e-KYC facilitates the completion of KYC process online eliminating the need for filling up physical forms and submission of physical documents. The main objective of e-KYC is to register the customer with least amount of paperwork and in the shortest possible time. The customers need to submit their details, such as – Aadhaar number, PAN, Aadhaar registered mobile number and bank details. Difference between KYC and e-KYC ‘Know Your Client’ or KYC is a process by which a service provider, either government or private, verifies your identity and other particulars linked to you using documentation such as your Aadhaar Card. …

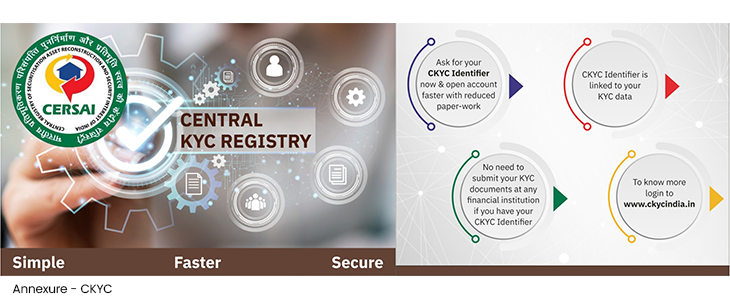

e-KYC – A new way of Digital Account opening