Green Energy is the new buzzword reverberating across the entire world. However, this buzzword is grabbing the limelight for all the RIGHT reasons. At a time when the effects of climate change are being felt more and more intensely, it is necessary for vehicles, industries and even residences to adopt green energy and say goodbye to fossil fuels. Energy companies – old and new – have started catering to this newfound need for green energy. Many such energy companies are listed on the stock exchanges in India. With the government’s push towards the usage of green energy, investing in green energy stocks in India makes sense. As the demand for clean and green energy rises, the revenue and profitability of such energy companies will skyrocket as well. So, in this blog post, let’s find out some viable green energy stocks that are listed on Indian stock exchanges.

Some Stats About the Green Energy Sector in India

Although we are hearing more about green and sustainable energy resources in recent times, India has been quite an early adopter of green energy. This is why, in the 58th edition of the Renewable Energy Country Attractiveness Index (RECAI) prepared by EY, India ranked No.3 – just after the US and China.

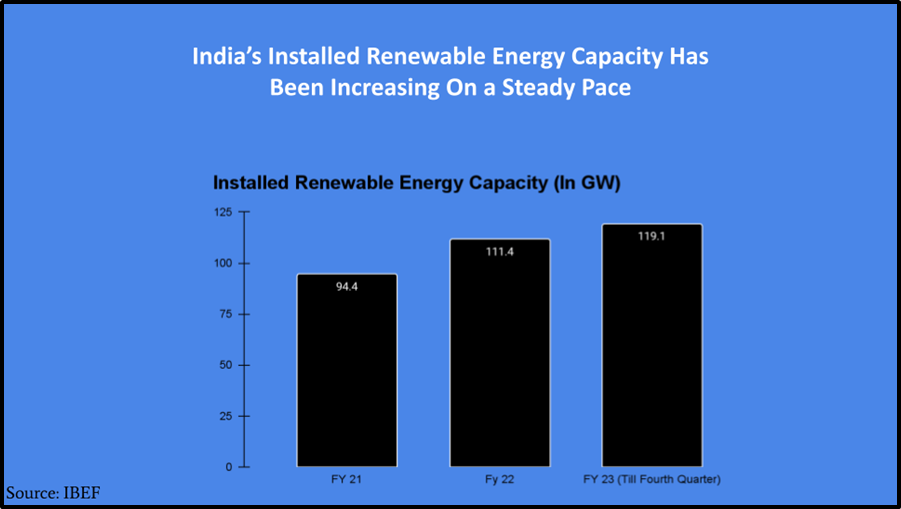

The installed Renewable Energy capacity in India has been increasing at a steady pace. While in 2021, the installed capacity was around 94.4 GW, it increased to 119.1 GW in December 2022.

As we said, the green energy sector in India has been in a growth phase since the 2000s. According to IBEF, the non-conventional energy sector in India has received a total of $12.57 billion in the form of FDI since 2000.

This means that there are many green energy companies in India that have strong fundamentals. They aren’t relying on the recent hype. Investing in such companies can be a good decision if you are a long-term investor.

| Note |

| Although we are using the terms ‘Green Energy’ and ‘Renewable Energy’ interchangeably, there is a subtle difference between the two. Not all kinds of renewable energy sources are green energy sources. But all green energy sources are renewable energy sources. |

List of Top-performing Green Energy Stocks in India

Broadly speaking, there are two types of Green Energy companies listed in NSE or BSE – those that produce Green Energy and those that manufacture products needed to produce green energy. We will talk about both of these two kinds. Let’s start –

Borosil Renewables

Borosil Renewables, despite not being a direct green energy producer, is an intrinsic part of the green energy industry in India. After the demerger in 2018, the leaders at Borosil formed a separate entity to focus solely on the solar glass production business. This separate demerged entity is known as Borosil Renewables and is one of the most loved renewable energy stocks in India.

Positive Aspects:

The moat of Borosil Renewables lies in the fact that it is practically the one and only solar glass manufacturer in India – at least till 2021. Other solar glass manufacturers like Triveni Glass have just started their journey, and they are in a very nascent stage. However, Borosil Renewables has been in the solar glass manufacturing business for more than a decade.

