“Which is better, the old tax regime or the new tax regime?” This is the question that people have been asking since 2020. Budget 2023 made some important tax changes for middle-class taxpayers applicable from the Financial Year 2023-24. The old tax regime wasn’t touched, while the new tax regime saw quite a few changes. Changes were made to the tax slabs, the rebate was tweaked, and more. The budget has left more questions for taxpayers on what they should opt for while filing their taxes. In this blog, we look at which tax regime is more advantageous, what has changed, and, more importantly, what will change for you.

Before we start

The new tax regime was introduced in the 2020 union budget. Taxpayers were given a choice to choose between the two (existing or the new) regimes. The new regime had a catch – although the tax rates were lower – taxpayers wouldn’t be able to claim the various deductions available under the old regime like 80C, 80D, HRA, LTC, Standard Deduction, etc. Barring conveyance allowance (payable on an actual basis) and 80CCD (2), taxpayer filing under the new regime had to forgo every deduction.

Key changes proposed in the budget

- The new tax regime will be the default tax regime. The taxpayer will have the option to opt for the old regime.

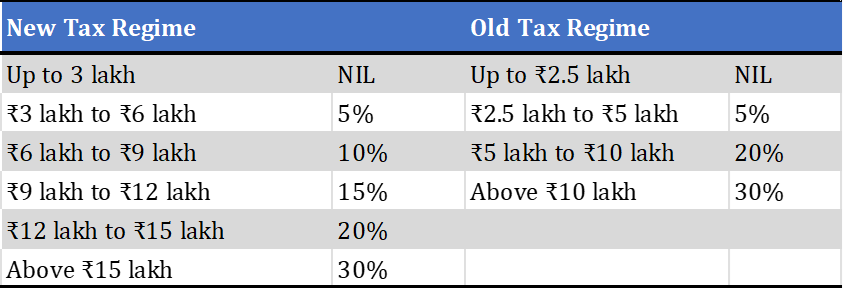

- Basic exemption limit raised to Rs 3 lakh from Rs 2.5 lakh in the new tax regime (see the table below)

- A tax rebate limit for full tax exemption has been increased from Rs 5 lakhs to Rs 7 lakhs under the new tax regime. No changes were made to the existing (Rs 5 lakhs) limit under the old tax regime.

- Standard deduction of Rs 50K was introduced in the new tax regime. Earlier, the standard deduction of 50K was reserved only for the old tax regime.

- Super rich tax cut: The highest surcharge under the new tax regime has been reduced to 25% from 37% for people earning more than Rs 5 crore. This move brings down their tax rate from 42.74% to 39%.

Old V/s New Tax Slabs (after the proposed changes)

Three of the major changes are an increase in the basic exemption limit, rebate u/s 87A, and the inclusion of standard deductions. With the proposed changes, the rebate stands at 25K if the net taxable income is below 7 lakhs. This means individuals having an income of up to 7 lakhs will not pay any taxes if the new regime is opted for. Before the change, the rebate stood at 12.5K if your net taxable income was below 5 lakhs – similar to the one that is available in the old tax regime.

Which is better?

If your net taxable income is below 5 or 7 lakhs after claiming just the standard deduction of 50K, you can choose the regime as per the net income. For instance, if it’s up to 5 lakhs, you can choose the old regime and not pay any tax. Similarly, if it’s above five lakhs but up to 7 lakhs, the new regime can be chosen.

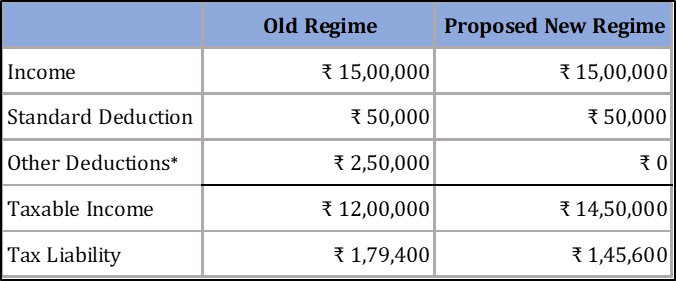

For income above 7 lakhs, you may need to calculate the expected tax liability under both regimes and choose the better one. Let’s see an example below to understand this better.

The table below shows the expected tax liability under both regimes for an individual with an annual income of 15 lakhs after applying a deduction of 2.5 lakhs in the old regime. The standard deduction is allowed under both regimes.

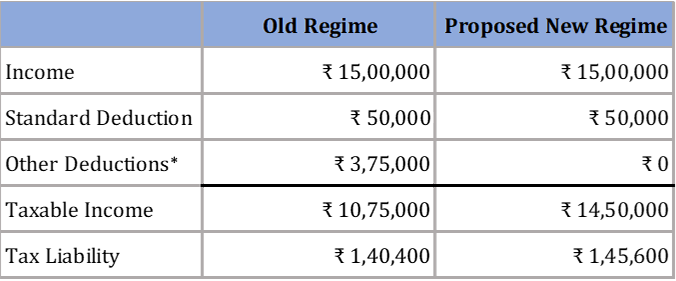

If a person has more deductions, it is better to choose the old regime as it can help reduce tax liability. See the below table where an individual with the same taxable income avails more deductions and has a lower tax liability under the old regime.

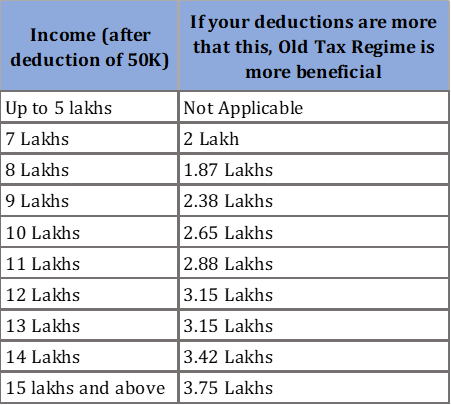

You can follow the table below to choose between the regimes depending on your income after the standard deduction of 50K. If your deductions are more than the amount mentioned under the 2nd column, the old regime would be more beneficial to you.

Final word

It is important to note that the amount and eligibility for deductions, income sources, and the quantum of income varies among individuals. So, one size doesn’t fit all. You must carefully evaluate and compare the tax liability under both regimes before deciding which to opt for. If you have investments in tax-saving instruments, pay premiums on life or medical insurance policies, pay tuition fees for children, make home loan principal repayments or interest payments, and avails deductions for HRA or LTA, it may be more advantageous to choose the old tax regime as the benefits of deductions, and exemptions can be fully utilized.

~ Nischay Avichal