Gilt Funds or Dynamic Bond Funds – Where to Invest Now?

ফ্যাশন না স্টাইল? কোনদিকে চলা অভ্যাস? নিজের মতে কেনাকাটা? নাকি যা চলছে বাজারে? এক পুজোর মরশুমে এক নামজাদা শাড়ির দোকানে এই কথোপকথন কানে এল – এক মা তাঁর তরুণী কন্যার শ্বাশুরির জন্য একটি দুর্দান্ত এবং দামী লালপেড়ে সাদা কাঞ্জিভরম কিনতে চাইছেন। বোঝা গেল নতুন বিয়ের ব্যাপার। মেয়েটি মাকে প্রাণপণে বোঝাবার চেষ্টা করছে, শাড়িটি তার শ্বাশুরিমার কোন প্রয়োজনে কাজে আসবে! মা নাছোড়! তিনি এই প্র্যাকটিকাল মতামত শুনতে রাজি নন। মেয়েটির বাবা বেচারা এই দুই মতের মধ্যিখানে পড়ে একেবারে স্যান্ডউইচ! এবার কেউ যদি জিজ্ঞাসা করে বসেন, ওই দামী শাড়ির দোকানে কোন প্রয়োজন মেটাতে গিয়ে জুটেছিলাম, তাহলেই মুশকিল! কারণ পুজোর সময় নতুন শাড়ি …

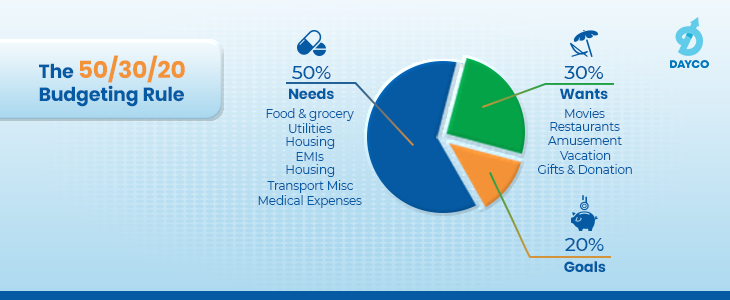

Budgeting is the cornerstone of your financial well-being. If you are aiming for financial independence, the answer begins with a budget. Budgeting is not just about noting down your expenses. A sound budget helps you shed light on bad spending habits and work towards your long-term goals. In this blog, we discuss an important budgeting technique called 50/30/20 (also called the 50/20/30 rule) and how it can help you bring more control over your financial life. What is the 50/30/20 rule? The 50/20/30 rule is a budgeting technique that can help you easily prepare and manage your budget. The straightforward …

You would be lying if you were to say that you haven’t heard the words “mutual funds” or “SIP” if you live in India. Thanks to the immense and successful marketing campaign by the industry, most Indians are well acquainted with mutual funds (at least the word). This is clearly reflected in the recent figures. As of 31st July this year, the Assets Under Management (AUM) of the Indian Mutual Fund Industry stood at 37.74 trillion and has witnessed a five-fold increase in a span of 10 years and around two-fold just in the last five years. Mutual funds are …

Unlike a regular mortgage, a reverse mortgage is a scheme wherein you can use your house property as collateral to avail a loan. The bank values and inspects your property and finalises the total loan amount. In contrast to a regular mortgage wherein you make periodic payments to the bank for the mortgage availed, the bank makes periodic payments to you in a reverse mortgage. The Government launched this scheme in India in the year 2007. How does a reverse mortgage scheme help you? Well, if you are a senior citizen with a self-owned house who is finding it hard …

রিয়েল এস্টেট ইনভেস্টমেন্ট ট্রাস্ট বলা যেতে পারে একটি সংস্থা যার কিনা মালিকানায় আছে রিয়েল এস্টেট, যার থেকে পাওয়া যেতে পারে নির্ভরযােগ্য উপার্জন। রেইট হল এমন সংস্থা যারা কিনা দামি রিয়েল এস্টেট প্রােপার্টি মর্টগেজ/বন্ধক নিজেদের আয়ত্তে চালায়। বিভিন্ন ধরনের রেইট: রেইট এর সমস্ত সুবিধা: আপনাদের আরও কিছু জানার থাকলে নির্দ্বিধায় নিচের কমেন্ট সেকশনে কমেন্ট করুন অথবা আমাদের কল করুন +91 9051052222 নম্বরে। –শুভজিৎ দত্ত ও দেবরাজ গুহ ঠাকুরতা

SEBI vide their circular dated 05/11/2020 had permitted the Mutual Funds to make overseas investments subject to a maximum of US $ 600 million per Mutual Fund, within the overall industry limit of US $ 7 billion. The regulator’s move was an opportunity for the investors interested to start investing in segments across the world having reasonable or low valuations. International Funds are basically mutual funds which invest in companies located outside the investor’s country of residence. By investing in a global fund, investors get the chance to be a part of a much more extensive and diverse portfolio with the help …

It’s really not uncommon for us to see people diverting their income or assets to their spouse or relative in the hope of reducing taxation. But guess what? Tax laws already have measures in place to prevent people from avoiding taxation through such means. In fact, people unaware of such provisions are laying the groundwork for tax blunders that would put them in a position to pay huge taxes in the future. The clubbing provisions in the Income Tax Act deal with cases where a person can also be taxed for the income earned by somebody else. What is Clubbing …

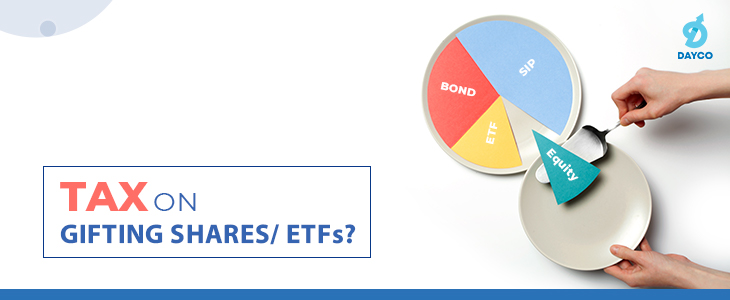

With the advent of new technology like e-DIS, online off-market transfer of securities has become seamless, paving the way for gifting shares and ETFs effortlessly. Brokers have leveraged this extensively by providing the facility of gifting shares and ETFs on their platforms. They have become the new go-to for birthdays, anniversaries, weddings and more– no end to gifts, is there? Shares and ETFs also make the best gifts. After all, they have the potential to grow and even become the next big thing in the future. Often, a person oblivious to financial markets–upon receiving something as peculiar as shares or …