Now, it is necessary for an investor to understand how the specific sector that Borosil Renewables operates in is performing. Although the solar energy industry in India is at a very nascent stage, the installed capacity has been increasing at a consistent pace.

- India was capable of producing 6.76 GW of solar energy in 2016

- In FY 2022, that figure increased to 54 GW

The consistent growth of the solar energy industry in India is good news for Borosil. The company also exports its products.

Negative Aspects:

Now for some bad news, despite performing well in its sector, the price of this green energy stock has been on a downward trend since 2022. During FY 2022, the price of Borosil Renewables hovered around Rs.620. As of June 2023, the price has nose-dived to Rs.507.

To See the Current Price of Borosil Renewables, go to https://market.daycoindia.com/corporateinformation/details-quote/borosil-renewables-ltd/92.

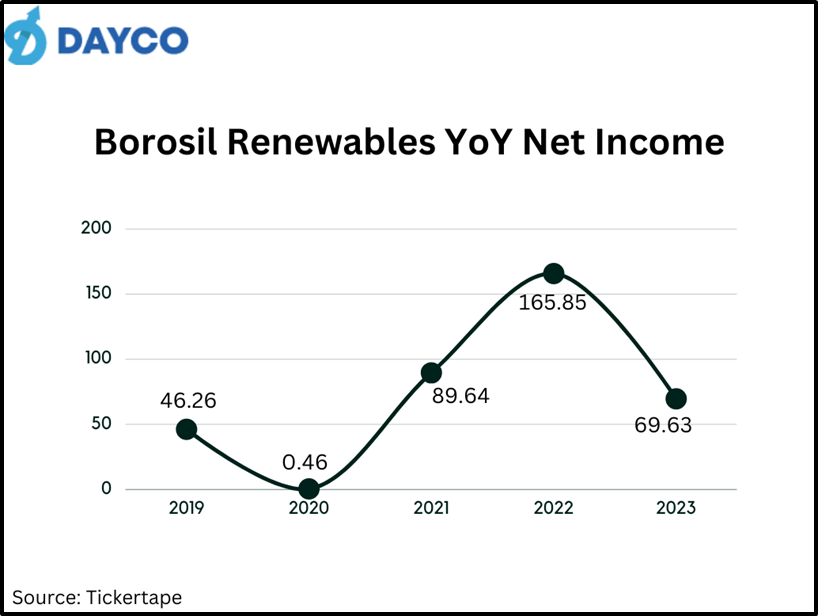

This downtrend is in line with the falling Net Income of Borosil Renewables. After a stellar performance in FY 2022, this Indian green energy stock failed to sustain its Net Income in FY 2023.

Figures in Crores

Despite this, Borosil Renewables is a fundamentally strong stock. The fact that promoters of the company hold around 61% of the company’s shares makes the stock a safe bet. All in all, Borosil Renewables should be on your watchlist.

Tata Power

Tata Power is a viable green energy stock in India. Although it started as a conventional energy producer, Tata Power is slowly pivoting into the green energy sector. As of June 2023, 37% of the energy produced by Tata Power is green energy.

Positive Aspects:

As a part of the Tata Group, Tata Power enjoys the benefit of a robust ecosystem. In fact, Tata Motors and Tata Power had already inked Power Purchase Agreements. These PPAs will enable Tata Motors to use solar energy in its plants in Pune and Uttarakhand.

Along with its conventional transmission and distribution business, Tata Power has expanded itself to provide infrastructure for EV charging stations to Electric Vehicle companies. For example, it has recently partnered with Le Roi Hotels to provide EV charging station infrastructure on its premises.

