rates can be volatile and are subject to large fluctuations; (b) the value of currencies may be affected by numerous market factors, including world and notional economic, political and regulatory events, events in Equity & Debt Markets and changes in interest rates; and (c) Currencies may be subject to devaluation or government imposed Exchange Controls which could affect the value of the Currency. Investors in securities such as Currency Derivatives, whose values are affected by the currency of an underlying security, effectively assume currency risk.

Since associates of Dayco Securities Pvt Ltd are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject company/companies mentioned in this Research Report.

Dayco Securities Pvt Ltd and its Associates, Officers, Directors, Employees, Research Analysts including their relatives worldwide may: (i) from time to may have long or short positions in, and buy or sell the Securities, mentioned herein or (ii) be engaged in any other transaction involving such Securities and earn brokerage or other compensation of the Subject Company/ companies mentioned herein or act as an Advisor or Lender/Borrower to such Companies or have other potential/material Conflict of Interest with respect to any recommendation and related information and opinions at the time of the publication of the Research Report or at the time of Public Appearance.

Dayco Securities Pvt Ltd does not have proprietary trades but may at a future date, opt for the same with prior intimation to Clients/ Investors and extant Authorities where it may have proprietary long/short position in the above Scrip(s) and therefore should be considered as interested.

The views provided herein are general in nature and do not consider Risk Appetite or Investment Objective of any particular Investor; Clients/ Readers/ Subscribers of this Research Report are requested to take independent professional advice before investing, however the same shall have no bearing whatsoever on the specific recommendations made by the analysts, as the recommendations made by the analysts are completely independednt views of the Associates of Dayco Securities Pvt Ltd even though there might exist an inherent conflict of interest in some of the stocks mentioned in the Research Report.

The information provided herein should not be construed as invitation or solicitation to do business with Dayco Securities Pvt Ltd. Dayco Securities Pvt Ltd or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the Research Report as of the last day of the month preceding the publication of the Research Report.

Dayco Securities Pvt Ltd encourages independence in Research Report preparation and strives to minimize conflict in preparation of Research Report. Accordingly, neither Dayco Securities Pvt Ltd and their Associates nor the Research Analysts and their relatives have any material conflict of interest at the time of publication of this Research Report or at the time of the Public Appearance, if any.

Dayco Securities Pvt Ltd or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

Dayco Securities Pvt Ltd or its associates might have received any compensation from the companies mentioned in the Research Report during the period preceding twelve months from the date of this Research Report for services in respect of managing or co-managing public offerings, corporate finance, investment banking, brokerage services or other advisory service in a merger or specific transaction from the subject company.

Dayco Securities Pvt Ltd or its associates might have received any compensation for products or services other than investment banking or brokerage services from the subject companies mentioned in the Research Report in the past twelve months.

Dayco Securities Pvt Ltd or its associates or its Research Analysts did not receive any compensation or other benefits whatsoever from the subject companies mentioned in the Research Report or third party in connection with preparation of the Research Report.

Compensation of Research Analysts is not based on any specific Investment Banking or Brokerage Service Transactions. The Research Analysts might have served as an officer, director or employee of the subject company

Dayco Securities Pvt Ltd and its Associates, Officers, Directors, Employees, Research Analysts including their relatives worldwide may have been engaged in market making activity for the companies mentioned in the Research Report.

Dayco Securities Pvt Ltd may have issued other Research Reports that are inconsistent with and reach different conclusion from the information presented in this Research Report.

A graph of daily closing prices of the securities/commodities is also available at and/or www.bseindia.com, www.mcxindia.com and/or www.icex.com.

Dayco Securities Pvt Ltd submit’ s that no material disciplinary action has been taken on the Company by any Regulatory Authority impacting Equity Research Analysis activities in last 3 years.

This Research Report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Dayco Securities Pvt Ltd and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

Analyst holding in stock: NO

Key to Dayco Securities Pvt Ltd Investment Rankings

Buy: Return >15%, Accumulate: Return between 5% to 15%, Reduce: Return between -5% to +5%, Sell: Return

Contact us:

Dayco Securities Pvt Ltd . (https://daycoindia.com/)

Name: Aditi Day Nundy

Address: Poddar Point B Block (North), 7th Floor, 113 Park Street, Kolkata – 700016, India

Contact No: 033-40675066

Email Id: aditi@daycoindia.com

Address: Poddar Point B Block (North), 7th Floor, 113 Park

Street, Kolkata – 700016, India

Contact No: 033-40675063

Email Id: compliance@daycoindia.com

This is the traditional method we have all followed for a long time before online KYC Aadhar authentication was permitted by SEBI.

