Holiday Planning Is All About Planning Your Cash Flow Wisely

![]() May 24, 2023

May 24, 2023

![]() 0 Comments

0 Comments

Life is all about experiences, whether good or bad, and traveling experiences are usually the good ones; at times, adventurous too! If you are a person who believes traveling is therapeutic and can help you rejuvenate, then this article is for you.

Whether you are traveling solo or with your family or friends, planning your holidays is important to avoid last-minute mess. While most people love to travel, not all can do it that frequently because the money often becomes a constraint - when not planned properly. Therefore, it is important to plan your cash flows well in advance so that you can go for more trips and your bucket list never remains unchecked.

Read on to learn the various ways of holiday planning and the cash flows associated with it.

First thing first, you need a budget, Period.

Whether you are planning a short trip to Darjeeling during Christmas or an elaborate Europe trip for a month, there has to be a budget for both- isn’t it?

Usually, in India, people plan for one or two short trips to nearby destinations and a long trip to a different city within the country- once a year. If you are planning likewise, you first need to count the number of people traveling and then the three main expenses- Transport, Accommodation, and Food. Other expenses will include location-specific experiences and other activities you plan to do, like trekking, sightseeing, adventure sports, and the like.

Now for preparing the budget, you need to spend some time on research as different hotels have different tariffs, transportation cost varies from one city to another, and so does the cost of food. Now let’s say you are planning a Himachal Pradesh Trip. Even if you visit popular tourist places, it costs around Rs. 40,000 per person for a 10 days trip. Likewise, you can determine the budget for every trip.

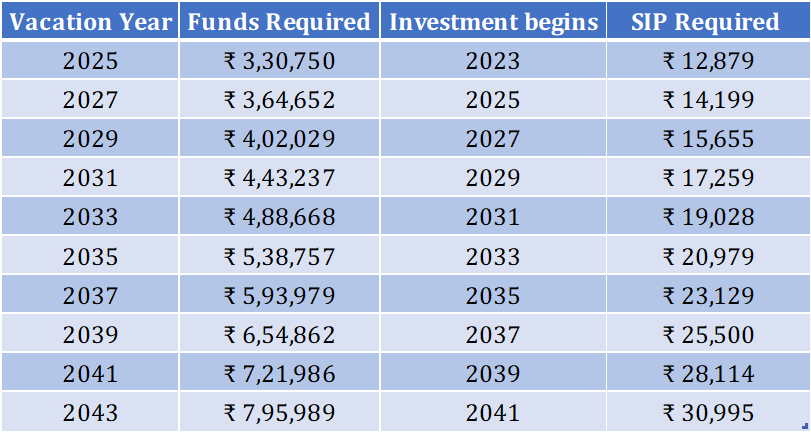

Below is a simple plan for a person who wishes to go on a vacation every two years starting in 2025. Let’s assume the present average costs to be around three lakhs per vacation and the post-tax return on investment to be 7%. Since vacation costs will not be the same in the future due to inflation, an average of 5% has been considered for calculations. Further, it is assumed that the person wishes to take a total of 10 such vacations.

The person saves for the next vacation as soon as they complete the one before it. The unused funds are best used to fund future vacations.

Where do you invest?

Once you have a clear idea of the total cost of your trip/s that you are planning in the next 2-3 years, you can use a SIP calculator to determine how you need to invest - every month - to accumulate the amount.

Since you would need money within a short tenure, say within a year or two, investment options that are safe and less volatile should be your primary choices, like debt mutual funds, RDs, and FDs (if you are investing lump sum). For vacations you plan within a year or two, you can save for the same using liquid funds, ultra-short duration funds, arbitrage funds, or short-term bank deposits, and for vacations which are three years or more, equity savings, conservative hybrid funds, and balanced advantage funds can be considered.

Banks FDs and RDs also attract premature withdrawal penalties; hence, plan them in a way that doesn’t require you to withdraw funds beforehand, which can reduce your accumulated amount. Categories like a conservative hybrid, equity savings, and balanced advantage offer better returns than bank deposits but are volatile in the short term. It is best to use these funds when planning a trip at least three years away.

While unplanned trips are fun, nothing hurts more than postponing them due to a shortage of money. So, start planning your next holiday today with the right SIP amount in the right fund.

If you have a question, share it in the comments below or DM us or call us – +91 9051052222. We’ll be happy to answer it.

- Dipanwita Gupta & Nischay Avichal

Share With

I'm a cool paragraph that lives inside of an even cooler modal. Wins!

Are you sure?

In case you didnt know, you can open your account online within 24 hours. Offline account opening takes up to 4 working days. If you wish to open your account offline, fill and sign the forms using a black/blue ballpoint pen. Please fill in the email and mobile number of the applicant to avoid account opening delays.

Enter Password

Please enter your details and password

New to Dayco?

Enter Password

Please enter your details and password

New to Dayco?

Filing Complaints on SCORES (SEBI) – Easy & Quick

- Register on SCORES Portal (SEBI)

- Mandatory details for filing complaints on SCORES:

- Name, PAN, Address, Mobile Number, E-mail ID

- Benifits:

- Effective Communication

- Speedy redressal of the grievances

Thanks !!

Your details were successfully received.

Thank you for Your Feedback!

Our Team is working constantly on improving our user experience and your feedback really means a lot.

Thanks !!

App Link Send to your mobile number successfully.

Thank You

All your Questions have been recorded

Thank You

All your Questions have been recorded

Thank You!

Thank you for your response. We'll get in touch with you at the earlisest for your investment planning needs

NEXT

Thank You!

Thank You for your interest in our Moderate Equity Portfolio. Please find below the credentials to track this portfolio:

User ID: mockmod@daycoindia.com

Password: abcd@1234

Portfolio Tracker

Please Read!

Risk profiling is crucial for identifying and managing potential risks in investment decisions. Please carry out your risk profiling before making any investment decisions.

Complete Risk Assessment Now

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Thank You !!

Please enter your details to download/print the report

Set Your Goal

Please Select an option from below

Set Your Goal

Please Select an option from below

Thanks You !

We appreciate your interest in our services. Our team will be in touch with you shortly.

CloseSet your Goal

Please enter your details in the fields provided

Thanks You!!

Calculation report has been sent to your mail id successfully

Clear form?

This will remove your answers from all questions and cannot be undone.

Book Appointment

Book Appointment

Leave a Reply