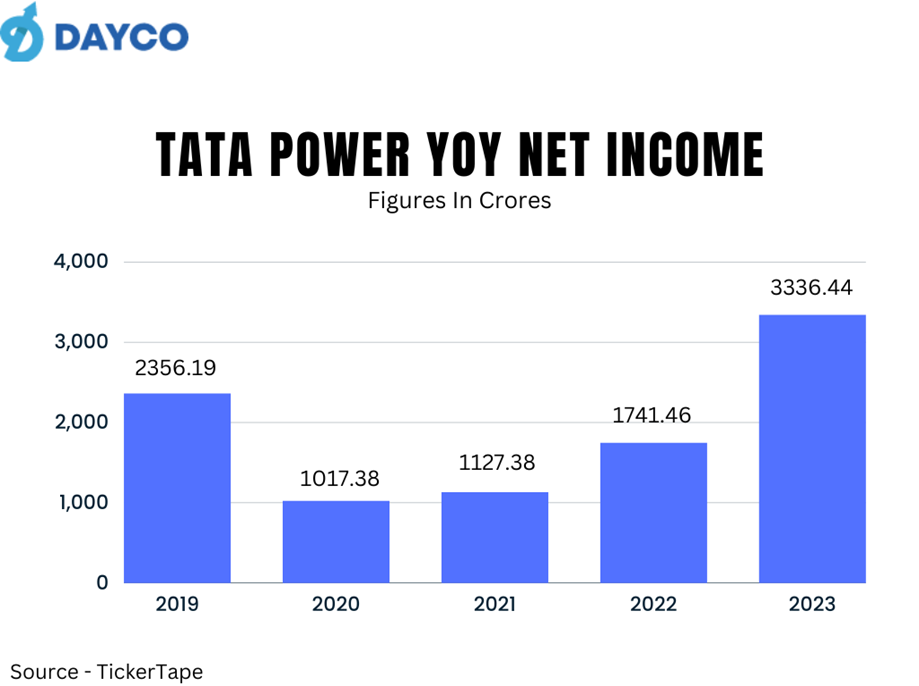

Although the net income of Tata Power has been growing at a slower pace than the industry average, the growth has been consistent.

Negative Aspects:

The price of this green energy stock has grown significantly over the past three years. Back in 2019, its price hovered around Rs.60. As of June 2023, the price of Tata Power is hovering around Rs.200.

This means that it will be very hard for the stock to give good returns in the near term. You can see it yourself. The price of the stock has become quite range-bound. Since December 2021, the price of the stock has remained around Rs.200.

However, from a long-term perspective, Tata Power is a perfect stock – no doubt about it.

Olectra Greentech

This is an Indian green energy stock that has given a return of 473% to investors who invested in it in 2018. That’s not a typo. From 2018 to 2023, the stock price has risen by 473%!

Olectra is not a green energy-producing company. It manufactures electric buses that are equipped to be run on Indian roads. The company boasts 4 different models of electric buses. On top of that, it manufactures an electric tipper meant for carrying heavy materials.

Positive Aspects

This green energy stock has been becoming the apple of the eye of investors for reasons more than one. Over the past five years, Olectra Greentech’s market share has been on a slow-but-steady rise.

