When you plan your goals or lay out your financial plan, it is essential that you consider the place for an emergency fund in it. Unexpected expenses and job losses can put severe pressure on your existing budget, which can be avoided by having a “Plan B” in place as we learned in this blog. Although we discussed what an emergency fund is and its need, the important question remained as to where one should park it.

Where Is The Safest Place To Invest Emergency Fund?

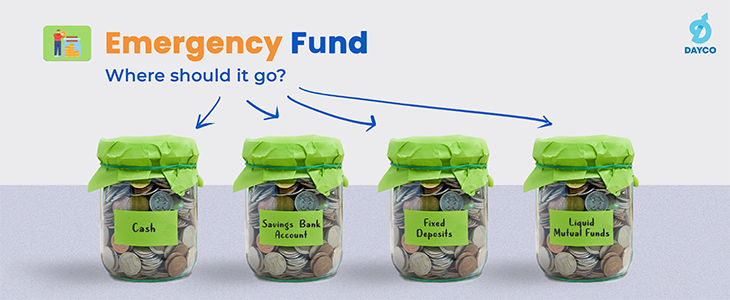

When parking and emergency fund you should keep in mind that the returns are secondary. You should look for easy accessibility, i.e., liquidity and safety of your capital. In an emergency need for funds, it is very crucial that you can easily access the funds you have saved or else it defeats the purpose. Here are some of the top ways to park away your emergency fund.

Cash: One of the most liquid options of them all. It can be easily accessible and can be relied upon. One of the disadvantages is of course no returns. However, it is recommended that you keep at least a week’s expenses in cash in your home locker. The amount shouldn’t be too large.

Savings Bank Account: Everybody has a savings account in a bank. You can use the account for parking a part of your emergency fund as the savings bank account offers easy operation and also provides interest in the range of 3-4% annually. Some banks offer higher and the money can be easily accessed by 24×7 ATMs. Parking emergency cash is suitable here as long as you don’t keep it in your primary bank account. Park it in a secondary bank account that you don’t use for day-to-day expenses.

Fixed Deposits: One of the other best options besides a savings bank account is an FD. They offer higher interest rates than a savings account and are similar in respect of accessibility and safety (DICGC insured). As long as you choose a large and established bank, your FDs are perfectly safe. Also, use the sweep-in facility provided by most banks to avoid penalties that regular FDs carry. In a sweep-in facility, your bank transfers any sum above the amount stipulated by you from your savings account to a sweep-in deposit (a fixed deposit). This option helps you earn higher interest as well as have flexibility.

Liquid Mutual Funds: Liquid mutual funds are a type of debt mutual fund that invests in debt and money market instruments with a maturity of up to 91 days only. Liquid funds and overnight funds (these invest in overnight securities having a maturity of 1 day) are relatively safer than other debt funds in the market and are suitable choices for parking your emergency fund. By keeping their maturity short, they minimize volatility. Some of the instruments that these funds invest in include Commercial Papers, Certificates of Deposits (CDs), Treasury Bills, etc.

One of the major tax-related disadvantages of an FD and savings bank account can be countered by a liquid fund. In FDs or savings bank accounts, the interest is taxable as it accrues and it may not be suitable for individuals in the higher tax bracket. In addition to this, liquid funds offer better returns and also have indexation benefits.

Liquidity-wise, there are no restrictions on withdrawals, and redemption requests are settled within a day. Some fund houses also provide an instant redemption facility that processes redemption requests on the same day.

Final Word

An emergency fund shouldn’t be kept in a single vehicle or option mentioned above. Keep a part in cash or liquid mutual fund and the other in FDs or savings bank accounts. Check the top 10 holdings of a liquid fund, a higher credit rating, lower exposure to commercial papers, and lower expense ratio when selecting a liquid fund, and keep in mind that you aren’t chasing returns and neither should your fund manager.

If you have a question, share it in the comments below or DM us or call us – +91 9051052222. We’ll be happy to answer it.

– Nischay Avichal