Investors use mutual funds to avoid putting all eggs in the same basket. When you invest in a mutual fund, you effectively invest in multiple stocks on a fractional basis. This diversification helps you stay relatively safe from market volatility.

The problem arises when you invest in multiple mutual funds having the same underlying stocks. This is what we call overlapping mutual funds. There are numerous downsides to this overlap. Let’s understand this in a more detailed way.

Mutual Fund Overlap: Here’s a Simple Scenario

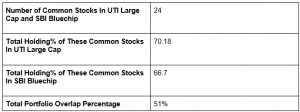

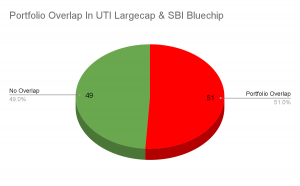

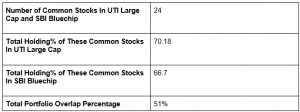

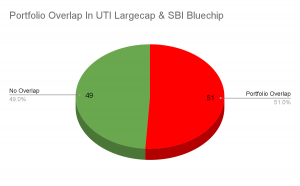

Imagine you have invested in two mutual funds – UTI Large Cap fund and SBI Bluechip fund. You thought that since the names of the funds are different, the underlying stocks will be different as well. But that is not the case.

These two funds have a lot of overlapping underlying stocks –

As you can see, the portfolios of these funds are made up of stocks that are common in both.

The Problem With Overlapping Mutual Funds: Less Diversification, More

Volatility

Investing in mutual funds with overlapping underlying stocks makes your entire portfolio susceptible to market volatility.

- If your mutual fund portfolio has too much overlapping of underlying securities, it means that you have more exposure to those overlapping securities. Hence, if the price of any of these overlapping securities falls sharply, it will have a more pronounced negative impact on your overall portfolio. In a nutshell, you will not be getting the benefit of diversification if you invest in overlapping mutual funds.

- Another problem with investing in overlapping mutual funds is the fact that it makes your overall investment journey expensive. How? Suppose you invested in mutual funds A and B, which have a significant number of overlapping securities underneath. Both of these funds charge you in the form of an expense ratio. This means that you are paying two funds to manage the same set of stocks. Imagine if there was no overlap in these mutual funds. In that case, you would have been paying two funds to manage two different sets of stocks, which is more logical.

There are many free tools available on the internet that help you see if the mutual funds you have invested in have overlapping securities. These tools will help you understand the percentage of the overlap between two mutual funds schemes.

Why Overlap Happens and How To Avoid Portfolio Overlap?

There are several reasons why portfolio overlap happens:

- Portfolio overlap can be prominently seen when the investment universe is small like in the case for large cap funds. There is a finite amount of large cap stocks (top 100) that these funds can invest in as per SEBI mandate. As a result, different largecap funds have the high likelihood of investing in the same underlying stocks.

- Secondly, funds with the same investment theme can have portfolio overlap. Why? Because the theme or sector is the same and there are only a limited number of stocks there. For example, technology funds have to predominantly invest in technology and IT stocks. So different technology funds have to choose from the same universe of IT stocks.

- Lastly, different funds from the same AMC can have portfolio overlap because the investment philosophy of the AMC. An AMC can have a broad investment philosophy that they apply to all of their funds. Hence, even different categories of funds can have overlapping stocks.

So, how to avoid mutual fund overlap?

Invest in mutual funds across different categories. For example, both LIC MF large-cap fund and Edelweiss Large-cap fund invest in large-cap stocks. These two funds are in the same category. As a result, they have a whopping 68% portfolio overlap.

Let’s go back to the example of UTI Large Cap fund and SBI Blue-chip fund. The category of these funds is the same (and as we said, Large cap funds have a mandate to invest in the top 100 stocks only as per market capitalisation). As a result, these funds have a huge overlap.

To avoid this, invest in funds from differing categories.

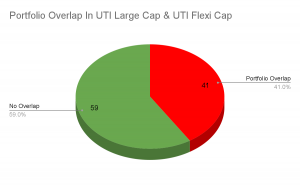

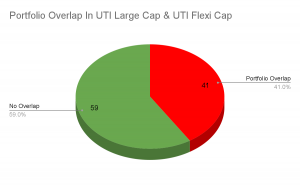

Interestingly, many AMCs have their own investment philosophies that they stick to. Thus, when you invest in seemingly different funds from the same AMC, there is a possibility of portfolio overlap.

Here’s an example. UTI Large Cap funds and UTI Flexi Cap funds are funds under two different categories. But since the funds are run by the same AMC having the same investment philosophy, a sizeable percentage of overlap can be observed.

- So, make sure you invest in funds from different AMCs – don’t stick to just one.

- Lastly, review your mutual fund portfolio periodically. This is specifically true in the case of flexicap and multicap funds and other actively managed funds. The holdings of these funds change frequently. This change in holding might gradually create an overlap between two such funds.

How Much Is Too Much Overlap in Mutual Funds?

Usually, you can’t avoid portfolio overlap to a certain extent. It’s likely that there will be some common underlying stocks in mutual funds that you have invested in. You just have to make sure that the overlap is not too much. But how much is too much? There is no standard rule in this regard, but it’s advisable not to have more than 30% to 35% overlap.

In the end…

Diversification smoothens the bumpy road of investment. And one of the primary objectives of investing in mutual funds is to achieve this diversification. It keeps your investments safe from volatility. You don’t have to care if one or two stocks go down. But when these one or two stocks grab the lion’s share of your overall mutual fund portfolio, that’s when the problem begins. In such a scenario, the price movement of these few stocks affects the stability of your entire portfolio. Always make sure that your overall portfolio does not have too much overlap. The journey of wealth-making is a long one. You don’t want a bumpy road.

-Nischay Avichal