e-KYC facilitates the completion of KYC process online eliminating the need for filling up physical forms and submission of physical documents. The main objective of e-KYC is to register the customer with least amount of paperwork and in the shortest possible time. The customers need to submit their details, such as – Aadhaar number, PAN, Aadhaar registered mobile number and bank details.

Difference between KYC and e-KYC

‘Know Your Client’ or KYC is a process by which a service provider, either government or private, verifies your identity and other particulars linked to you using documentation such as your Aadhaar Card. The process is similar in the case of e-KYC, here; authentication is carried out via an electronic mode. In other words, e-KYC is simply the process of carrying out verification digitally, without the need of physical documentation.

With the introduction of e-KYC, you can now furnish documentation easily. In fact, Aadhaar-based e-KYC makes authentication simple as it is as valid as a Xerox copy of your Aadhaar Card.

Eligibility

To take part in e-KYC verification, you must have a registered Aadhaar card and a mobile number linked to it. Every resident Indian is entitled to an Aadhaar Card. Similarly, NRIs and foreigners who have lived in India for at least 182 days in the 12 months preceding the date of enrolment for Aadhaar can also obtain a card. After having met these basic criteria, you qualify for Aadhaar and so also, the e-KYC process.

e-KYC OTP based

During Aadhaar-based e-KYC verification, an OTP is sent to you by UIDAI for authentication purposes. This is sent on your registered mobile number. To obtain it you must click ‘generate OTP’.

What is the e – KYC process?

e-KYC eliminates physical paperwork and in-person verification that is needed in case of regular KYC registration and enables you to do your KYC online while opening a Demat & Trading Account in just a few easy steps.

1) Go to https://eaadhaar.uidai.gov.in/#/ and check if your Aadhar card is linked with your mobile number. If yes, then you will be able to open an account through our portal.

2) Before account opening, make sure to enable the camera option in your browser as you will have to upload a live photo to this portal.

3) Keep the following documents and information ready with you.

A. PAN details.

B. Aadhar details to complete eKyc for e-sign.

C. Mobile for OTP Authentication.

D. Bank Account details including Bank Account number & IFSC Code.

E. Soft Copy of following documents-

PAN Card(JPEG & PNG Format, size 2mb)

Signature on white paper. (JPEG & PNG Format, Size 96kb)(Scanned, cropped and clearly visible. Signature should cover 90% of screen)

Cancelled Cheque. (JPEG & PNG Format, Size 2mb)

Bank Account Statement. (PDF Format, Size 2mb)

4) Once you are ready with all the required documents as mentioned above, log into www.daycoindia.com

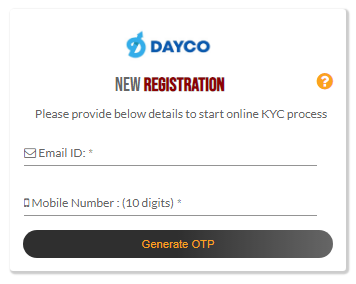

Go to the eKYC section. You will get the screen as appears below.

5) AMC charges for ₹500 to be payable at the beginning of the year.

6) Once you successfully receive the “Application Ref.No”, we will email you an Welcome kit consisting of your Client ID, DP ID, UCC Code and Client Master Report on your registered mail id.

Now you have completed your KYC formalities and can proceed to make your first use of your Account with us.

If you have a question, share it in the comments below or DM us or call us – +91 9051052222. We’ll be happy to answer it.

– Satarupa Dutta (Data: Melvyn Pinto)