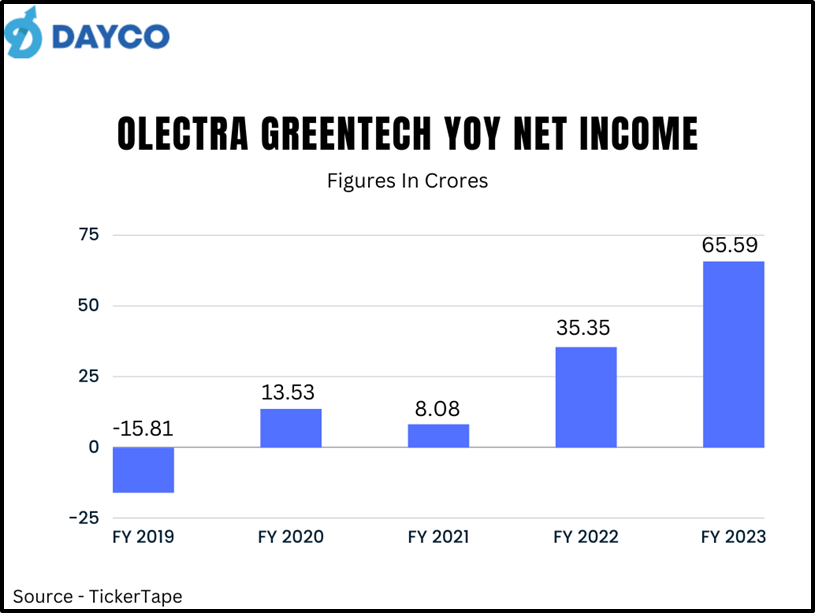

The net income of the company has been on a steady rise since 2021 –

On top of that, if you use our tool to read company filings, you must have come across the news that the company has recently bagged a big order from the Telangana Government (in an indirect way.) The Telangana Government has assigned Evey Trans Pvt Ltd for the delivery of 550 electric buses in March 2023. The company will be procuring these buses from Olectra Greentech. Back in 2022, Olectra got an order for a whopping 2100 electric buses from Brihanmumbai Municipal Corporation. It’s the biggest order that any electric vehicle manufacturer has ever received in India.

Negative Aspects

As is the case with any stock whose price rises exponentially, the potential for the rise in the price of shares of Olectra Greentech is low. The price of the stock has doubled since February 2023. This means that it has doubled within three months! It is extremely unlikely that the stock will give such a stellar performance in the near term.

However, given the unparalleled interest in Indian green energy stocks, keep Olectra Greentech on your watchlist and keep waiting for any drop in stock price.

Ashok Leyland

Ashok Leyland is one of the most wholesome stocks in the sense that the shareholding pattern indicates a nice balance of percentage holdings by Mutual Fund companies, Promoters, Individuals, and even Foreign Institutions.

As a company that launched India’s first electric bus, Ashok Leyland is quite serious about building its electric vehicle portfolio. In fact, it has separated its EV business from its traditional business of manufacturing ICV vehicles. Today, the EV business is handled by the step-down subsidiary of Ashok Leyland – Switch Mobility.

Positive Aspect

The moat of this Indian green energy stock lies in the fact that Ashok Leyland’s EV arm – Switch, is headquartered in the UK. Hence it has access to resources and markets in Europe as well as India. In fact, the company has a presence in not just Europe but the Middle East, Africa, and Australia as well. It is well-positioned to be a leader in the electric bus and truck space.

Negative Aspect

As of writing this article (July 2023), the share price of Ashok Leyland hit a 52-week high a week back. Although industry experts still see the continuation of this uptrend, don’t expect too high a return if you are planning to invest now. But apart from this, Ashok Leyland is a highly leveraged business with a debt-equity ratio of 3.61 on a consolidated basis, which has been on a continuous uptrend since 2017.

Tata Motors

Tata Motors is yet another EV manufacturing company that makes the stock fall in the green energy bracket. Often dubbed the Tesla of India, Tata Motors is playing an important role in the adoption of electric cars in India with flagship models like Nexon.

Positive Aspects

As of April 2023, Tata Motors has a market share of 81.4% in the electric car segment. It is the de facto market leader when it comes to electric cars in India. As part of the Tata Group, Tata Motors takes advantage of the ecosystem built by other Tata brands – specifically Tata Chemicals and Tata Power.

After generating negative net income from FY 2019 to FY 2022, it has finally posted a positive net income of Rs. 2414 crores in FY 2023.

Negative Aspects

On a consolidated basis, Tata Motors is a highly leveraged business. As of March 2023, it has non-current liabilities of more than Rs. 1.23 Crores standing on its balance sheet. This should be factored in when you make a decision to invest in this stock. Also, as of writing this article, the stock has already given a return of 44% over the year.

KP Energy Ltd

KP Energy is in the business of building infrastructure for Wind Power generation companies. And when we say infrastructure, we aren’t just talking about Wind Mill components – KP Energy taare of the entire set-up process. From site identification to building an entire Wind Farm – the company does it all. As such, this green energy stock in India has a unique moat.

