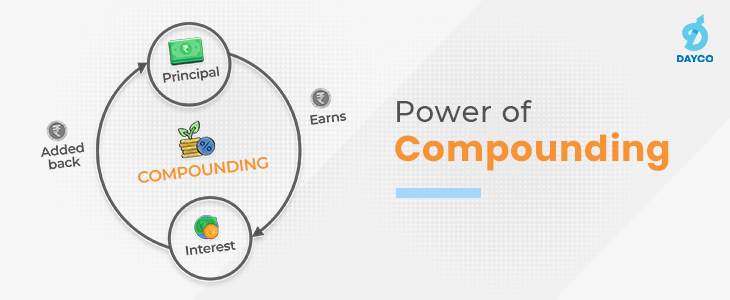

Compound interest accelerates your investments’ growth over time, along with balance expansion. It’s a tool that helps your principal grow fast as your interest earns interest, i.e., by adding the earned interest back into your principal balance and making interest on that.

The growth of one’s investment balance would accelerate over time as one earns interest on an increasing basis. Numerous additional alternative intervals can be used in addition to the frequently used annually, quarterly, monthly, and daily compounding periods. The more frequently interest is compounded, the more rapidly your wealth grows over Time.

Simple Interest vs. Compound Interest

Simple interest and compound interest work differently in the sense that simple interest is calculated based on the principal amount only and it is not reinvested into the principal amount. Interest for credit card loans compounds and that is the reason it hurts one’s pocket when credit card debt grows so large so quickly.

When it comes to one’s Personal Finance or Goal-Based Investments towards Wealth Creation, Retirement Planning, Children’s Education or Daughter’s Marriage compound interest plays an essential part.

As compound interest is used in banks, the amount you deposit in your account benefits from it. If you start investing money at a younger age in your account, it is more beneficial as the compound interest will keep on increasing, paying interest over interest which gives benefits in the long run over the period of time.

There are five key variables involved in understanding Compound Interest.

- Interest – This is the interest rate you earn or is charged. The higher the Interest rate, the more money you earn or, the more money you owe.

- Starting principal – How much money are you starting with? How big a loan did you take out? While compounding increases over time, it’s all based on the initial amount you deposit or borrow.

- Frequency of compounding – The pace at which interest is Compounded daily, monthly, or annually—determines how rapidly a balance grows. When taking out a loan, make sure to be familiar with how often interest is compounded over a period of time.

- Duration – How long do you anticipate owning an account or paying off a Loan? The longer you stay invested or the longer you hold on to your Loan account, the longer it has to compound and the more you’ll earn—or owe.

- Deposits and withdrawals – Do you anticipate making regular deposits into your investments? How often will you make loan payments? The pace at which you build up or pay down your loan makes a big difference over the long run.

One of the most important benefits of compound interest is that it grows your money faster than simple interest. Because of the faster growth rate of compound interest, it is beneficial for your investments and for banks and other lending institutions to calculate loan dues. Your objective should be to make the most out of compound interest for your personal investments by starting investments early and staying disciplined and consistent.

You will come across various well-known investors acknowledging compound interest as the best tool for growing wealth. One of the most famous is “Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t… pays it” by one of the greatest and most influential physicists of all time– Albert Einstein.

If you have a question, share it in the comments below or DM us or call us – +91 9051052222. We’ll be happy to answer it.

~Avishek Pyne