From its inception in 1963 till now – mutual funds in India have come a long way. But one thing has remained constant. And that is the apprehension of investors regarding how safe their money is in these mutual funds. Some people go one step further and wonder whether investing via SIP carries more risk. Let’s debunk all myths about this today.

What Is an SIP

Let’s give you an analogy. You buy an AC worth Rs.40,000. Instead of paying the amount upfront, you pay in instalments. Why? The payment becomes manageable. You don’t feel the pinch when you pay for instalments.

Similarly, in the world of mutual funds, you can invest a lump sum amount, or you can periodically invest small amounts in a systematic way. This is what is known as SIP or Systematic Investment Plan. In this case, there are multiple benefits:

- SIP makes investment in mutual funds accessible to all. You can start investing in SIP with just Rs.100.

- Since investing via SIP helps you in not feeling the pinch, you tend to continue investing. Also, SIP requires a mandate for automated deduction from your bank account. This makes you a disciplined investor.

- Above all, when you invest via SIP, you get an upper hand over market volatility by using it to your advantage. When you invest a lump sum amount, there is always a chance of entering the market at the wrong time and that may lead you to experience more market volatility initially However, when you invest via SIP, you spread the volatility risk, making it comparatively less risky than lump sum investments.

So, SIP has some inherent benefits.

Is Investing Via SIP Safe?

Short answer: yes. Investing in mutual funds can help you create wealth and achieve your financial goals successfully with proper risk management. That said, investments in mutual funds are market-linked – meaning they carry the inherent risk associated with the market. You may experience volatility and see the current value of your investment fluctuate and even go below your invested capital. This is true whether it is an SIP investment or a lump sum investment. The key to successful SIP investing is managing risk better and investing in mutual funds as per your risk appetite and financial goals.

SIPs Can Cut Some Risks Associated With Mutual Funds

While it is true that SIPs come with all the risks associated with investing in mutual funds, they can actually make these risks a little less scary. Here’s how:

Rupee Cost Averaging

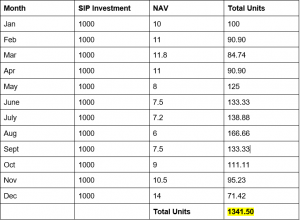

Imagine two people investing in a mutual fund. One invests a lump sum amount, and the other keeps investing via SIP. At the end of the year, both invested 1 lakh rupees. Here’s a tabular representation of how their investments fared during the market high and market low:

Person A: Lumpsum Investment of 12000 made in January

| Month | Lump Sum Investment | NAV | Total Units |

| January | 12,000 | 10 | 1200 units |

Person B: Investment of 1000 every month

Due to Rupee-cost averaging, Person B accumulated more units – he got more units during the market lows, while Person A was able to accumulate units only once when he first invested. The average cost of investment for Person B (8.94) is also less due to rupee cost averaging.

Some people might think, “I will time the market and invest a lump sum amount when the market is down.” Trust us, timing the market is easier said than done. How will you know how much and how long the market falls?

SIP Best Practices

Disciplined Investing Mindset

Investing in something is a very emotional decision. It’s very hard to take emotions out of your investment decisions. Yet, emotion is the enemy of financial success. When you invest via SIP, you get to ‘processify’ your investment activities. It brings regularity to your investment activities. When you put your investment decisions inside a system, you get to make investment decisions without any emotional bias. No matter what happens in the market, your SIPs continue. In most cases, you create a mandate so that your SIP amounts are deducted from your bank automatically. The benefit of this is that you don’t have the ‘excuse’ of forgetting to invest. Thus, SIP makes your mutual fund investment journey safer by making you a disciplined investor.

Long-Term Perspective

Maintaining a long-term perspective is key in SIP investments. While markets may fluctuate in the short term, historical data shows that over longer periods, equities tend to grow. By staying invested and continuing your SIP contributions, you can benefit from the power of compounding. SIPs are about enduring short-term market ups and downs and following your financial goals and asset allocation.

Asset Allocation Matters

Asset allocation plays a pivotal role in portfolio management. Diversifying your investments across different asset classes as per your goals—such as equities, bonds, and cash equivalents or different funds in this case—helps manage risk. Each asset class behaves differently in varying market conditions. By spreading your investments, you can reduce the impact of market volatility on your overall portfolio. This balanced approach ensures that your investments are not overly exposed to any single asset class, thereby potentially stabilizing your returns over time.

Regular Monitoring and Review

Regularly monitoring and reviewing your SIP investments is essential to staying on track with your financial goals. Periodically assess whether your chosen mutual funds still align with your investment objectives. Market conditions and your personal circumstances may change over time, necessitating adjustments to your portfolio. Rebalancing—adjusting your asset allocation back to your target mix—helps maintain your desired risk level as per your goals.

Seeking advice helps

Before starting SIP investments, conducting thorough research or seeking advice from financial advisors can be beneficial. Understanding the mutual funds you’re investing in—such as their investment objectives, past performance, and expense ratios—helps you make informed decisions. SEBI registered advisors can offer personalized guidance based on your risk tolerance and financial goals, ensuring your SIP strategy is well-suited to your needs.

Start Small But Start: That’s the Essence of SIP

SIP has made professional fund management and wide investment opportunities accessible to all at a lower cost and in a flexible manner. You can start with as low as Rs.100 worth of SIP per month. This makes taking the plunge easier and possible. Once you start investing, you can then increase the SIP amount incrementally.

The Bottomline

From the discussion above, it is clear that investing via SIP does not carry any extra risk over and above the risks associated with investing in mutual funds. In fact, SIPs help you cut some of these risks. Notice the full form of SIP – Systematic Investment Plan. The words ‘Systematic’ and ‘Plan’ are very important. SIPs help you systematise your investment activities. Start SIPs as per your goals, follow asset allocation, review your portfolio at least once annually, and seek professional help to make the most of your SIPsLastly, we would recommend you read more about chaos theory – small things can have immense consequences. Your small SIP investments are the key to your financially secure future.

-Nischay Avichal