If you have a question, share it in the comments below or DM us or call us – +91 9051052222. We’ll be happy to answer it. – Nischay Avichal

BUDGET KEY HIGHLIGHTS

If you have a question, share it in the comments below or DM us or call us – +91 9051052222. We’ll be happy to answer it. – Nischay Avichal

It’s a wedding season. A lot of preparations are happening around if there is a wedding in the family. From shopping, beauty treatments, cooking classes, grooming classes to honeymoon, all may be there on the to-do list. If you are one of the grooms or the brides-to-be, did you plan for your post-marriage life, in terms of money? If not, you may start it today, taking your spouse-to-be in confidence. This would probably be the most important factor for your happy life. Last but not the least, all the above exercises must be jointly done with the spouse and he or she …

মূল্যবৃদ্ধির আতসকাচের তলায় ব্যাঙ্ক-পোস্টঅফিসের মেয়াদি আমানতের রঙ কেমন ফিকে হয়ে যায় সেটা আমরা আগের পর্বে দেখেছি (এখানে পড়ুন, নিশ্চিত আয় প্রকল্পে মূল্যবৃদ্ধির ঘুণ পোকা, ব্যাঙ্ক-পোস্টঅফিসের বাইরে ভাবুন)। কিন্তু, তার মানে এই নয় যে ব্যাঙ্ক-পোস্টঅফিসে আমানত করবেন না। তবে, সারা জীবনের সঞ্চয় করা অর্থের পুরোটা ব্যাঙ্ক-পোস্টঅফিসে রাখাটাও সমীচীন নয়। কেননা, শেয়ার-মিউচুয়াল ফান্ডে লগ্নির ঝুঁকি এড়াতে গিয়ে সেক্ষেত্রে খেসারত দিতে হয় রিটার্নে। তাছাড়া, ব্যাঙ্ক আমানতে টাকা রাখারও যে ঝুঁকি আছে সেটাও মাথায় রাখতে হবে। কোনও ব্যাঙ্ক দেউলিয়া হলে বা উঠে গেলে, ওই ব্যাঙ্কে আপনার একাধিক প্রকল্পে কোটি টাকা আমানত করা থাকলেও ব্যাঙ্ক আমানত বিমার আওতায় আপনি সর্বোচ্চ ৫ লক্ষ টাকা ফেরত পেতে …

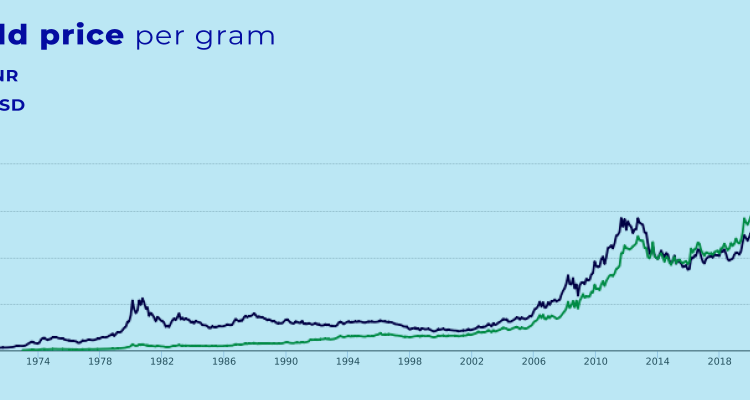

Sovereign Gold Bonds are a more remunerative and tax-efficient way to invest in gold. But given the continuous decline in gold prices over the last 16 months, should you bet your money on the ninth tranche of SGBs that the Reserve Bank of India has started offering last Monday (10 January)? The issue closes on Friday (14 January), and the issue price of the bonds – equivalent to the cost of 1 gm of gold with .999 purity – has been pegged at Rs 4786. The near-month gold contracts traded at Rs 47890 (per 10 gms) on the MCX. This means that the …

Insurance Planning is a very crucial part of financial planning. Listing down your goals and investing for them assumes you will have a constant flow of income to save for them. However, various variables constantly affect your income and well-being. You shouldn’t ignore the possibilities of mishaps or unforeseen events, ultimately putting your goals and finances in a precarious situation. Unexpected events like the sudden passing of an earning member or medical emergencies can dent a massive hole in your finances, as the pandemic has proved. Insurance Planning helps you take care of the financial uncertainties that may arise in your life, which can either …

Are you making a resolution this new year? Is it a financial one? No? Okay, no judgements here. Everyone wants more control and clarity over their finances, and well, you definitely might have thought about getting things in order but maybe never quite got the time to see it through. Yeah, with all the stuff we have on our hands, we wouldn’t dare to blame you. Resolutions about finances are similar to all the other resolutions you may have made over the past years in that it is a step towards a better you. What better time than now to renew and steer …

Most people start tax-saving investments when the financial year is about to end. Those investments are mostly related to taking the benefit of 80C, on 1.5L per annum. Some people are aware of the additional tax benefit of 50k under section 80CCD(1B), by investing in NPS. Here let us discuss some less known tax-saving ways beyond the benefit of 80C. 1) Are you a Government employee and contributing to General Provident Fund (GPF)? You can contribute from 6% of your salary to 100% as per your own choice and interest on your annual contribution up to 5L will be tax-free. This is because …

With the times we are in, health insurance is on everyone’s mind, and it’s rightly so. Buying the right policy can make all the difference in your life. With medical inflation skyrocketing, it is even more pertinent to be familiar with health insurance policies. The number of health policies available in India is upward of 150 – you may not be entirely correct if you think this gives you a lot of choices. A large number of choices gives rise to what is known as the paradox of choice –it describes how people generally get overwhelmed when faced with a …

Close on the heels of RBI launching its platform, RBI Retail Direct, to facilitate retail investors purchase government securities, treasury bills and sovereign gold bond, the Union government has come up with its third tranche of Bharat Bond ETF issue opening for NFO subscription from 3 December 2021 and closing on 9 December. Thereafter you can buy or sell units of Bharat Bond ETF from stock exchanges. If you are on the lookout for a safe investment instrument offering higher return and tax benefits compared to bank fixed deposits and at the same time having the liquidity of a stock exchange, bond ETFs …

The amount of premium you pay for your health insurance policy should not be the only determinant for selecting a health insurance plan. Cheaper plans provide only a basic cover and may not offer all the features you need. In contrast, the more expensive ones may provide additional benefits which you may never use. Before you choose a Health Insurance Policy, you may consider the following pointers to select the most suitable option for yourself- • Individual Policy vs. Family Floater Plan – This covers all family members from children to senior citizens under a single plan. The cover floats on all …