Risks get ironed out in the long-run

We have seen in the previous article how the shine of bank fixed deposits fades away under the lens of inflation. (Read here: Think beyond bank deposits to stave off inflation)

However, it doesn’t necessarily mean that you should not keep money in bank deposits. It rather suggests that one should not keep all his/her hard earned money in bank and post-office deposits. Because, you may be losing on return by not investing in shares and mutual funds for the risks inherent therein.

But, do you know, bank deposits too are not entirely secured? Whenever a bank goes down or it becomes bankrupt, you can get back a maximum of Rs 5 lakh or sum of your total deposits in the bank, whichever is less. Under the amended act on deposit Insurance, bank deposits are insured upto Rs 5 lakh. So, even if you have a total of Rs 10 lakh in one or more deposit accounts in a bank, you’ll get back a maximum of Rs 5 lakh when the bank turns it belly up.

Let us now examine how risky investments in shares really are. There are various risks associated with an investment, such as loss, illiquidity etc. But, generally speaking, the loss from an investment is construed as the risk of investment in an asset class. And the probability or chances of incurring a loss gives us a better understanding of the riskiness of that particular asset class.

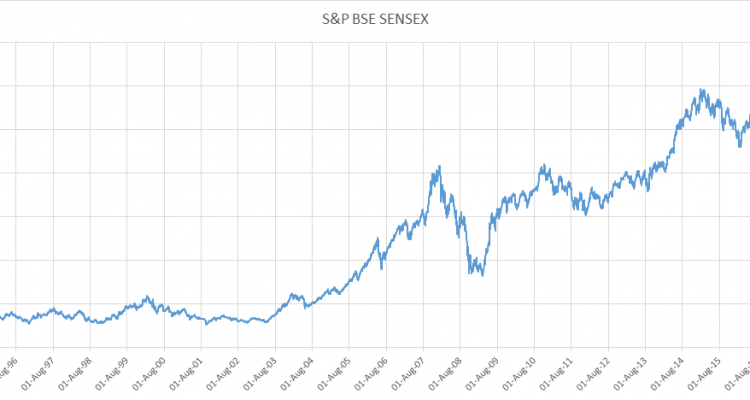

The following table exhibits the probability, maximum average annual loss and maximum average annual return of Sensex, the bellwether share price index, corresponding to moving averages of different time intervals since the base year (1979) of the index. For example, a 3-year moving average is calculated as the average returns of 2000-2002, 2001-2003, 2002-2004 and so on. In case of a 5-year moving average, it will be like 2000-2004, 2001-2005, 2002-2006 and so on.

| 1 year | 3 years | 5 years | 7 years | 10 years | 15 years | 20 years | 25 years | |

| Loss probability | 31.71% | 17.95% | 5% | 8.57% | 3.13% | 0% | 0% | 0% |

| Max avg annual loss | 47% | 15% | 5% | 2% | 2% | – | – | – |

| Max avg annual gain | 267% | 62% | 53% | 43% | 35% | 27% | 20% | 19% |

The table clearly shows, if someone invests in equities with a time horizon of 10 years and more, the chances of incurring even a 2% loss is negligible (3% or less). On the other hand, the annual average return is far higher than the inflation rate.

Besides, equity investments also comes with a distinct tax advantage over bank fixed deposits.

If you sell your equity investment within 12 months from purchase, you’ll have to pay short-term capital gains tax at the rate of 15% on the profit that you have made. If you sell it after 12 months of purchase, then it will be long-term capital gains tax at the rate of 10%. It is also to be noted, if in any financial year your long-term capital gains from equity investment is Rs 1 lakh or less, you don’t have to pay any tax at all. Long-term capital gains tax in equity investment is applicable only on profits more than Rs 1 lakh.

On the other hand, if you are an income tax payer then the interest income from bank fixed deposits have to be added to your annual income and tax has to be paid accordingly.

So, you can split your savings in such a way that the amount of money that you may require within five years, put it in a bank deposit and the amount of money that you may not require in the next five-seven years, invest it in equities or equity mutual funds. You can also invest in equity-linked mutual funds (ELSS) for saving taxes under section 80C of the Income Tax Act. However, ELSS comes with a 3-year lock-in that is you cannot sell it within three years.

If you have a question, share it in the comments below or DM us or call us – +91 9051052222. We’ll be happy to answer it.

– Parichoy Gupta