Semiconductors power the modern world. They are at the very essence of everything we interact with daily in our life. It powers smartphones, pads, and laptops that are inseparable from our lives. Everything from banking to medical infrastructure to financial markets, from household appliances to cars and aircraft is made possible through a tiny circuitry embedded atop a silicon plate. The device you are reading this blog on and the systems that make this blog available on the internet requires a chip working somewhere in the background.

What we are getting at is that chips are important…very important! In this blog, we will discuss the overview of the semiconductor industry, the current state of the Indian semiconductor industry, value chain, and above all, we will give you a list of semiconductor stocks in India.

India’s Opportunity

The global semiconductor industry is huge and is expected to grow to $588 billion in 2024. India’s semiconductor market was valued at $34 billion in 2023. A report from IESA and Counterpoint Research[1] suggests that by 2026, we’ll hit a whopping $64 billion in semiconductor consumption with consumer electronics, telecom, IT hardware and industrial sectors leading the demand. By 2030, this demand is also expected to reach $110 billion[2].

Reasons Why Indian Semiconductor Ecosystem Can See a Major Shift

- India imports most of its chips and runs a large import deficit. We imported $15.6 billion worth of semiconductors in 2022. Interestingly, our chip imports jumped 92% from FY21 to FY23[3].

- As chips power the modern world, countries that are ahead and self-sufficient in chip manufacturing certainly have a first mover advantage. Innovation, research, and advancement in science is not entirely possible without advanced

- Chip Manufacturing is highly concentrated and is vulnerable to global supply chain disruption as was clearly evident during COVID. This doesn’t help as we depend almost entirely on imports. For context, 100% of the world’s most advanced semiconductors are manufactured in Taiwan and South Korea. These regions are highly prone to natural disasters and not to mention the geopolitical tensions in Taiwan. India reduces the risk of supply chain disruptions by nurturing a chip manufacturing ecosystem domestically.

- Building a manufacturing ecosystem in India helps our economy as the chip industry is a high tech and high paying job which can produce significant high-quality employment in the country.

- India has rolled fiscal incentive of $10 billion to attract fabs and OSAT (outsourced assembly and test) players. India has also set up the ISM, a government body aimed to draw investment in the semiconductor sector at every crucial stage of chip-making: from design and fabrication to OSAT/ATP (Semi-conductor Assembly, Test, and Packaging) facilities. There are also extra incentives to lure display fabs. Under this program, the central government offers to cover 50% of the project cost on a pari passu basis for establishment of fabs (chip manufacturing unit), ATP/OSAT facilities, or display fabs. The respective state also pitches in another 20 – 25% of the project cost. For nurturing the design ecosystem, design linked incentives that offers to match 50% of the investment are also in place.

Semiconductor value chain

The process of manufacturing a chip is multi-faceted. It would not be an exaggeration to call it one of the most complex forms of engineering humans undertake. Precision and attention to detail matters. The process of manufacturing a chip begins on a silicon wafer that are made out of 99.99% pure silicon. A process called photolithography is used to carve the circuit patterns on the silicon wafers. Following which processes like etching and ion implantation is used to give the finishing touches. The wafers are then sliced, encapsulated, and tested for reliability. If you want to learn more about the manufacturing process, you can check out this video from Samsung.

The smaller the process node size in a chip, the more advanced the chip is. The process node size is measured in nm (nanometres). Advanced 10 to 14 nm chips are used in computers while 28 and 40 nm chips find their application in consumer electronics and automotives. The latest iPhone 15 flaunts the first SoC built on a 3nm process. The fabrication process also becomes more complex as the nm decreases – chips of 7 -10 nm can take more than three months to be fabricated on an average.

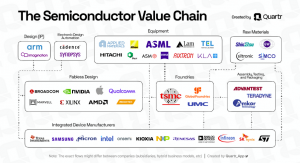

The infographic from Quartr aptly summarizes the value chain and the major players in it. Foundries or Fabs are companies that undertake manufacturing of chips with major players like TSMC, SMIC, UMC, Samsung, and GlobalFoundries. Fabless companies do not manufacture the chips themselves. They design the chips and outsource its manufacturing to fabs. NVIDIA, Qualcomm, MediaTek, AMD are major fabless companies. IDMs or Integrated Device Manufacturers are companies that do much of the manufacturing by themselves. They design and also manufacture the chips by themselves. Major IDMs are Texas Instruments, Samsung, Intel, and Micron. The other players in the value chain include companies that provide software (EDAs) or equipment necessary to manufacture the chips and companies that package and test the final product (also called OSAT/ATP). Strikingly, ASML is the only company in the world that manufactures photolithography machines that enable manufacturing of advanced chips. A single machine that is larger than a bus costs upwards of $300 million.

Key Semiconductor Players In India

At this stage in India, we are seeing players emerge in OSAT/ATP and fab. Recently, three new plants were inaugurated in March – two in Gujarat and one in Assam. Two are OSAT plants – one from Tata Electronics Private Limited (TEPL) in Assam and the other from CG Power (JV with Renesas Electronics Corporation, Japan, and Stars Microelectronics, Thailand) in Sanand, Gujarat. The fab plant is a partnership between TEPL and PSMC, Taiwan which will be set up in Dholera, Gujarat. The plant will manufacture 28 nm chips and power management chips for electric vehicles (EV), telecom, defense, automotive, consumer electronics, display, etc.