Therefore in order to open the account offline, you can either call for a representative from the Stock Broker / Depository Participant office to visit you or you can go to the Stock Broker / Depository Participant’s office for account opening. Here are the steps to follow for Demat & Trading account opening

Watch This Video: https://youtu.be/Nu7FVpGtVS4

Step 1. A client can complain by visiting this URL:

http://crm.daycoindia.com/CustomerComplaint.aspx

Step 2. A unique token number will be generated after reporting the complaint and the the system forwards the token number to the client's mail

Step 3. A If the client wants, he can check the status of his complaint by visiting the same URL by entering their ucc code: http://crm.daycoindia.com/CustomerComplaint.aspx

Click the below link for SEBI's new website

https://investor.sebi.gov.in/

| Stock Broker Name | Registration Number | Registered Address | Branch Address (if any) | Contact Number | Email id |

|---|---|---|---|---|---|

| Dayco Securities Pvt Ltd | INZ000265037 | Poddar Point B Block (North), 7th Floor, 113 Park Street, Kolkata – 700016, India | 033-40675066 | contact@daycoindia.com | |

| Branch Name | Branch Address | ||||

| Gariahat | F-4, Maurya Centre, 48 Gariyahat road, Kolkata, 700019 | ||||

| Salt Lake | AA-116 Salt Lake City, Sector 1, Kolkata-700064 | ||||

| Lyons Range | CSE Building (3rd floor) 7 Lyons Range Kolkata,700001 | ||||

| Amtala | Amtala New Market ( Beside CTC Bus Stand ) P.O.- Kanyanagar, P.S.- Bishnupur, Dist.- 24 PGS(S) 743398. | ||||

| Arambagh | Puspananda Supermarket Basudevpur More, P.O.- Arambagh, 712601 | ||||

| Basirhat | Beltala P.O.- Basirhat, Dist- 24 Pgns (N) 743411 | ||||

| Bolpur | Pijush Ghosh Sarani Beside Aruna Appartment, School Bagan. P.O. - Bolpur Dist- Birbhum, 731204. | ||||

| Burdwan | Baidyanath Katra. G.T.Road, Near Karjan Gate P.O. & Dist- Burdwan, 713101 | ||||

| Coochbihar | C/o. Lauha Bepani, N.N. Road Power House, Choupathi, P.O. & Dist- Coochbehar, 736101 | ||||

| Diamond Harbour | Diamond Harbour, Madhabpur Vidyasagar Pally , South 24 Parganas, 743331 | ||||

| Durgapur | 6/21 Sarojini Naidu Path, City Centre, Durgapur, 713216 | ||||

| Durgapur 2 | B.C.Roy Avenue, Sen Market - 1st Floor. Opp. Durgapur Inn Hotel, Durgapur, 713201 | ||||

| Ghatal | Vill- Konnagar, Near Old LIC Building P.O.- Ghatal, Dist- Midnapur, 721212. | ||||

| Guskara | Ghushkara, Near Newtown, P.O. - Guskara, Burdwan, 713128. | ||||

| Haldia | Sakti Place, 1st Floor of NIIT Computer Center, P.O. - Khanjanchak Dist: Purba Midnapore. Durgachak, Haldia, 721602 | ||||

| Howrah Belpukur | Village. Belpukur ( Rupbani Cinema Campus ) P.O. - Ajodhya, P.S. - Shyampur, Dist - Howrah, 711312 | ||||

| Kakdwip | Dhanonjoy vila, 2nd Floor, Young Staff More. P.S. & P.O - Kakdwip, South 24 Parganas, 743347 | ||||

| Kalna | Old Bus Stand, Room No. - 29, P.O. - Kalna, Back side of Karma Tirtha, Dist - Burdwan Kalna, 713409 | ||||

| Krishnanagar | 2 J.N Roy Lane, Kayetpara P.O. - Krishnanagar Dist. Nadia, 741101 | ||||

| Mahishadal | Mahishadal, Near Sahid Stambha, Rathtala, P.O. & P.S. - Mahishadal, Dist - Purba Midnapore 721628 | ||||

| Rampurhat | Mangolik Anusthan Bhaban, Nagen Babu Market, Nischintapur, Rampurhat Didt - Birbhum 731224 | ||||

| Sainthia | Marwari Patty Sainthia Dist- Birbhum. P.O. - Sainthia, 731234 | ||||

| Sonarpur | Station Road Sahebpara, P.S & P.O - Sonarpur, 700150 | ||||

| Suri | Kendua Sonatore, P.O. - Suri, Dist. - Birbhum, 731101 | ||||

| Tarkeshwar | Tarakeswar, Sarada Pally, Opp New Bus Stand, Hooghly, 712410 | ||||

Rights of investors

Responsibilities of Investors

Complaint Resolution process at Depositories

E-account opening

Account opening through digital mode, popularly known as “On-line Account opening”, wherein investor intending to open the demat account can visit DP website, fill in the required information, submit the required documents, conduct video IPV and demat account gets opened without visiting DPs office.

