ETFs – a simple and low-risk way to invest in shares.

Investment in equities doesn’t always entail a thorough research of balance sheets, management pedigree, etc of companies. Thanks to the advent of exchange-traded funds (ETFs), those are now things of the past. Passive investment through ETFs is increasingly becoming a darling to seasoned as well as first-time investors in equity markets around the world. Consider this bit of information to get an idea about how popular are ETFs – 60% of daily trading volume in the US stock market, which is 8 times bigger than India, are ETFs. In fact, the lion’s share of foreign portfolio and foreign institutional investments in Indian capital markets are coming through ETFs.

What actually these ETFs are?

The name says it all: Exchange-traded funds. That is, an ETF is basically a basket of securities, which can be equity shares, debt papers, and gold and so on, that tracks the return of an underlying index. The units of an ETF can be bought and sold on the stock exchanges like a common share. In short, ETFs are like many individual investments bundled into one single investment just like a mutual fund. But unlike in mutual funds, the ETF fund manager cannot buy and sell in the constituent securities underlying the ETF on a daily basis to generate profits. ETFs are the most basic form of passive investment and hence are meant for long-term gains.

Our story focuses on ETFs based on equity indices such as Sensex or Nifty. If you are a first-time investor, start from here in your tryst with equity investment. Every mutual fund house now have Sensex/Nifty ETFs alongside other ETFs.

Being the most basic form of passive investment, the cost of ETFs are very low compared to any active fund that delves in daily or frequent trading in underlying securities, be it gold, debt or equity. Besides, being a bundle of individual investments, diversification is in-built in an ETF. For example, a Sensex ETF will give you exposure to all those companies from various sectors that constitute the Sensex itself.

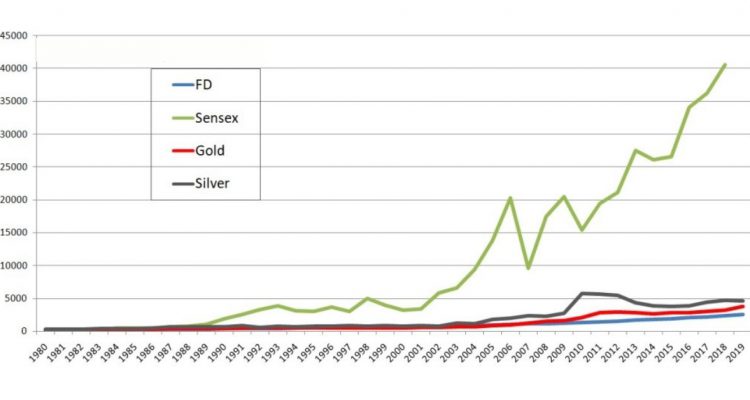

Another advantage of ETFs is their long-term nature. It is known to all that the return on investments from equities in the long-run wins hands down over any other asset class such as debt or gold. The table below gives a glimpse of compounded annual return (CAGR) of Sensex ETFs from different fund houses over the last five years. Remember a CAGR of 14.87% will double your money in five years.

Money Spinner

| Compounded annual return rate for 5-year investment | |

| HDFC Sensex ETF | 15.56% |

| SBI ETF Sensex | 15.46% |

| Kotak Sensex ETF | 15.22% |

| ICICI Pru Sensex ETF | 15.34% |

| UTI Sensex ETF | 15.49% |

So, all the above ETFs have doubled your investments in the last five years! Certainly, you won’t get such hefty returns on your bank fixed deposits.

Equity ETFs are also quite superior to bank deposits in terms of tax advantage. As we have mentioned earlier, there are many types of ETFs. But equity ETFs, that is ETFs with equities as underlying securities, have the biggest tax advantage. The table below illustrates the tax liability of different kind of ETFs.

Tax Advantage

| Up to 12 months | 12–36 months | More than 36 months | |

| Equity ETF/index fund* | 15% | 10% without indexation | 10% |

| Debt ETF | Marginal income tax rate of the investor | Marginal income tax rate of the investor | 20% with indexation |

| Gold ETF | Marginal income tax rate of the investor | Marginal income tax rate of the investor | 20% with indexation |

| International ETF | Marginal income tax rate of the investor | Marginal income tax rate of the investor | 20% with indexation |

Sensex/Nifty ETFs fall in the equity ETF category and hence the tax that you have to pay on short-term or long-term capital gains on these ETFs are much lower than your tax liability on interest income from bank deposits. In case of interest income from bank deposits one has to pay tax at his/her marginal income tax rate.

If you have a question, share it in the comments below or DM us or call us – +91 9051052222. We’ll be happy to answer it.

– Parichoy Gupta