The Life Insurance Corporation of India is coming out with India’s largest IPO. Once listed, LIC will likely become the country’s biggest company by market capitalization. It is the sole public player out of India’s 24 life insurance companies to date. The company plans to sell 3.5% of its stake through an offer for sale (OFS).

The corporation is also offering special discounts and reservations to policyholders and employees. The company has reserved 35% of the total issue for retail investors, 10% for the policyholders, and 5% for LIC employees.

To avail of the 10 percent quota of policyholders, you should have purchased a LIC policy on or before Feb 13th, 2022, and linked your PAN with your policy on or before 28th Feb 2022.

Further, you will need a Demat account to participate in the offer. A Demat is a prerequisite for holding and dealing in equity shares or applying for IPOs. The account facilitates holding equity shares & other securities like mutual funds, bonds, government securities, and exchange-traded funds (ETFs). A Demat account can be opened by approaching any of the authorized Depository Participants. You’ll need to provide your PAN card, residence& ID proofs, and other documents as may be necessary.

Here are the offer details for the IPO:

- IPO Opening Date: 4th May 2022

- IPO Closing Date: 9th May 2022

- Face Value: ₹10/share

- IPO Price Band: ₹902 – ₹949

- Issue Size: ₹21,008.48 Cr

- Fresh Issue: NIL

- Offer for Sale: 22,13,74,920 Equity Shares

- Policyholder discount: ₹60 per Equity Share (Policy bought on or before 13th April 2022)

- Retail and Employee discount: ₹45 per Equity Share

The company’s DRHP filed with the SEBI states, “Our Corporation has been providing life insurance in India for more than 65 years and is the largest life insurer in India, with a 64.1% market share in terms of premium (or GWP), a 66.2% market share in terms of new business premium (or NBP), a 74.6% market share in terms of number of individual policies issued, an 81.1% market share in terms of number of group policies issued for Fiscal 2021, as well as by the number of individual agents, which comprised 55% of all individual agents in India as at March 31, 2021. According to a research report by CRISIL, the life insurance industry’s total premium is expected to grow at 14-15% CAGR over the next five years, to reach close to ₹12.4 trillion by Fiscal 2026. On a total-premium basis, the industry’s size was ₹6.2 trillion in Fiscal 2021.

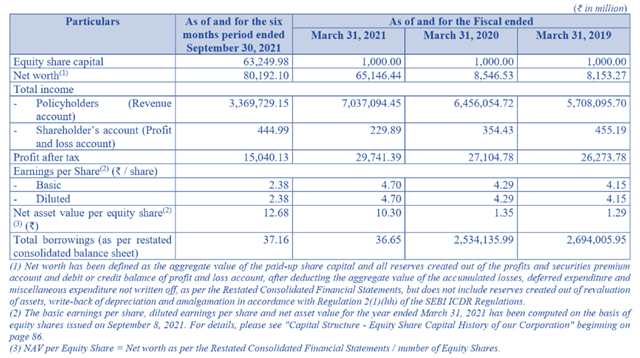

A snapshot of the company’s finances from the DRHP:

If you have a question, share it in the comments below or DM us or call us – +91 9051052222. We’ll be happy to answer it.