Online instructions for execution

Internet-enabled services like Speed-e (NSDL) & Easiest (CDSL) empower a demat account holder in managing his/her securities ‘anytime-anywhere’ in an efficient and convenient manner and submit instructions online without the need to use paper. These facilities allows Beneficial Owner (BO) to submit transfer instructions and pledge instructions including margin pledge from their demat account. The instruction facilities are also available on mobile applications through android, windows and IOS platforms.

e-DIS / Demat Gateway

Investors can give instructions for transfer of securities through e-DIS apart from physical DIS. Here, for on-market transfer of securities, investors need to provide settlement number along with the ISIN and quantity of securities being authorized for transfer. Client shall be required to authorize each e-DIS valid for a single settlement number / settlement date, by way of OTP and PIN/password, both generated at Depositories end. Necessary risk containment measures are being adopted by Depositories in this regard.

e-CAS facility

Consolidated Account Statements are available online and could also be accessed through mobile app to facilitate the investors to view their holdings in demat form.

Miscellaneous services

Transaction alerts through SMS, e-locker facilities, chatbots for instantaneously responding to investor queries etc. have also been developed.

Basic Services Demat Account (BSDA)

The facility of BSDA with limited services for eligible individuals was introduced with the objective of achieving wider financial inclusion and to encourage holding of demat accounts. No Annual Maintenance Charges (AMC) shall be levied, if the value of securities holding is upto Rs. 50,000. For value of holdings between Rs 50,001- 2,00,000, AMC not exceeding Rs 100 is chargeable. In case of debt securities, there are no AMC charges for holding value upto Rs 1,00,000 and a maximum of Rs 100 as AMC is chargeable for value of holdings between Rs 1,00,001 and Rs 2,00,000.

Transposition cum dematerialization

In case of transposition-cum-dematerialisation, client can get securities dematerialised in the same account if the names appearing on the certificates match with the names in which the account has been opened but are in a different order. The same May be done by submitting the security certificates along with the Transposition Form and Demat Request Form.

Basic Services Demat Account (BSDA)

The facility of BSDA with limited services for eligible individuals was introduced with the objective of achieving wider financial inclusion and to encourage holding of demat accounts. No Annual Maintenance Charges (AMC) shall be levied, if the value of securities holding is upto Rs. 50,000. For value of holdings between Rs 50,001- 2,00,000, AMC not exceeding Rs 100 is chargeable. In case of debt securities, there are no AMC charges for holding value upto Rs 1,00,000 and a maximum of Rs 100 as AMC is chargeable for value of holdings between Rs 1,00,001 and Rs 2,00,000.

I'm a cool paragraph that lives inside of an even cooler modal. Wins!

In case you didn’t know, you can open your account online within 24 hours. Offline account opening takes up to 4 working days. If you wish to open your account offline, fill and sign the forms using a black/blue ballpoint pen. Please fill in the email and mobile number of the applicant to avoid account opening delays.

Please enter your details and password

New to Dayco?

Please enter your details and password

New to Dayco?

Please enter your details and password

New to Dayco?

Please enter your details and password

New to Dayco?

Your details were successfully received.

Our Team is working constantly on improving our user experience and your feedback really means a lot.

App Link Send to your mobile number successfully.

All your Questions have been recorded

All your Questions have been recorded

Thank you for your response. We'll get in touch with you at the earlisest for your investment planning needs

Thank You for your interest in our Moderate Equity Portfolio. Please find below the credentials to track this portfolio:

User ID: mockmod@daycoindia.com

Password: abcd@1234

Risk profiling is crucial for identifying and managing potential risks in investment decisions. Please carry out your risk profiling before making any investment decisions.

Please enter your details to download/print the report

Please enter your details to download/print the report

Please enter your details to download/print the report

Please enter your details to download/print the report

Please enter your details to download/print the report

Please Select an option from below

Please Select an option from below

We appreciate your interest in our services. Our team will be in touch with you shortly.

ClosePlease enter your details in the fields provided

Calculation report has been sent to your mail id successfully

Absolutely Quick & Free

All Investments Managed Under One Roof

Quicker & Simpler Transactions Anytime

Ease of Transfer & Gifting of Investments

Multiple Nominees & One-Point Transmission Support

Join thousands of smart investors who have already modernized their portfolios. Experience seamless, digital investment management today. For Portfolio Summary and Investment Advisory, Contact At: 9051052222

Login to the app or web to trade.