In recent years, mutual fund investments have become increasingly popular among Indian investors. The flexibility, diversity, and potential for higher returns that mutual funds offer have made them a go-to investment option for many. One of the reasons for this growth in popularity is the increased awareness and education about mutual funds among the general public. Many investors now understand the benefits of diversifying their portfolio through mutual funds, which can mitigate risk and generate higher returns. Additionally, the availability of online platforms and mobile apps for investing in mutual funds has made it easier for individuals to access and manage their investments more easily than ever before.

As a mutual fund investor, it is more important that you keep yourself updated on the latest rules to make informed investment decisions. Are you investing in mutual funds and wondering when your transactions will be processed? Transactions in mutual funds are processed based on the cut-off timings decided by the regulator, and it has seen quite a slew of changes recently. As a mutual fund investor, it is important to know the cut-off timing rules for mutual fund transactions. In this blog, we’ll explore the cut-off timing rules for mutual fund transactions and why it’s important for you to be aware of them.

Mutual Fund Cut Off Time. What Is It?

Cut-off timing refers to the time by which mutual fund orders must be placed to be processed on a particular day. The cut-off timing for mutual fund transactions varies depending on the type of mutual fund and the mode of transaction.

The stock market plays a significant role in the value of mutual fund investments. Previously, you had to submit your applications at Asset Management Companies (AMCs) offices or their Registrar and Transfer Agents (RTAs), and ensure that it was submitted before the cut-off time to redeem at a high market or purchase at a low market. Only by submitting the application before the cut-off time could you get the same-day NAV (Net Asset Value).

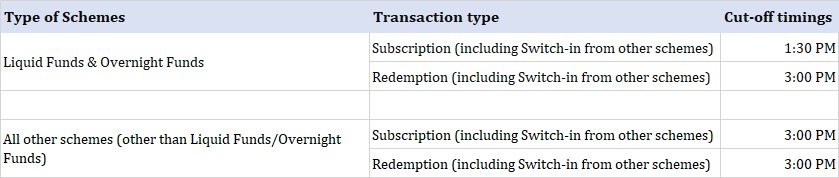

However, SEBI’s recent changes to the NAV rules have made the cut-off time less relevant. Starting February 1, 2021, the applicable NAV in respect of the purchase of units of a mutual fund scheme depends upon the realization & availability of the funds in the bank account of the mutual fund before the applicable cut-off timings for purchase transactions, irrespective of the amount of investment, under all mutual fund schemes. This means that even if you submit the application before the cut-off time, the allotment will be based on when the fund house receives the money. Please refer to the below table for the applicable cut-off timings for mutual fund transactions.

The Applicable NAV for purchase transactions (including Switch-In transactions) under all mutual fund schemes, irrespective of the amount of investment, is determined as follows:

| Time of receipt of Transaction and Money | Applicable NAV |

|---|---|

| Where the purchase transaction is received up to the cut-off time on a business day at the official point(s) of acceptance and funds for the entire amount of subscription/purchase are available for utilization up to the cut-off time on the same Business Day. | NAV of the same Business Day shall be applicable |

| Where the transaction is received up to the cut-off time on a business day at the official point(s) of acceptance, but the funds for the purchase of units are available for utilization after the cut-off time on that Business Day or on a subsequent Business Day | NAV of the subsequent Business Day on which the funds are available for utilization before the cut-off time shall be applicable. |

| Where the transaction is received after the cut-off time on a business day at the official point(s) of acceptance and funds for the entire amount of subscription/purchase are available for utilization up to the cut-off time on the same Business Day. | NAV of subsequent Business Day shall be applicable. |

| Where the application is received after the cut-off time on a business day at the official point(s) of acceptance and funds for the entire amount of subscription/purchase are available for utilization after the cut-off time on the same Business Day or subsequent Business Day. | NAV of subsequent Business Day on which fund realized prior to the cut-off time shall be applicable |

How does cut-off timing impact mutual fund transactions?

The net asset value (NAV) of a mutual fund is a key indicator of its performance, as it reflects the fluctuation of the market value of the securities in which the fund invests. It’s important to note that the NAV is only declared at the end of the trading day when the market is closed. As a result, the NAV determines the price at which mutual fund units can be purchased or sold. The NAV an investor will receive depends on the time they purchase or redeem the mutual fund.

The cut-off timing for mutual fund transactions can impact when your investments are bought and sold. If your order doesn’t meet the abovementioned criteria, it will likely be processed on the next business day.

Why is it important for investors to know the cut-off timing rules for mutual fund transactions?

According to SEBI regulations, mutual fund houses must announce the NAV of all mutual funds after the market closes, which is at the end of the day. This is why the cut-off time for submitting MF applications is crucial for investors. To receive the end-of-day NAV, investors must invest before the cut-off time. Most MFs have a cut-off time of 3:00 PM, meaning that investments made before this time will receive the NAV for that day. However, this does not apply to liquid mutual funds. Additionally, investments made after the cut-off time will still be received on the same day, but the NAV will be for the next business day. It’s important to note that the cut-off timing rules are similar for MF redemption or withdrawal.

Thank you for taking the time to read. We hope this information on mutual funds cut-off timing will help you make informed investment decisions.

~Nischay Avichal