With all the buzz around RBI’s new Retail Direct platform, we are thrilled to cover government securities (G-secs) in this week’s blog. Through the RBIs retail direct platform, individual retail investors can now purchase G-secs directly from the RBI without the involvement of intermediaries.

Before you go all-in with your G-secs investing spree, let’s understand G-secs and risk and returns you should be aware of. G-Secs are debt instruments issued by India’s central or state government via the RBI (Reserve Bank of India) to borrow money from the investors. This is a frequent source of fundraising by the government agencies to finance infrastructure projects, meet budget deficits, repay loans, etc.

The securities issued by the government can basically be classified by their maturity.

- Bonds or dated securities are issued for the long term, maturing anywhere between 1-40 years.

- Treasury Bills are short term instruments maturing in 91 days, 182 days, or 364 days.

Suppose you buy a government bond/dated security of 5 years maturity at a 6% coupon rate of Face Value (FV) Rs. 1000. In that case, you will receive Rs. 60 p.a (1000*6%) for 5 years and the principal amount of Rs. 1000 on maturity. The coupon amount is paid semi-annually, i.e., the amount of Rs. 60 splits into two equal payments of Rs. 30 each.

Advantages

G-Secs have the sovereign’s commitment to repay interest and principal. This provides a notable amount of capital protection and a regular income stream in coupons. This means you don’t have to worry about the government not paying back your money, ergo, no credit risk.

Government bonds are a no-brainer for investors looking for guaranteed capital protection along with regular income.

- If you are a retiree and in need of steady inflows, G-secs would be a good choice.

- If you are an investor who is prudently looking forward to diversifying your portfolios, you can also look at G-secs.

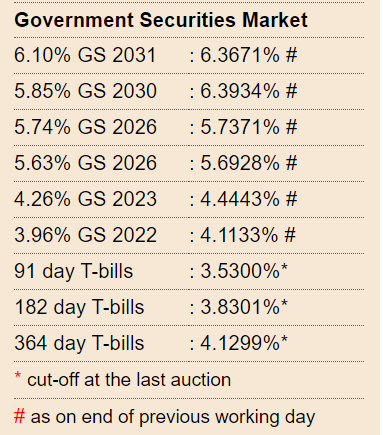

You should also keep in my mind the current yields being offered. Yield to maturity (YTM) is a standard measure of returns in the bond market. It signifies the total rate of return you will earn if you hold the bonds until maturity. By default, you should always go with bonds offering the highest yield. Comparing bond yields with other similar risk-free instruments available in the market will help you make a decision. Also, if you are planning to hold a long-term bond until maturity, you should understand that you have locked the coupon rate for that period. Avoid locking into low yields if current yields are low or other risk-free debt instruments offer attractive yields. It’s the timing of your entry that matters here.

Below is a snapshot from the RBI website showing coupon rate and YTM of currently available government bonds. You can see that the 10-year G-sec has a yield of 6.3671% as per the previous working day.

Although government bonds are a good option for risk-free stable inflows and diversification, there are a few caveats that you should be aware of before investing.

Risks

The market value of your bonds will fall when the interest rates rise in the market and vice versa. RBI policy measures like repo rate changes, open market operations, US treasuries market, developments in global markets and inflation are a few factors affecting interest rates in the market.

The longer the maturity of your bond, the more it is affected by the changes in interest rate in the market. This makes bond prices with longer maturity very volatile to changes in the market interest rates.

This phenomenon is called the interest rate sensitivity or the duration risk of a bond. You should typically stick to bonds with short or intermediate tenure if you have a short investment horizon because they are less volatile than bonds with longer maturity. Another way to avoid the interest rate risk is to hold your bonds until maturity.

Most government bonds are listed in the stock exchanges,where investors can sell and exit the bonds before maturity. Not all bonds are actively traded on the exchange (low demand and supply), giving rise to liquidity risks, which is the inability to liquidate, i.e., sell your bonds when you need funds or sell at a lower price, incurring a loss. With retail participation expected to increase in the G-sec market, only time will tell about the liquidity we’ll witness. Even with the retail involvement, you may have difficulty selling if you hold smaller lots.Also, with the limited risks attached to government bonds, you can’t expect to generate inflation-beating returns, especially if you have a long investment horizon.

From the taxation and liquidity perspective, gilt mutual funds score over G-secs. In the case of g-secs, coupons from your bonds will be taxed as per the marginal rate. Holding the bond for more than a year will attract LTCG (Long term capital gain) tax at 10% without indexation. Whereas LTCG from gilt mutual funds that invest primarily in G-Secs are taxed at 20% after indexation. Gilt funds also re-invest any coupons the fund receives. They also offer more liquidity as you can redeem your investments within a day.

We hope this information helps you invest wisely. Please stay tuned for more blogs like these.

If you have a question, share it in the comments below or DM us or call us – +91 9051052222. We’ll be happy to answer it.

– Nischay Avichal