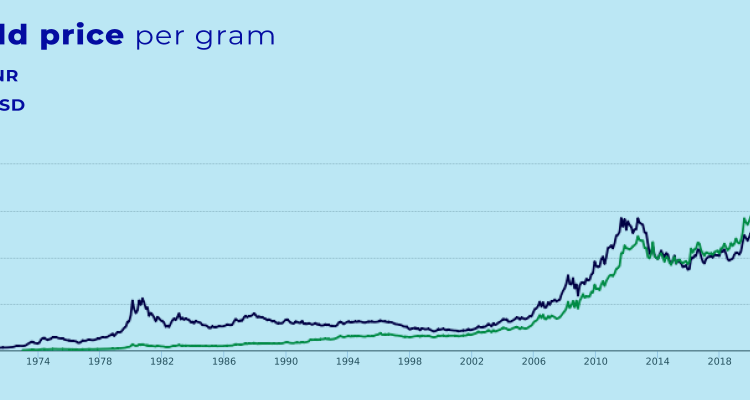

Sovereign Gold Bonds are a more remunerative and tax-efficient way to invest in gold. But given the continuous decline in gold prices over the last 16 months, should you bet your money on the ninth tranche of SGBs that the Reserve Bank of India has started offering last Monday (10 January)? The issue closes on Friday (14 January), and the issue price of the bonds – equivalent to the cost of 1 gm of gold with .999 purity – has been pegged at Rs 4786. The near-month gold contracts traded at Rs 47890 (per 10 gms) on the MCX. This means that the …

Gold prices are falling. Should you invest in Sovereign Gold Bonds?