Our Future is very unpredictable. If you are planning your life under the assumption that everything will remain as it is, you are putting yourself and your finance in great danger. No matter how hard we try one cannot really predict what is in store for you in the times to come. We all have our own goals, desires and objectives that we dream to fulfil at some point of time, but these objectives cannot be achieved without a solid financial planning.

Financial Planning is a strategy to achieve your life’s objectives through meticulous management of your finances. It helps to determine your short and long- term financial goals and create a balanced plan to meet those goals. Tax planning, prudent spending and careful budgeting will help to preserve your hard earned cash. Fulfilling the future needs and improving the standards of living depends on the plans you make today.

Benjamin Franklin rightly said that, “If you fail to plan, you are planning to fail.”

Financial planning not only helps in building wealth, but also helps in securing your finances. Long-term financial goals need security, and that can only be provided by taking an insurance plan. A planned goal always helps you in evaluating your insurance need, which helps in getting a cover for your liabilities.

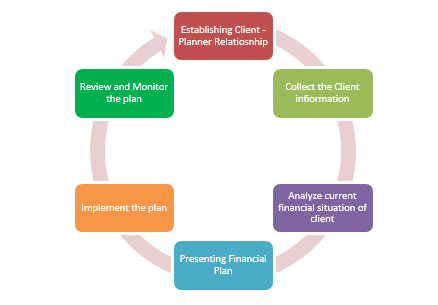

Steps of Financial Planning:

1. Note down when and how much you are saving

2. Gather your data and identify your goals

3. Evaluate your current financial picture

4. Learn about Investment options

5. Implement the Financial Plan

6. Monitor and revise the plan accordingly

5 key reasons why you need financial planning for a better tomorrow-

1. Inflation

Inflation is the biggest destroyer of purchasing power. Looking at the current times and future expected changes, the demand is growing faster than supply which leads to a hike in price. In order to sustain inflation in the future, one should actively and strategically plan their finances. Financial planning ensures you sustain the inflation while keeping your goals unaffected.

2. Growth in income

Financial Planning helps in building your assets without increasing your liabilities, which in-turn increases your net worth over a period of time. With accurate planning, one can take the pole position to control all the aspects of your income and work and towards building a solid financial platform in terms of both your personal and professional life.

3. Improved ROI (return on investment) on your portfolio

Proper Financial Planning includes investment planning, risk management, liquidity management, liability management and goal planning advisor will help you to design your integrated investment plan which takes into consideration your goals, risk appetite and available liquidity which helps to improve the ROI on your portfolio.

4. Financial Understanding

Better financial understanding can be achieved when measurable financial goals are set. It gives you a whole new approach to your budget and improving control over your financial lifestyle.

5. Helps you to identify Financial Errors

A Financial Advisor exposes the financial mistakes and provides easy fixes. It will let you analyse opportunities to invest idle funds or consolidation of debts.

Types of Financial Planning:

Emergency Funding

One of the main goals of implementing a financial plan is to create an emergency fund which helps you to take care of any contingency that might come, without affecting primary objectives. Providing security to your family is an important part of financial planning.

Protection or Insurance Planning

One of the main aims of planning your finances is your family’s financial security. Having a proper insurance coverage could provide peace of mind both for you and your family. A Financial Advisor will also help you to buy proper insurance products like term life insurance, medi-claim for all the members of the house and also other insurance like personal accident, critical ill ness etc.

Retirement Planning

Long term Financial Planning assists you in creating sufficient corpus for your retirement, when the expenses continue but the income dries out. So, it is always advisable to consider early investing for achieving your life’s goals. Financial Planning gives you an approx. visibility for next 10-20 years. Along with a secured future and comfortable lifestyle after retirement, one can sustain even at the time of any emergency arises, only if one follows the Financial Planning as per Financial Planning Advisor.

Investment Planning

Investment Planning is the main component of Financial Planning. Planning is a very important step before investing. We need to go through all the Investment options. Different investment avenues help investors to achieve different goals. Like MF, Equity (suitable for Long Term Goals), Stocks, Bonds etc. and compare the rate of returns and risks associated with it. After determining the risk return portfolio; your advisor will allocate assets in such a way that it can achieve optimum diversification while targeting the expected returns. If you are interested in relatively steady income, and you are risk averse, you may want to invest in debt mutual funds. Equity Linked Saving Scheme (ELSS fund) is good to save tax. You need to select the right investment option based on factors such as your goals, age, risk appetite and investment amount. By following few steps, you can preserve your assets for generations in the long run.

Investment Planning includes:

1. Long term Wealth Creation

2. Child Education/Child Marriage planning

3. House Purchase Plan

4. Car purchase Plan

5. Holiday Plan

Growth in income naturally leads to growth in the overall cash flows. With careful analysis of your spending patterns and nature of expenses, one can identify their activities and responsibilities that need more attention. It helps you to optimize your expenses and thus increases your investible surplus.

It is better to plan early since investing options may earn high returns over the period of time. Investing your money from now will make it easier to achieve such long term goals.

Tax Planning

Tax planning is the analysis of a financial situation or plan from a tax perspective. Tax planning covers several considerations. Considerations include timing of income, size, and timing of purchases and planning for other expenditures.

Estate Planning

To protect your assets and your loved ones, when you can no longer do it in future, you need an estate plan for that. It gives you an opportunity to choose who will inherit what among your possessions and valuable. It is basically transferring assets to heirs with an eye towards creating the smallest possible tax burden for them.

Conclusion

You may have several different financial goals you wish to achieve but to reach them at the right point in life, you need to have a financial plan in place at a very young age.

If you have a question, share it in the comments below or DM us or call us – +91 9051052222. We’ll be happy to answer it.

– Satarupa Dutta