HCL Tech, Foxconn, Micron, Kaynes, and L&T are other players which are in the process of setting up an OSAT or fab plant in India. The following is the list of listed players that may potentially benefit from the semiconductor ecosystem India seeks to build.

Please be mindful that the companies mentioned here are not endorsed as investment recommendations; they’re included solely for educational purposes. It’s highly recommended that you conduct your own thorough analysis of each company’s valuation, considering their venture into semiconductors and its potential impact on revenue and profitability.

List of Semiconductor Stocks In India

Here are some stocks listed in Indian exchanges that are in the semiconductor industry – either directly or indirectly

Tejas Networks:

Currently a part of Panatone Finvest, which is a subsidiary of Tata Sons Pvt Ltd, Tejas Networks is engaged in the design and manufacturing of wireline and wireless networking products. These products are used by telecom service providers, utilities, government entities and defence networks. Saankhya Labs, a subsidiary of Tejas that specializes in semiconductor solutions tailored for broadband, satellite,and broadcast applications, has received the nod for Design linked incentive that we talked about earlier.

Bharat Electronics:

BEL is a Navratna DPSU primarily engaged in manufacturing for the defence industry. Its portfolio includes Radars and Fire Control Systems, Missile Systems, Communication and C4I Systems, Electronic Warfare & Avionics, Naval Systems & Anti-submarine Warfare Systems, Electro Optics, among others. BEL is planning to set up a semiconductor fab with Hindustan Aeronautics. The details of this project are not clear yet.

CG Power:

The company’s business is spread across two divisions- industrial and power. The industrial division manufactures railways equipment, motors, drivers and automation while the power division manufactures transformers and switchgears. The company is part of the 85+ years old Murugappa group. The company recently formed a JV with Renesas Electronics Corporation (Japan) and Stars Microelectronics (Thailand) to establish a semiconductor unit in Sanand, Gujarat. Renesas operates 12 semiconductor facilities and is a key player in microcontrollers, analog, power, and System on Chip (SoC) products. The plant will manufacture chips for automotive, consumer, and power applications.

Kaynes Technology:

Kaynes is an integrated electronics manufacturer in India, specializing in end-to-end solutions and IoT-enabled services. With expertise spanning over thirty years, Kaynes offers a comprehensive range of ESDM services, including Conceptual Design, Process Engineering, Integrated Manufacturing, and Life Cycle Support. Their clientele includes key players across various sectors such as Automotive, Industrial, Aerospace and Defence, Outer-space, Nuclear, Medical, Railways, IoT, IT, and more. The company is investing around INR 28 billion in an OSAT and compound semiconductor facility in Hyderabad.

HCL Technologies Ltd:

HCL Tech is among the top five Indian IT service providers by revenue and is a key player in global markets. Its offerings encompass a comprehensive range of services, including software-driven IT solutions, remote infrastructure management, engineering and R&D services, and BPO. HCL is currently pursuing a JV with Foxconn (Taiwan) to set up an OSAT facility in India.

Va Tech Wabag Ltd and Ion Exchange (India) Ltd:

Chip manufacturing needs a lot of water– millions of gallons and it’s not just any water. We are talking about ultra-pure water. This underscores the critical need for effective filtration systems in chip manufacturing. Silicon wafers must remain immaculate to prevent contamination, necessitating the use of ultrapure water with minimal conductivity. Achieving this level of purity demands sophisticated filtration methods. Va Tech Wabag leads with its expertise in designing, supplying, installing, constructing, and maintaining of waste water treatment plants, industrial water treatment, and desalination plants. Meanwhile, Ion Exchange (India) offers a comprehensive suite of solutions across the water cycle, from pre-treatment to process water treatment, waste water treatment, sea water desalination, and more. Both the companies have highlighted their focus on semiconductors in their recent concall.

Linde India Ltd and Inox India:

Chips manufacturing also requires ultra-high purity gases. The most commonly used gases in chip manufacturing are nitrogen, helium, hydrogen, and argon. In fact, these gases represent a significant portion of material expenditure after silicon wafers. Linde India can be one of the key beneficiaries here as it is engaged in manufacturing of industrial gases and also construction and designing of air separation plants. Inox India on the other hand is engaged in supplying cryogenic equipment. It helps design, manufacture, and install cryogenic tanks and systems for the storage, transportation, and distribution of industrial gases.

Besides the companies mentioned above, there are other companies that could benefit indirectly from the emerging semiconductor ecosystem. These could be companies that are into electronic manufacturing services (EMS), auto OEMs, consumer electronics, auto ancillary, aerospace and defence equipment, etc.

[1] https://www.counterpointresearch.com/zh-hans/insights/india-semiconductor-manufacturing-trajectory/

[2] https://timesofindia.indiatimes.com/business/india-business/chip-demand-may-hit-110-billion-by-30/articleshow/91165793.cms

[3] https://businessworld.in/article/indias-chip-imports-surge-by-92-in-3-years-486137

-Nischay Avichal