Investing in the stock market comes with inherent risks and rewards. The general consensus is that a volatile stock is a risky bet, but at the same time it has the potential of generating higher returns. Now the question arises – what standard should we use to gauge whether a stock’s volatility is on the higher side or not. That’s where the Beta value of a stock becomes helpful. Read on, to know what high beta stocks are and whether you should invest in them. How To Calculate the Beta of a Stock Beta of a stock is calculated using …

Understanding the Risk, Reward And Viability of Overnight Funds

Are you planning to start your investment journey but not sure what your risk appetite is? Or do you want to keep your quarterly bonus somewhere accessible before the next big Goa trip? Well, whatever maybe your financial plan, overnight funds may just be the right investment instrument for you. Why, you ask? This article has answers to all your questions. Read along to explore a new investment avenue perfect for different types of investors. What are overnight funds? Overnight funds are a short-term investment tool. SEBI refers to it as open-ended debt funds with a maturity period of one …

Direct Tax Updates: What Changes For You After The Recent Budget

This recent Union Budget has brought in a spate of major changes in direct taxes, impacting every individual taxpayer and investor. Getting one’s head around the new tax regime to keeping oneself aware of the revision in the capital gains tax on equity shares, ETFs, and mutual funds—is crucial in comprehending their impact on your finances. This blog will break down all the key updates that you should be aware to stay ahead in the taxation game. The New Tax Regime What has changed? The tax slabs have been modified to increase more tax savings for individuals opting for the …

Liquid ETFs, Returns and Their Uses: A Comprehensive Guide

Exchange-traded funds (ETFs) have become an increasingly popular investment vehicle due to their flexibility, liquidity, and the variety of assets they can encompass. Among the various types of ETFs available, liquid ETFs are one of the less known ETFs that can have many use cases for investors. This blog will delve into what liquid ETFs are, where they invest, their safety, uses, and the taxation rules that apply to them. What Are Liquid ETFs? Liquid ETFs are a type of exchange-traded fund that invests primarily in short-term, highly liquid money market instruments. They are designed to provide investors with a …

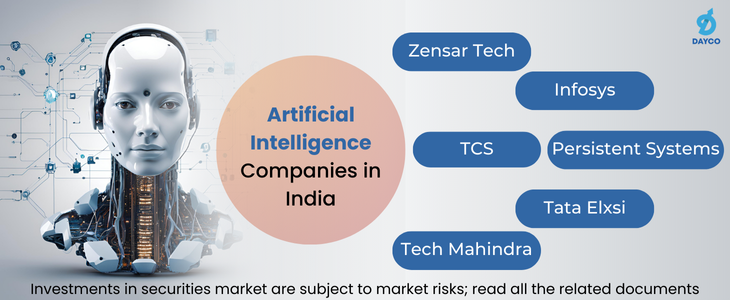

Listed Artificial Intelligence Companies in India

Artificial intelligence (AI) offers global options to complement and supplement human intelligence while also improving people’s lives and workplaces. AI and machine learning, with their diverse applications, may be found in practically every technological element of our lives. On a larger scale, AI and machine learning have had a disruptive impact on various industries, including agriculture, retail, healthcare, and education, among others. It also has the potential to transform businesses and increase efficiency by automating jobs, personalising customer experiences, and optimising operations. Spending on AI and machine learning has been increasing sharply in tandem with the technology’s potential. India spent …

Promising Battery Stocks Charging Up the Indian Market

Batteries are the silent workhorses of today’s society, powering everything from smartphones to electric automobiles. We use batteries in our daily lives for everything from electric vehicle operation to TV remotes. However, their importance is frequently overlooked. As India places more emphasis on producing renewable energy, the need for batteries has increased to unprecedented levels. They are also playing an increasingly important role in powering our energy infrastructure and the transportation sector as the country moves closer to a sustainable future. The size of the battery industry in India is projected to be USD 7.20 billion in 2024 and is …

Top Wind Energy Companies in India

With its growing population and rising energy needs, India has recently had to deal with the difficult task of juggling power generation with environmental obligations. The country’s carbon footprint has also increased as a result of its growing population, which accounted for 1.44 billion in January 2024 (According to a report by a statistical firm, DataReportal); the government wishes to monitor that. In the wake of these rising environmental concerns, the emphasis has switched from using fossil fuels to other renewable energy sources. India can produce energy without damaging the environment and lessen its reliance on fossil fuels by harnessing …

Is It Safe To Invest Via SIP?

From its inception in 1963 till now – mutual funds in India have come a long way. But one thing has remained constant. And that is the apprehension of investors regarding how safe their money is in these mutual funds. Some people go one step further and wonder whether investing via SIP carries more risk. Let’s debunk all myths about this today. What Is an SIP Let’s give you an analogy. You buy an AC worth Rs.40,000. Instead of paying the amount upfront, you pay in instalments. Why? The payment becomes manageable. You don’t feel the pinch when you pay …

Listed Cyber Security Stocks In India

As long as the world is powered by the internet and computers, cyber security will stay relevant. That’s another way of saying that the cybersecurity industry is a stable, future-proof industry. And why wouldn’t it be? The world is witnessing a record surge in cyber attacks on a year-on-year basis. 2023 saw a staggering 6.06 billion malware attacks around the globe. India, too, witnessed a 15% rise in cyber attacks in 2023, totalling 2138 attacks per organisation. Cybersecurity is the need of the hour. Businesses and individuals – both require the services of cyber security companies to keep themselves safe …

Understanding Nomination in Demat Accounts: A Comprehensive Guide

If you have financial assets, you know the importance of a demat account. It is a digital repository of all your securities, such as shares, government bonds, mutual funds, and exchange-traded funds (EFTs). One of the main benefits of having a Demat account is it is safe, secure, and easily transferable. But who is entitled to these assets in case of unfortunate events? Having a nominee for a Demat account is one of the most important steps in safeguarding the assets. But who is a nominee? This article will walk you through the entire concept of nomination in Demat accounts. …