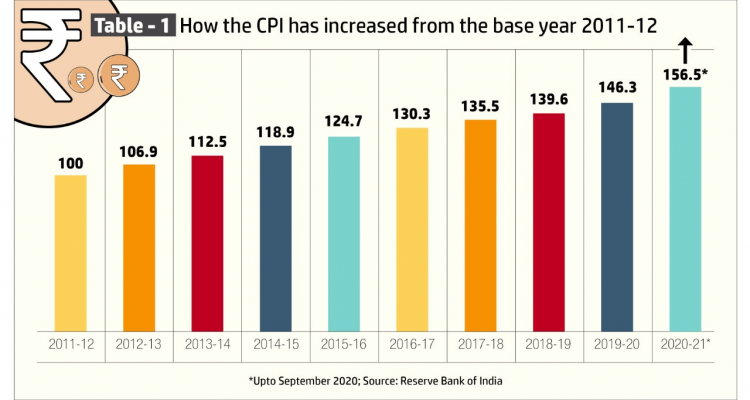

Think beyond bank deposits to stave off Inflation If you feel quite satisfied by keeping your savings in a bank or post-office fixed deposit scheme, think again. Sure, while signing up for a bank fixed deposit, you know beforehand exactly how much (rate of interest) and how long (the maturity of the deposit) you’ll get. But, have you considered the ‘real’ return on maturity after providing for inflation and income taxes? Or, for that matter, bank fixed deposits also come with liquidity risks in the form that if you want to withdraw the money before maturity, you’ll have to pay …

Why should you invest in shares/mutual funds – part 1