Sovereign Gold Bonds are a more remunerative and tax-efficient way to invest in gold. But given the continuous decline in gold prices over the last 16 months, should you bet your money on the ninth tranche of SGBs that the Reserve Bank of India has started offering last Monday (10 January)?

The issue closes on Friday (14 January), and the issue price of the bonds – equivalent to the cost of 1 gm of gold with .999 purity – has been pegged at Rs 4786. The near-month gold contracts traded at Rs 47890 (per 10 gms) on the MCX.

This means that the 9th tranche of SGBs 2021-22 series is being offered quite in line with the current market price of the yellow metal.

Beginning November 2015, the union finance ministry has been notifying the SGB scheme for each financial year, and on behalf of the government, the RBI has been issuing the SGBs in several tranches. The 10th and the last tranche of 2021-22 series SGBs will be issued from February 28 till March 4 this year.

However, investors who had subscribed for those gold bonds from the 4th tranche onwards in the 2020-21 series are pretty worried because the current market price of gold has fallen below the issue prices of those tranches of the 2020-21 SGB series.

But the investors in the first issue of SGBs in November 2015 are still smiling their way home. Because the issue price of the first series of SGBs was Rs 2684!

The Sovereign Gold Bond scheme has been an enormous success for the government as it has been able to mop up more than ₹32,000 crores since the first issue of Sovereign Gold Bond in November 2015.

SGBs offer some distinctive advantages over investing in physical gold and gold ETFs.

1. Sovereign Gold Bonds come with the backing of a sovereign guarantee

2. Bonds are offered with a maturity period of eight years.

3. Premature redemption of bonds is allowed after five years of issuance. Otherwise, one can sell/purchase the bonds from secondary markets post listing.

4. Bondholders get a coupon interest at the rate of 2.5% per annum, and the interest is paid once every six months.

5. SGBs are offered in various tranches corresponding to a financial year

6. On redemption of SGBs after maturity of eight years, no capital gains tax is applicable.

7. On premature redemption or sale of bonds on stock exchanges after five/three years (as the case may be),long-term capital gains of 20% with indexation benefit is applicable.

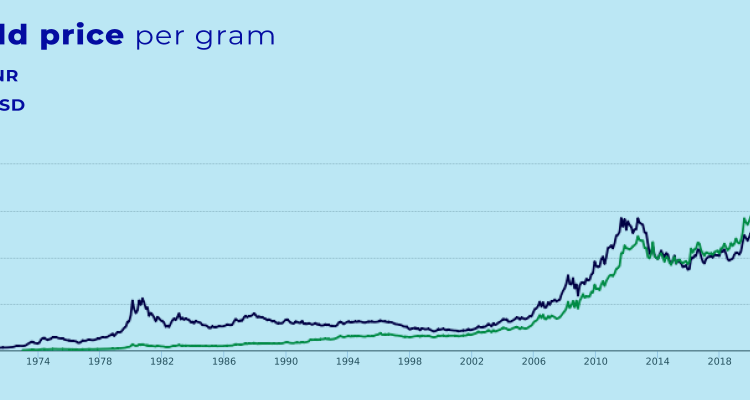

The historical price movement of gold shows that on an 8-year rolling basis, gold has always given a positive return. So, if you hold onto your SGBs for eight years, i.e., until maturity, you may likely end up with gains. Recently, the gold price has been on a downhill journey since scaling a record high of Rs 56000 per 10 grams in August 2020, despite a surge in inflation across the globe. The yellow metal with .999 purity (24-Karat) is currently trading at Rs 47870 on the MCX.

It can be seen from the gold price graph that the price of gold climbed a peak during periods of economic uncertainties and slumped whenever the US dollar appreciated.

Now that the inflation rate has reached a four-decade peak and the US fed is sounding a faster than expected hike in interest rate as early as March this year, the gold price is likely to stay range-bound with the appreciation of the US dollar.

However, the price of gold in India will vary with the USD-INR exchange rate. If the Indian rupee strengthens following a faster recovery in the country’s GDP, the gold price will remain subdued in India, too.

Experts believe that internationally the gold price will face stiff resistance at $1970 a troy ounce (1 troy ounce = 31.1035 gm approximately). The current price is around $1830. It went past the $1970 mark in August 2020, when the price of gold in India scaled a peak of Rs 56000 per 10 grams. At that time, the USD-INR exchange rate was Rs 76.20 a dollar. Now it is less than Rs 74 a dollar.

If you have a question, share it in the comments below or DM us or call us – +91 9051052222.

We’ll be happy to answer it.

– Parichoy Gupta