Positive Aspects

As a part of the KP Group, KP Energy Ltd has the benefit of the ecosystem. KP Group is also in the business of producing solar energy. Also, if you look at the financials of KP Energy, you’ll see that the company has a debt of just 28 crores. As far as its net income is concerned, it has remained profitable. In FY 21, 22, and 23, the company posted a net income of Rs.6.06 crore, Rs.18.40 crore, and Rs.43.90 crore, respectively.

Negative Aspects

In the past year, the stock has given a return of 338%. This means that there is a low probability that the stock will go significantly higher in the near term. The stock is under the GSM list.

NHPC

NHPC is a hydropower generation company that’s owned by the Government of India. This stock has been showing great profitability. The net income has been on an upward trend since 2018. Back in 2018, its net profit stood at Rs. 2513.90 crores. Today that figure has risen to 3889.98 crores. But its debt stands at 26,095 crores. Yet, since this is a GOI-owned company, you should keep this stock on your watchlist.

Conventional Energy Companies Are Gradually Increasing Their Green Energy Portfolio

As new and non-traditional players are crowding the green energy sector in India, conventional energy producers aren’t blind to the importance of green energy. Here are some listed conventional energy companies that are focusing on green energy production –

JSW Energy – JSW Energy is one of the rarest hydropower-based electricity generation companies in India. Among its installed capacity of 9.8GW, 61% of the capacity comes from renewable energy sources. The stock has shown impressive profitability as well. However, its current debt of Rs. 25000 crores is worrisome.

SJVN – This is a scheduled PSU company that has been in the conventional power sector. However, today, the company is in the business of producing solar, wind, and hydropower. The company boasts of a hydropower plant with a 1500MW capacity. Its wind power-based electricity generation capacity stands at almost 100MW. The company also boasts 3 solar projects with a capacity of 81.3MW.

Honourable Mentions

Apart from the above green energy stocks, it would be unfair if we didn’t mention –

- Suzlon:

Suzlon Energy Ltd is an Indian multinational company that specializes in the business of renewable energy solutions, particularly in wind power. Established in 1995, Suzlon has emerged as one of the largest wind turbine manufacturers in the world. It offers end-to-end solutions for wind energy projects, including the development, manufacturing, installation, and maintenance of wind turbines.

Suzlon is a green energy stock that people love to hate. Suzlon is the kind of green energy stock that can make you rich and poor. From the highs of Rs.300 to the lows of Re.1 in 2020 – the stock movement of Suzlon would put thriller movies to shame.

Despite the dismal performance over the years – with mounting debt – Suzlon has managed to bag some big orders, one after another, in recent months. The company has managed to turn its Consolidated PAT positive after six years and has reduced finance costs significantly. It seems the company is on a path to recovery.

That being said, be very careful before investing in this kind of stock. The recent improvements in its financials shouldn’t be a sure-shot sign to invest. The stock can be considered by highly aggressive investors with a long investment horizon.

- Adani Green Energy:

Adani Green Energy Ltd is one of the leading renewable energy companies in India. It is a part of the Adani Group, a diversified conglomerate with businesses spanning various sectors. Adani Green Energy is focused on developing, operating, and maintaining renewable energy projects in India and other parts of the world. Adani Green is yet another green energy stock that can be leveraged by traders. After the recent damaging report by short-seller Hindenburg, you should be cautious as the stock still remains in the volatile zone. The stock has nosedived from a high of Rs.2000 to a low of Rs.480 and still shows no signs of recovery.

Conclusion

There are many more green energy stocks listed in India. We will talk about them in another blog post. As you can see, all these green energy stocks have both positive and negative aspects. It is essential for an investor to check the company’s fundamentals, examine historical profit and loss reports and read all the news pertaining to the green energy stock that he or she intends to invest in.

Green energy stocks are prone to too much hype. To see the big picture, use Dayco India Fundamental Analysis Tool to perform a minute analysis of a stock. Click here – https://market.daycoindia.com/corporateinformation/get-quotes/company-snapshot.

If you have a question, share it in the comments below or DM us or call us – +91 9051052222. We’ll be happy to answer it.