Thinking about diving into the world of mutual funds? Awesome choice! But, before you jump in, let’s talk about taxes. Understanding mutual fund taxation helps you gain more from mutual fund investments by choosing the right funds and optimising your investments and withdrawals. Let’s break it down in simple terms.

There are a few key things that decide how much tax you’ll owe on your mutual fund gains.

- Types of Funds: Different mutual funds have different tax rules. Whether it’s an Equity Mutual Fund, Debt Mutual Fund, or a Hybrid Mutual Fund, each has its own set of tax guidelines.

- Dividends or Capital gains: If you have invested in Income Distribution Cum Withdrawal (IDCW) plans or dividend plans, the regular payouts form a part of your taxable income. If you sell your mutual fund units, the gains, if any, are called “Capital Gains”. Both dividends and capital gains are taxable and have different tax rules.

- Holding Period: The tax rate on capital gains depends on the holding period of the mutual funds unit. Generally, the longer you hold onto your MF investment, the less tax you’ll have to pay.

Taxation: Dividends and Capital Gains

The dividends you get from mutual funds are added to your taxable income and get taxed based on your income slab rates. Also, if the dividend income is more than Rs.5000, then the sum is subject to 10% TDS as well.

Now, capital gains taxation depends on how long you’ve held onto your mutual fund units and what type of fund you’re in. Gains are classified as short-term and long-term based on the following rules and have different tax rates which are discussed later in this blog.

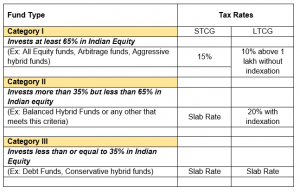

1. Funds Investing Over 65% in Indian Equity: Think equity funds, arbitrage funds, equity savings, and others in this category.

- Short-term gains (STCG) – when the units are redeemed before the completion of 12 months

- Long-term gains (LTCG) –b when the units are redeemed after the completion of 12 months.

2. Funds Investing 35-65% in Indian Equity: Balanced hybrid funds and the likes fall into this category.

- Short-term gains (STCG) –held for less than 36 months

- Long-term gains (LTCG) –held for 36 months or more

3. Funds Investing Less Than or Equal to 35% in Indian Equity: Here, the holding period doesn’t matter much. All gains are treated as short-term. Debt funds, conservative hybrid funds, and the likes fall into this category.

Taxation Rates

Recent Changes

Till FY23, all funds that invested less than 65% in Indian equity were classified as non-equity and holding period and tax rates for capital gains taxation was similar to category II above. So, if you have units that were purchased before 1st Apr 2023, the gains will be taxed accordingly. All units purchased on or after 1st Apr 2023 come under the new taxation rules.

Thank you for taking the time to read.

~Nischay Avichal